RBI New Rule: Credit Scores Will Now Update Every 7 Days, Read Draft Guidelines!!

The Reserve Bank of India (RBI) has issued draft guidelines on 26 November 2025 to strengthen the country’s loan and credit reporting system. These new rules will be implemented from 1 April 2026. These new rules are expected to be highly beneficial for bank customers.

What are the new Rules?

Now, customers will not have to wait long for credit score updates. All Credit Information Companies (CICs) must update credit scores every 7 days. At present, credit scores are updated once every 15 days. CICs must update data on the 7th, 14th, 21st, and 28th of each month, and also on the last day of the month. Banks will send data by the 3rd day of every month.

Banks will send details about the customer’s credit to CICs on these four dates. This includes details like account opening, account closure, changes that affect the credit score, or updates in loan status. Banks must inform CIBIL about loan or credit card closure on the same day. Earlier, this used to take weeks or even months, causing problems for customers while applying for new loans.

A CIBIL (CIC) Report is a detailed credit report issued by CIBIL (Credit Information Bureau India Limited), one of India’s RBI-approved Credit Information Companies. It provides a complete record of your credit history, including your CIBIL score, loan and credit card accounts, repayment behaviour, EMI delays, outstanding balances, credit limit usage, closed accounts, and all inquiries made by banks or financial institutions. This report helps lenders assess your creditworthiness before approving any loan or credit card. A strong CIBIL CIC Report increases your chances of getting loans quickly and at lower interest rates, while a poor report can lead to rejection or less favourable terms. In simple words, it is your financial report card that reflects how responsibly you have handled credit in the past.

Advertisement

Banks and NBFCs cannot check a person’s credit report without customer’s permission. This will prevent unnecessary credit inquiries, protect credit profiles, and stop unwanted drops in credit scores.

Heavy penalties will be imposed for wrong reporting, delays in correcting mistakes, or checking credit reports without permission. This will force banks to keep data accurate, and customers will see faster credit score improvements.

Banks will receive fresh and updated credit reports, which will help them assess risk better. This will also help them decide interest rates, loan amounts, and loan tenures more accurately.

Credit Score is very important for Bank Loans

A person’s credit score plays an important role in loan approval. Credit profiling companies calculate the score by checking whether you have taken loans before and how you have used credit cards. A credit score depends on repayment history, credit utilization ratio, existing loans, and timely bill payments.

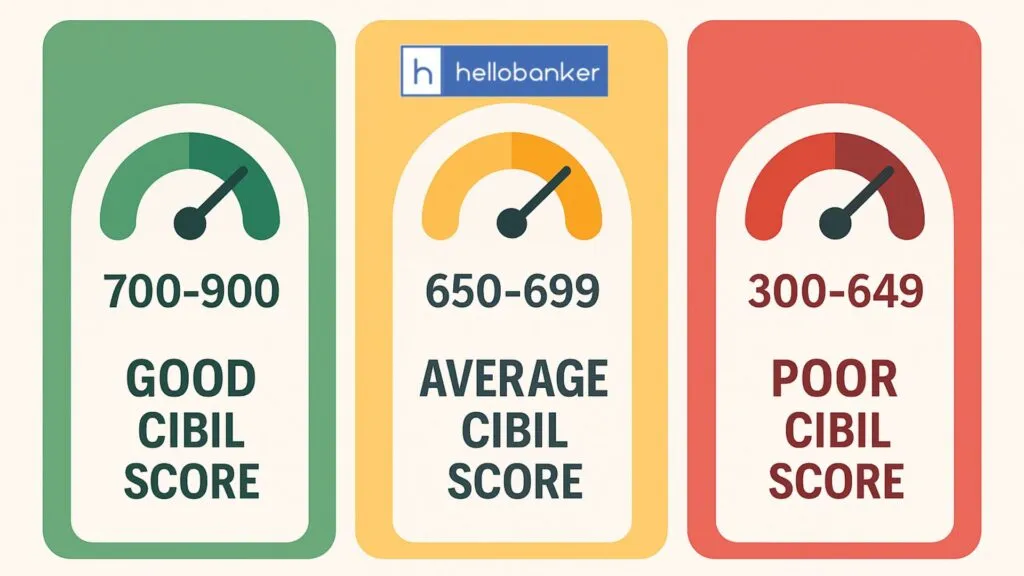

The credit score ranges from 300 to 900. A score of 550 to 700 is considered average, while a score between 700 and 900 is considered very good. You can check your CIBIL score for free once a year on the official CIBIL website: www.cibil.com.

- 30% depends on repayment history

- 25% on secured or unsecured loans

- 25% on credit exposure

- 20% on debt utilization