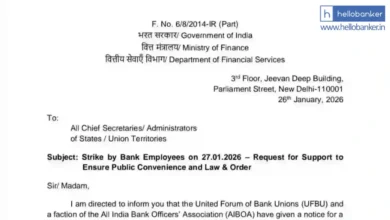

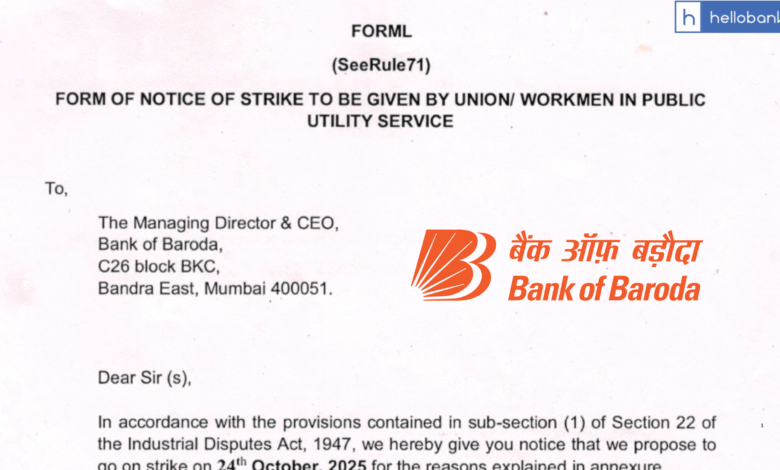

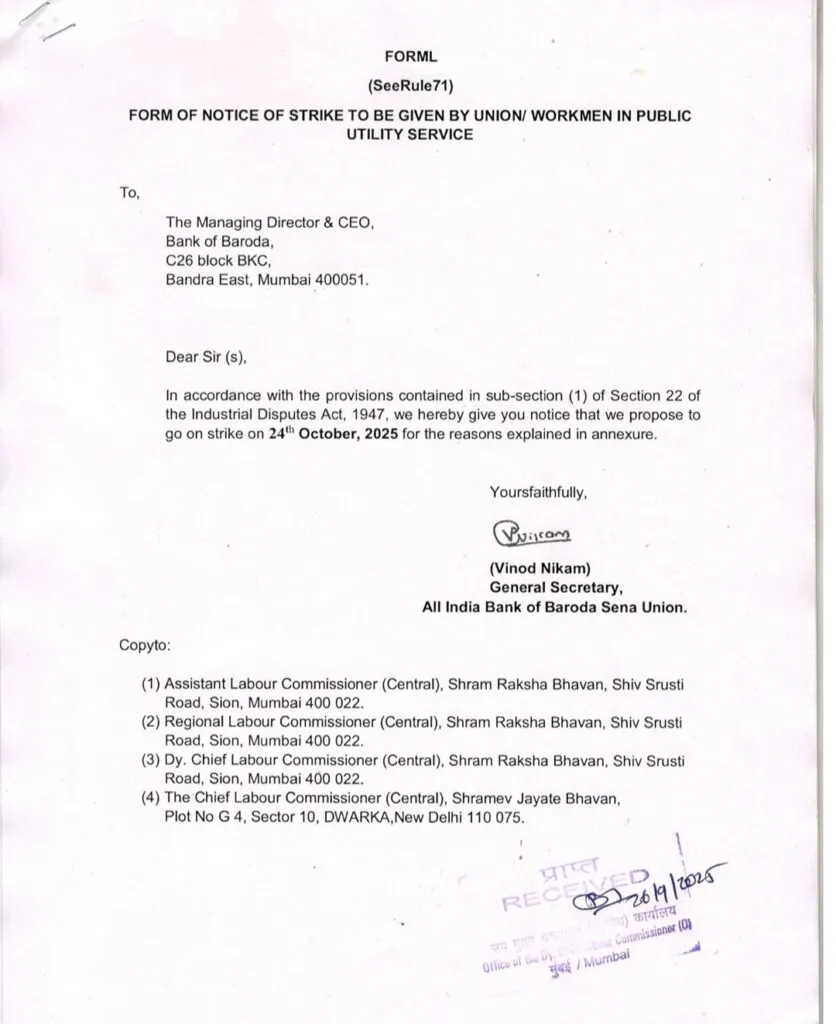

Bank of Baroda Staff announces Strike on 24 October 2025

All India Bank of Baroda Sena Union has announced Strike on 24 October, 2025. The strike has been announced due to improper implementation of Continuous Clearing & Settlement in CTS.

The RBI and the Bank have announced a phased rollout viz. Phase I effective 4 October 2025 and Phase Il effective 3 January 2026 but the Bank has proceeded to implement modalities in a hasty and unilateral manner without adequate ground level preparedness or meaningful consultation with employee representatives.

The new modalities impose a severe and sudden increase in frontline workload. Branches are now required to continuously scan, verify and forward outward cheques within sharply compressed timelines while simultaneously managing heavy customer footfall and essential branch functions.

Phase II’s outward clearing turnaround time reduced to T + 3 hours forces staff to clear, verify or investigate items in near real time, often while handling critical customer work, ongoing campaigns, and prolonged online meetings.

The Bank’s ad-hoc removal or dismantling of HUB support structures despite no explicit RBI direction to do so has further worsened the burden on branches. In many rural and remote areas the mapping of branches without CTS scanners to nearby branches is impractical due to poor commuting options. Hardware readiness alone cannot substitute for manpower. The present implementation creates unmanageable time compression, increases the risk of operational errors and financial loss, and exposes employees to the possibility of unfair disciplinary action arising from systemic inadequacies.

The Union stated – We are not opposed to technological advancement or process improvements, however, the human limits of frontline staff must be recognised.

Under the extreme pressure created by concurrent campaigns, unrealistic targets, extended online TEAMS meetings into late evenings, and frequent reporting calls, even experienced employees may make mistakes. Such errors can lead to financial loss, reputational damage and, unfairly, punitive action against staff. The current state of implementation therefore poses a material risk to employee welfare, customer service quality and the bank’s operational integrity.

Union has put forward following demands:

- The provision of additional frontline staff allocated to branches proportionate to cheque volumes and associated workloads.

- Redeployment of additional staff to CBOs/HUBs and branches during the implementation period to ensure balanced workload.

- Consultation with union and staff representatives before proceeding with Phase I so that workable operational norms are agreed.

- an explicit assurance from management that no employee will be unfairly disciplined for errors arising from system or implementation deficiencies during the transition period.