SBI Employee Surya Swathi saved senior citizen from losing lacs of rupees to Cyber Fraud

In Hyderabad, a State Bank of India (SBI) officer stopped a senior citizen from losing ₹13 lakh to a scam called “digital arrest.” This was one of three recent frauds prevented by SBI staff, thanks to the bank’s training on cyber fraud awareness.

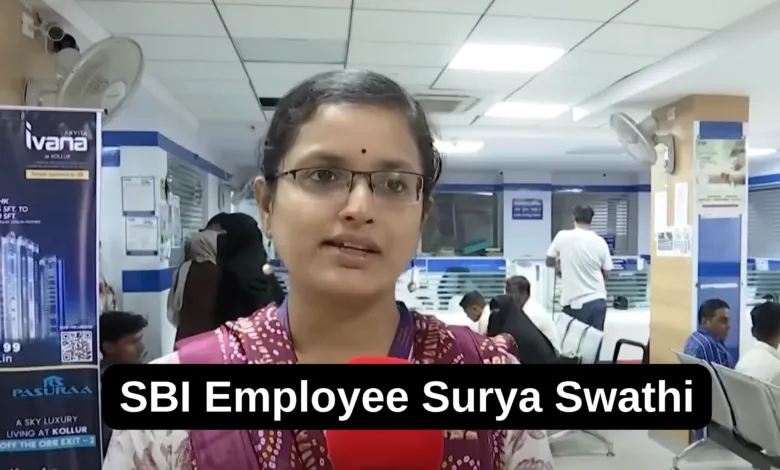

At SBI’s AC Guards Branch, Surya Swathi, a bank officer, noticed something unusual when a long-time customer, a 61-year-old doctor, came to the bank. The doctor said he wanted to withdraw money by breaking his Fixed Deposits (FDs). He appeared tense, which raised Swathi’s suspicion.

When Swathi asked him why he needed the money, the customer replied that it was for personal reasons. Sensing that something was wrong, she informed the branch manager, Kumar Goud, and they decided to dig deeper. The customer then told them he was buying property but admitted he hadn’t seen it yet. This increased the staff’s concern, and they asked him to return with a family member before allowing the withdrawal.

The Scam Unfolds

The customer was being scammed by fraudsters who had told him he was under a “digital arrest.” They warned him not to trust anyone or tell anyone about it. They kept him on a call the entire time, giving him instructions.

The scammers convinced the doctor to transfer ₹13 lakh to their account. Fortunately, the bank staff delayed the transaction for three days, during which they tried to make the customer understand that he was being cheated.

How the Staff Acted

On the second day, the customer avoided Swathi’s counter, knowing she wouldn’t allow the withdrawal. However, the entire branch staff was aware of the situation by then and kept an eye on him.

On the third day, Swathi showed the customer an article from the Prime Minister’s Mann Ki Baat program, which mentioned that “digital arrest” is a scam. She also connected him to the national cybercrime helpline, 1930, where officials explained that no such thing as a digital arrest exists and that many others had fallen for similar scams.

Hearing this, the customer finally understood that he was being tricked. He immediately stopped answering calls from the scammers.

What is ‘Digital Arrest’?

Digital arrest is a new scam where fraudsters convince people that they are under “virtual arrest” and must stay connected with them over phone or video call. They also tell the victims not to inform anyone, claiming that the “arrest” will end only when the victim transfers money to them.

This scam often targets senior citizens who may not be familiar with technology. Police have repeatedly said that there is no such thing as a digital arrest, but many people still fall for it.

A Lesson for Everyone

Thanks to the alertness and training of SBI employees, this senior citizen was saved from losing his life savings. This incident shows the importance of being cautious about unusual financial requests and verifying any claims before taking action. It also highlights the crucial role of well-trained bank staff in protecting customers from fraud.

If you or someone you know receives suspicious messages or calls, always report them to the national cybercrime helpline, 1930, and remember to stay alert.