Union Bank of India Officers will conduct surprise visit to branches to improve customer service

Union Bank of India, one of the largest public sector banks in the country, has launched an initiative to enhance customer service across its branches. As part of this effort, designated officers will conduct surprise visits to branches to evaluate the quality of service being delivered to customers. Union Bank has released following guidelines for visit of branches: Click here to read more news related to Union Bank of India.

- A branch will be allotted to a staff via e-mail prior to the scheduled date.

- Upon receipt of the communication, the designated officer is required to make necessary travel arrangements.

- The assigned officer must arrive at the allotted branch before business hours to observe the reporting time of the branch staff.

- Officer will take a selfie with Branch Signage visible in the background as it is to be uploaded in the google form while filling the survey form. The photo must have geo stamping on it (Longitude & latitude). Officer can use Geo stamping Apps for the purpose like GPS MAP Camera etc.

- The officer will also observe whether parking facility is available for customers.

- The officer must assess the cleanliness inside and outside the branch premises, including the ATM/CRM/E-lobby and the availability of a ramp facility for differently abled customers upon entering the branch.

- The officer will act as a prospective customer, inquiring about banking services such as opening an account or seeking information about loan facilities etc.

- During interactions with branch staff, the officer will observe the following:

- Whether staff are present at their respective counters during work hours.

- Whether staff members are dressed professionally

- Whether branch staff are wearing Bank ID cards.

- Whether staff members are greeting customers.

- Whether politeness and courtesy are demonstrated in communications at all levels.

- Whether staff possess the necessary knowledge about the bank’s products and ser/ic es.

- ‘Whether staff are attentive and prompt.

- Whether alternate delivery channe/s are promoted by staff.

- The Officer will also access the conduct of staff while interacting with other customers and provide his input accordingly.

- The officer will observe the interior of the premises with respect to the following parameters:

- Availability of a “May I Help You” counter.

- Availability of Drinking Water for customers.

- Availability of a complaints/ suggestions box in a prominent place.

- Display of a comprehensive notice board, details of the grievance officer and other information at the branch.

- Availability of adequate lighting inside the branch premise and the ATM room.

- Display of IIEDU TV and Interest Rates (deposit and advances) in a prominent location.

- Access to washroom facility for customers.

- Availability of account opening and service request forms. Click here to read more news related to Union Bank of India.

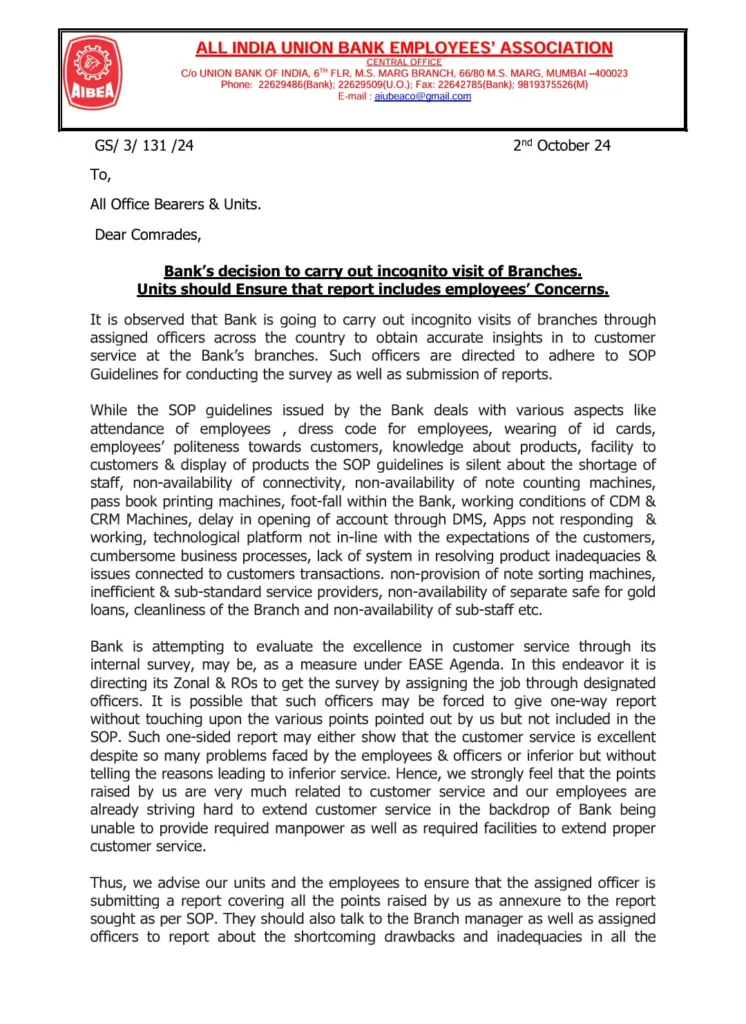

But Union Bank of India’s new guidelines for incognito visits aimed at evaluating customer service in its branches have stirred discussions within the banking sector. Employee unions are raising concerns that these assessments overlook critical staff-related issues, such as working conditions and personnel shortages, which they argue are essential for delivering high-quality customer service.

Despite the bank’s efforts to improve customer service, employee unions have expressed concerns that the incognito visits fail to address key factors affecting employees’ ability to perform their duties efficiently. The All India Union Bank Employees Association (AIUBEA) and the All India Union Bank Employees Federation (AIUBEF) have called for these assessments to include a focus on employee welfare. They argue that longstanding issues such as recruitment freezes and staff shortages are major obstacles to delivering better service. What you think about this – let us know in the comments section below.

Bank software is not working perfectly.

What is use of this .