PSU Banks collected over Rs.8,500 crore from customers for not maintaining minimum balance, Check Bank Wise amount

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

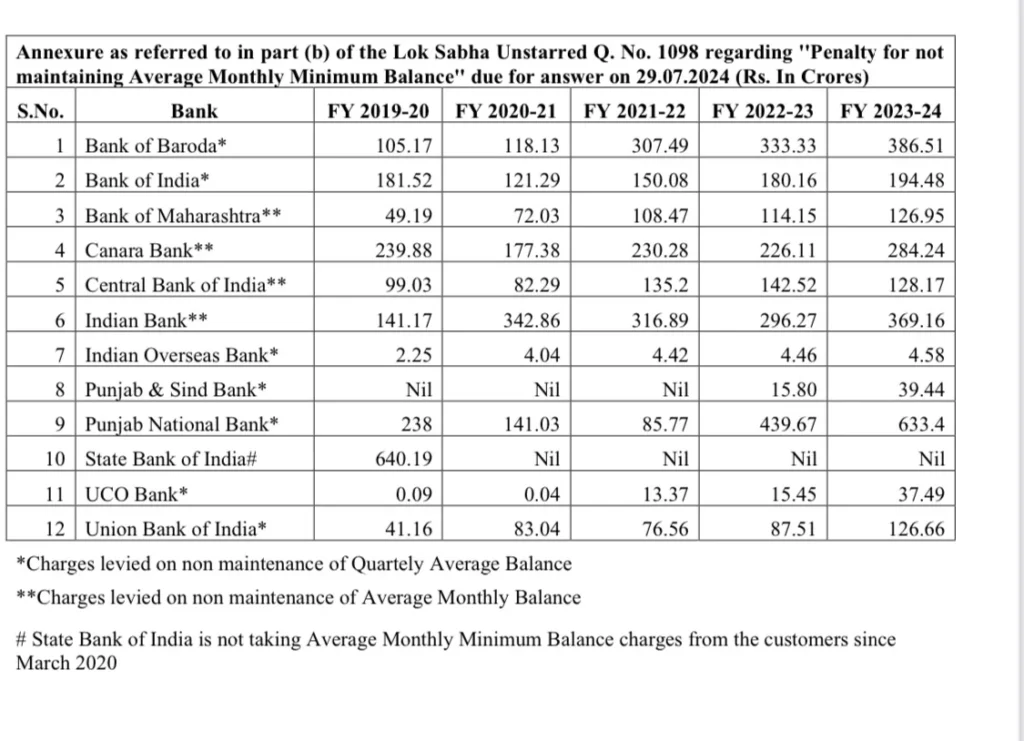

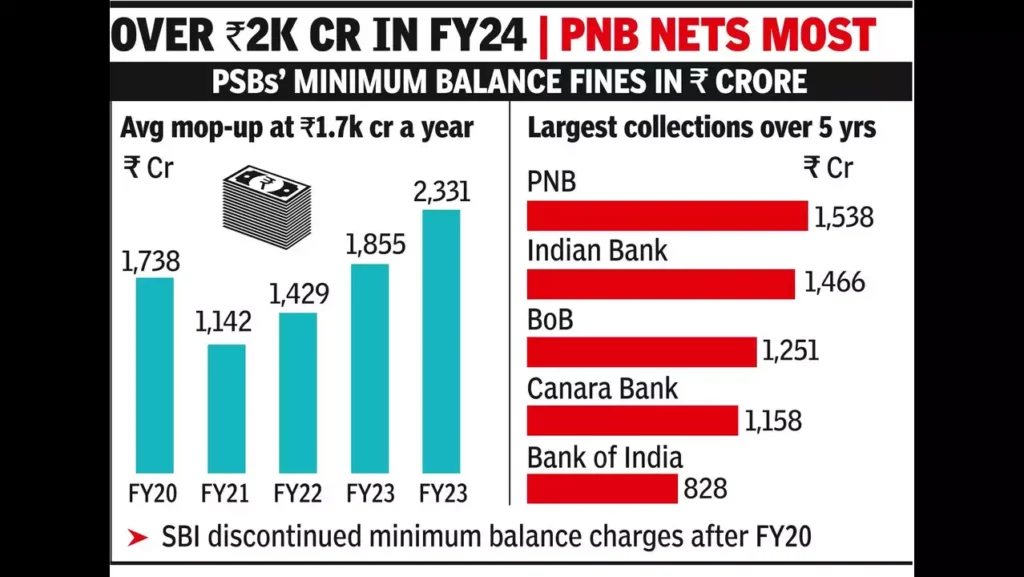

In the fiscal year 2024, eleven public sector banks, excluding the State Bank of India (SBI), have charged a whopping ₹2,331 crore in penalties for account holders who failed to maintain the minimum balance in their savings accounts. This represents a significant increase of 25.63% from the ₹1,855.43 crore charged in FY2023. Over the past three years, these banks have collectively collected ₹5,614 crore in such penalties, according to figures from the Ministry of Finance. According to data presented as part of written response to un-starred question in the Lok Sabha by the Minister of State (Finance) Pankaj Chaudhary, PSBs collected around ₹8,500 crore under this head in five years starting from FY20.

Notably, SBI has not imposed any penalties for not maintaining a minimum balance since FY2020. Among the banks that do charge such penalties, Punjab National Bank (PNB) led the way, collecting ₹633.4 crore from customers. Bank of Baroda followed with ₹386.51 crore, and Indian Bank collected ₹369.16 crore.

The situation is even more critical when private sector banks are considered, as they also impose significant penalties for failing to maintain a minimum balance. In contrast, Basic Savings Bank Deposit Accounts (BSBDA) offer some relief. These accounts provide several basic facilities free of charge and do not require a minimum balance. Services include cash deposits at bank branches or ATMs, and receiving funds through electronic channels or cheques from government agencies. There is no cap on the number of deposits or their value each month.

The Reserve Bank of India (RBI) has issued guidelines on this matter through circulars in 2014 and 2015. Banks are allowed to set their own penalty charges for non-maintenance of minimum balances, provided these charges are clearly communicated to customers at the time of account opening and any subsequent changes. Charges are calculated as a percentage of the difference between the actual balance and the minimum required balance.