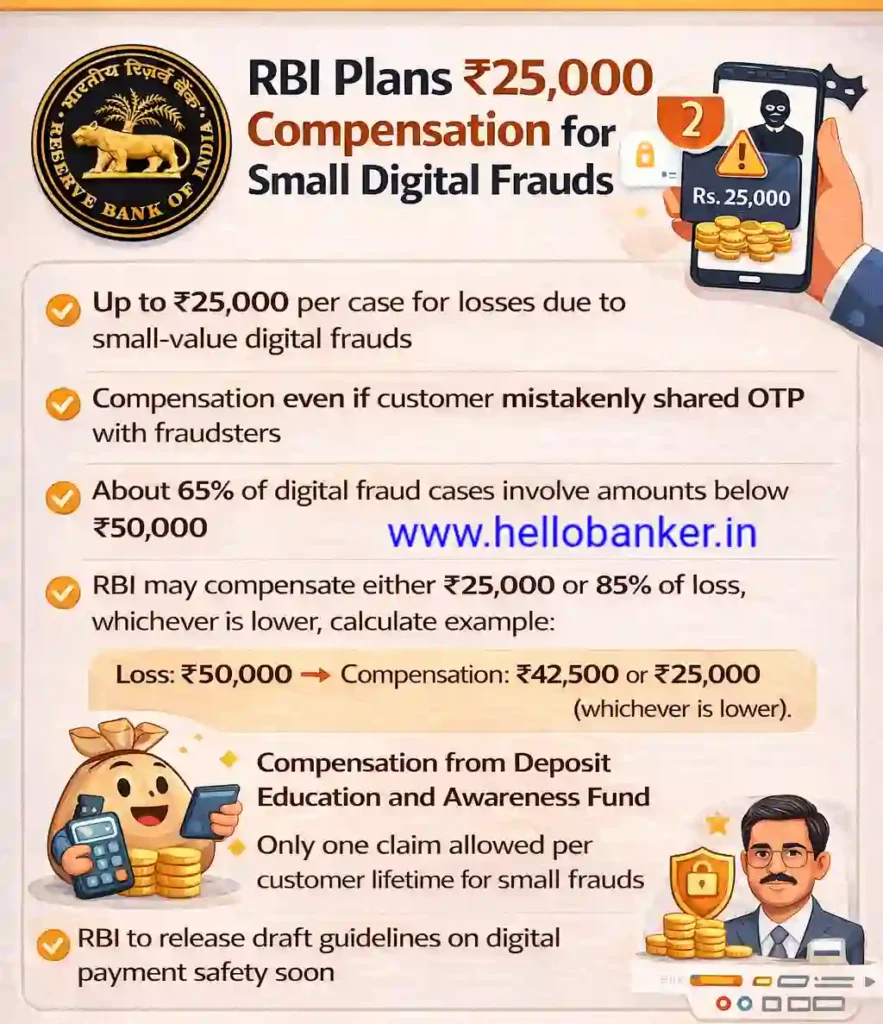

RBI to provide Rs.25000 compensation to victims of Digital Fraud, Understand Rules!!

The Reserve Bank of India (RBI) has proposed compensation of up to ₹25,000 per case for losses caused by small-value digital frauds. But one point is important, that the RBI plans to provide compensation even if the customer is himself/herself at fault.

This means that even if a customer by mistake gives OTP to fraudsters, RBI will provide him/her compensation upto Rs.25,000.

The new rules are important because about 65% of fraud cases involve amounts below ₹50,000. Under the new proposal, customers can get compensation even if they have shared a one-time password (OTP).

Also Read: RBI’s New Decisions: No Mis-selling, KCC Tenure 6 Years, Free loans upto Rs.20 Lacs

RBI Governor Sanjay Malhotra said that a new framework is being planned. Under this framework, customers may be compensated up to ₹25,000 for losses from small-value frauds. He said the compensation would apply as long as the loss was unintended. The RBI may compensate either ₹25,000 or up to 85% of the loss amount.

A customer will be able to use this benefit only once in their lifetime. The benefit will apply even if the customer shared an OTP. The RBI will soon issue a discussion paper and invite public feedback on this proposal.

The Governor also said that the RBI may compensate 70% of the loss amount. The remaining 30% loss will be shared between the customer and the bank. 15% will be borne by the Bank, and the remaining 15% will be borne by the customer.

Also Read: Repo Rate unchanged at 5.25%, RBI MPC Meeting Updates!

Let’s understand with the help of an example:

For example, if someone has lost ₹50,000 in a fraudulent transaction, 85% of that amount (₹42,500) or ₹25,000, whichever is less, will be paid by the RBI.

In case someone lost ₹20,000, 85% of that amount (₹17,000) or ₹25,000, whichever is lower, will be paid. In this case, the victim gets ₹17,000.

From where will RBI get money to pay to customers?

RBI Deputy Governor Swaminathan J said that the compensation will be paid from the Deposit Education and Awareness Fund. This fund includes unclaimed deposits and has built up sufficient surplus income over time.

Also Read: SBI reports highest Net Profit among all Banks in Dec Quarter

As part of customer-friendly steps, the RBI announced that it will release three draft guidelines for public consultation. The first draft will focus on the mis-selling of financial products to improve transparency and accountability. The second will deal with loan recovery practices and aim to stop harassment by recovery agents. The third will focus on limiting customer liability in unauthorised electronic banking transactions.

The RBI will also release a separate discussion paper on improving the safety of digital payments. This may include delayed credit of funds for verification and extra security checks for certain users, such as senior citizens.

Also Read: Net Profit of Banks in Q3FY26, Check Top Bank

These steps are expected to improve trust in the banking system and make digital banking safer for customers.

Read Trending News 👇