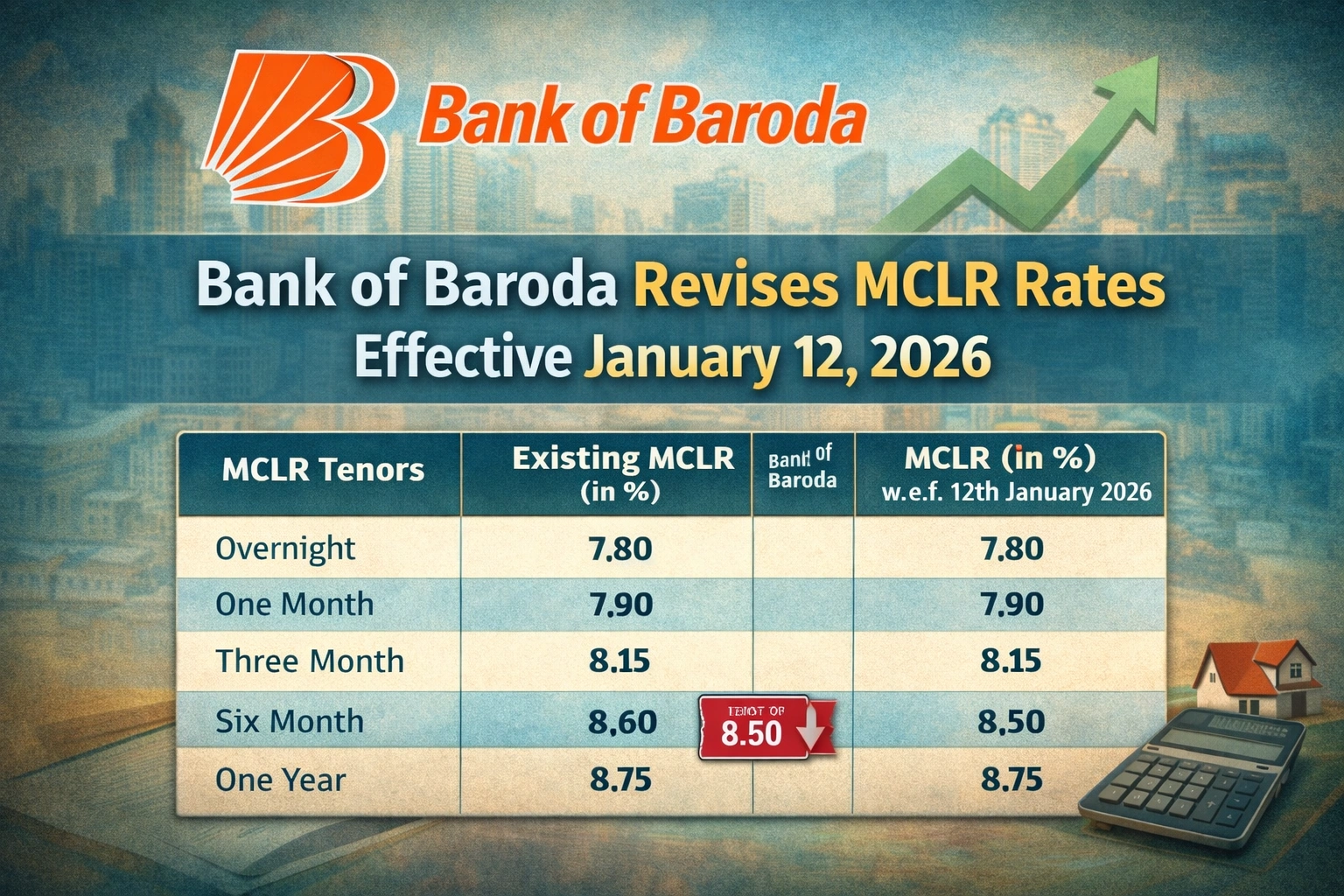

Bank of Baroda on Friday announced a revision in its Marginal Cost of Funds Based Lending Rate (MCLR), with the new rates set to take effect from January 12, 2026.

As per the revised structure, the overnight MCLR continues at 7.80%, while the one-month MCLR remains unchanged at 7.90%. The three-month MCLR has also been retained at 8.15%. However, the six-month MCLR has been lowered to 8.50% from 8.60%, offering some relief to borrowers linked to this tenor. The one-year MCLR, which is commonly used as a benchmark for retail loans such as home and auto loans, remains unchanged at 8.75%.

| MCLR Tenors | Existing MCLR (in %) | MCLR (in %) w.e.f. 12th January 2026 |

|---|---|---|

| Overnight | 7.80 | 7.80 |

| One Month | 7.90 | 7.90 |

| Three Month | 8.15 | 8.15 |

| Six Month | 8.60 | 8.50 |

| One Year | 8.75 | 8.75 |

MCLR serves as the benchmark rate below which banks are not allowed to lend, and changes in MCLR directly impact interest rates on loans that are linked to it.