Indian Government increases Stake in Vodafone Idea to Nearly 49%

On Monday, April 21, 2025, the Indian government raised its stake in Vodafone Idea (Vi) from 22.6% to 48.99%. This increase in ownership follows the conversion of ₹36,950 crore of the company’s spectrum payment dues into equity shares. The move was welcomed by investors, with Vodafone Idea’s stock price closing at ₹8.10, marking an increase of 10.81% for the day.

Why Did the Government Increase Its Stake in Vodafone Idea?

Vodafone Idea had a huge amount of unpaid dues related to spectrum auctions. Instead of forcing the company to pay in cash, the government is giving relief by taking shares in exchange. This is part of the Telecom Reforms and Support Package, introduced in September 2021, which aimed to help struggling telecom companies in India.

How Will the Conversion Happen?

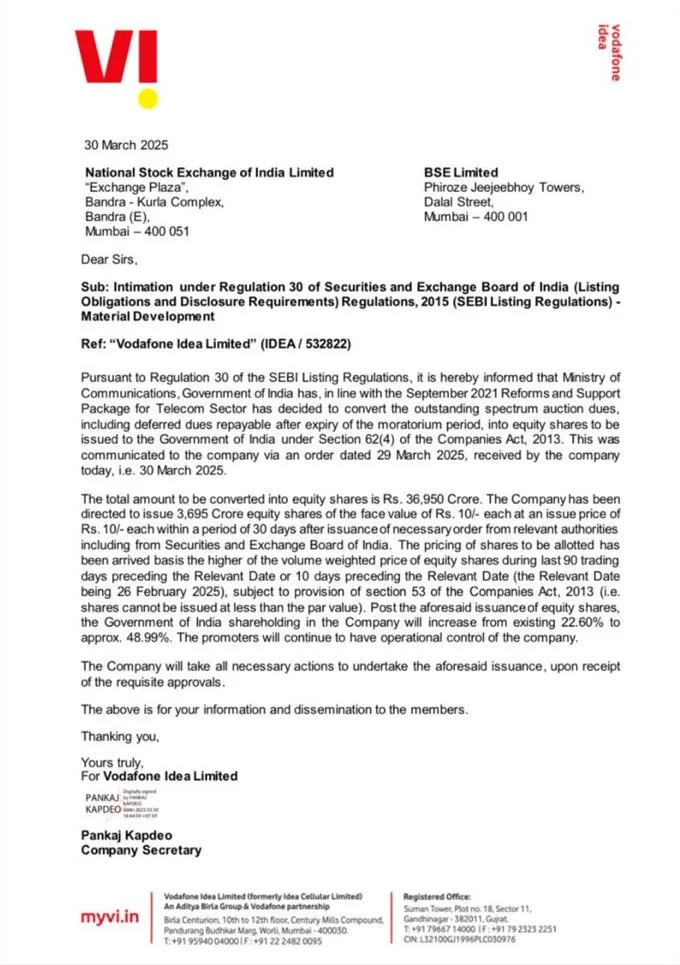

- The Ministry of Communications issued an order approving the conversion on March 29, 2025, and Vodafone Idea received the confirmation on March 30, 2025.

- Vodafone Idea will issue 3,695 crore new equity shares, each having a face value of ₹10.

- The share price will be determined based on stock market trends. It will be set at either:

- The average price of Vodafone Idea shares over the last 90 trading days

- The average price over the last 10 days before February 26, 2025

- Whichever is higher, in line with the Companies Act, 2013 (which ensures shares are not issued at a price lower than ₹10).

The government’s decision to increase its stake in Vodafone Idea is part of a broader effort to help the company recover from its financial struggles. By converting a significant portion of its spectrum dues into equity, the government aims to reduce the company’s statutory liabilities, making it more financially stable and viable.

Impact on Vodafone Idea’s Shareholding

Although the government has become the largest shareholder in Vodafone Idea, with nearly 49% of the company’s shares, Vodafone Plc and the Aditya Birla Group (ABG) will continue to manage the operations of the company. However, both Vodafone Plc and ABG have seen their stakes reduced significantly:

- Vodafone UK’s shareholding has dropped from 24.4% to around 16.1%.

- Aditya Birla Group’s ownership has decreased from just over 14% to 9.4%.

Previous Government Interventions

This isn’t the first time the government has stepped in to help Vodafone Idea. Back in February 2023, the government converted around ₹16,130 crore of the company’s debt into equity. This debt conversion included interest payments from the deferment of AGR (Adjusted Gross Revenue) and spectrum instalments.

Ongoing Financial Struggles

Despite these efforts, Vodafone Idea continues to face significant financial challenges. In the December 2024 quarter, the company’s total debt increased by about 7%, reaching ₹2.17 lakh crore. This rise in debt is primarily due to increased statutory liabilities, which are payments the company owes to the government.

Before the latest government stake increase, Vodafone Idea’s total debt of ₹2.17 lakh crore included:

- ₹2.14 lakh crore in payment obligations to the government.

- ₹2,300 crore in debt to banks and financial institutions.

Conclusion

The Indian government’s increased stake in Vodafone Idea is a significant step to stabilize the company and promote competition in the telecom industry. While this intervention offers short-term relief, Vodafone Idea will need to manage its growing debt and liabilities to achieve long-term financial stability.