The Reserve Bank of India (RBI) has created a Supervisory Data Quality Index (sDQI) that measures data quality in terms of the Accuracy, Timeliness, Completeness and Consistency in the submission of returns. The objective of sDQI is to assess the adherence to the principles enunciated in the Master Direction on Filing of Supervisory Returns 2024. The sDQI score of Scheduled Commercial Banks (SCBs) has improved in March 2025 as compared to March 2024.

| Trends in sDQI Scores of SCBs | ||||||||||

| Bank Group | March 2024 | March 2025 | ||||||||

| Accuracy | Completeness | Time liness | Consistency | sDQI Score | Accuracy | Completeness | Time liness | Consistency | sDQI Score | |

| Scheduled Commercial Banks | 86.1 | 96.2 | 86.8 | 85.0 | 88.6 | 86.7 | 95.8 | 89.1 | 85.7 | 89.3 |

| Public Sector Banks | 87.1 | 99.6 | 85.4 | 84.6 | 89.2 | 85.7 | 99.4 | 84.8 | 85.2 | 88.8 |

| Private Sector Banks | 85.5 | 99.7 | 85.8 | 84.6 | 88.9 | 87.5 | 98.9 | 86.5 | 85.3 | 89.6 |

| Foreign Banks | 86.1 | 92.7 | 86.2 | 85.4 | 87.6 | 86.9 | 92.6 | 90.9 | 85.9 | 89.1 |

| Small Finance Banks | 86.6 | 99.6 | 92.8 | 84.9 | 91.0 | 85.8 | 98.9 | 91.5 | 86.1 | 90.6 |

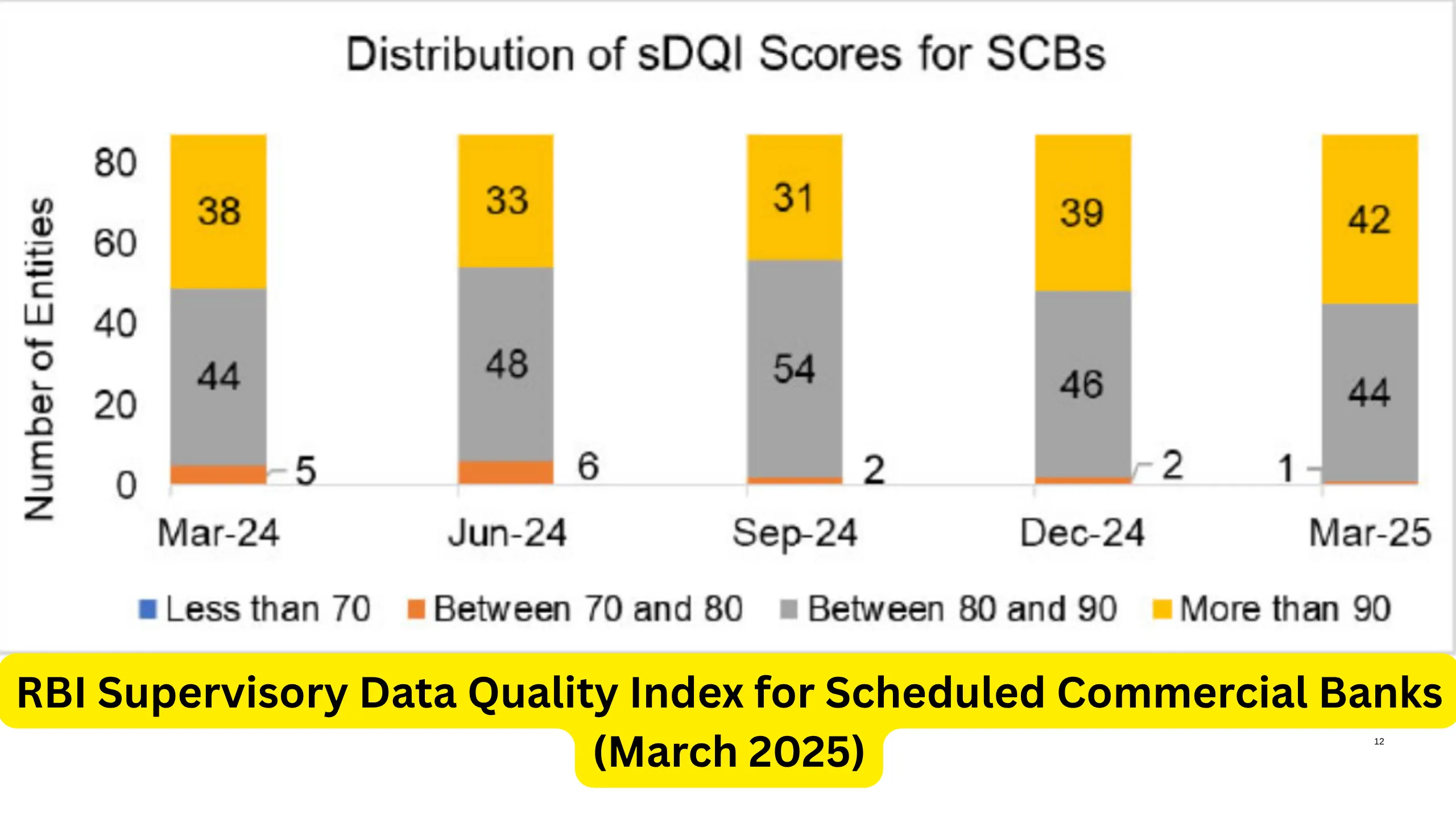

The distribution of the Overall sDQI Scores for all SCBs upto the quarter ended March 2025 is given below.

| Interpretation of scores | |||

| Less than 70 | Between 70 and 80 | Between 80 and 90 | More than 90 |

| Major Concerns | Needs Improvement | Acceptable | Good |

The trends in the parameters and in overall sDQI scores for SCBs is shown below.

The sDQI for SCBs covers 87 SCBs and their key returns (viz. Return on Asset Liability and Off-Balance Sheet Exposures (ALE), Return on Asset Quality (RAQ), Return on Operating Results (ROR), Risk Based Supervision Return (RBS), Liquidity Return (LR), Return on Capital Adequacy (RCA), Central Repository of Information on Large Credits (CRILC) – Main).