Important News For Bank of Baroda Customers! PPS Limit Decreased, Submit PPS otherwise Cheque will be rejected

After Punjab National Bank (PNB), Bank of Baroda (BOB) has released an important notification about Positive Pay System (PPS). Bank of Baroda has announced an important change to its Positive Pay System to make cheque payments more secure and reduce the risk of fraud, especially for high-value cheques.

Punjab National Bank (PNB) has issued a public notice that the usage of the Positive Pay System (PPS) will become mandatory for all cheques of ₹5 lakh and above, not just for clearing, but also for transfer and cash payments. This new rules will be applicable from June 2, 2025.

The Positive Pay System is a security feature introduced by the Reserve Bank of India (RBI) on January 1, 2021. It is designed to stop fraud related to cheques, especially those involving large amounts of money.

When you issue a high-value cheque, you must share some key details about the cheque with the bank before it is deposited. These details include the cheque number, amount, date, payee name, and account number. Once you submit these details, the bank cross-checks them before clearing the cheque. This helps ensure the cheque is genuine and hasn’t been tampered with.

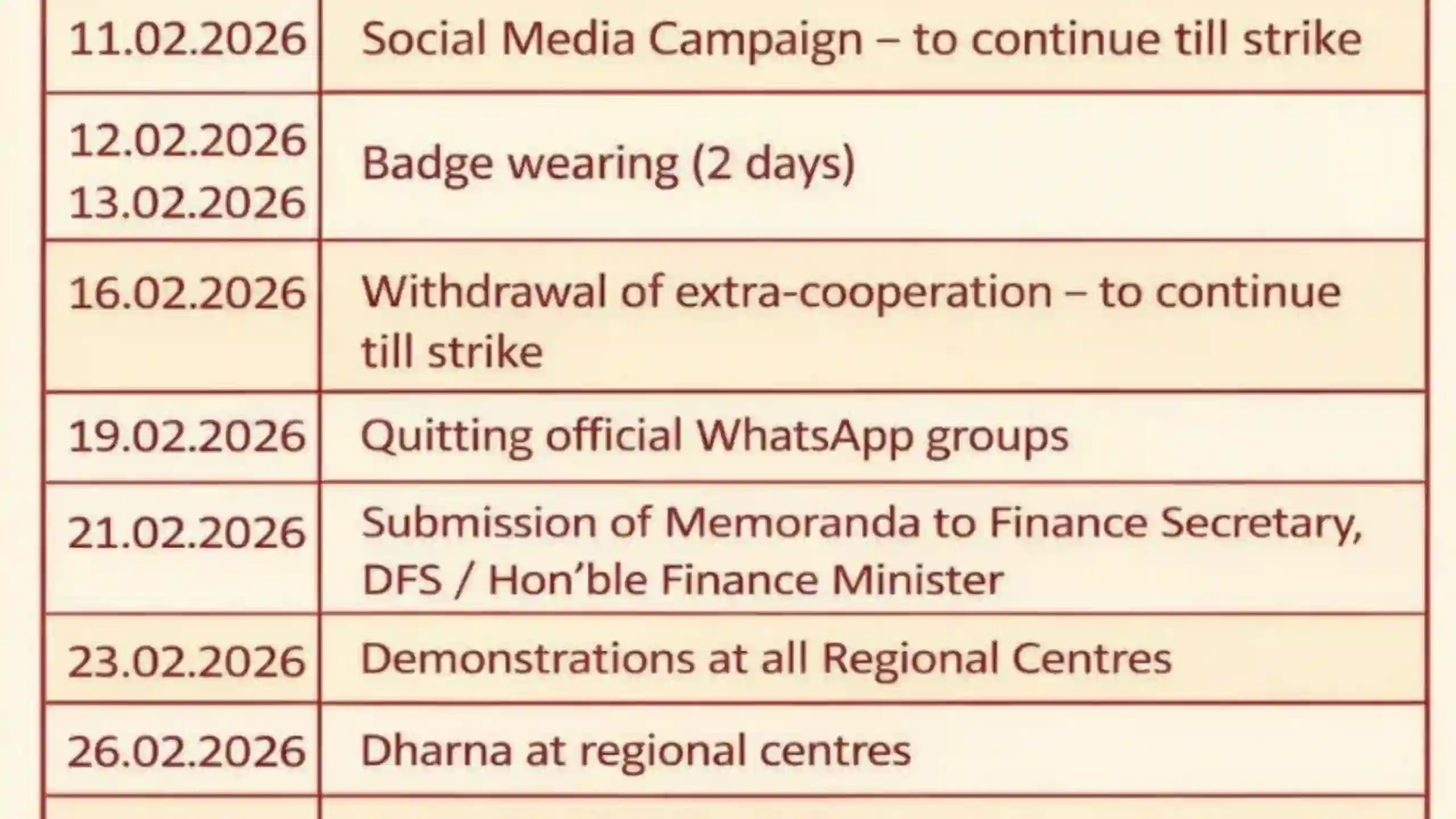

Bank of Baroda New Rules for PPS

Until now, Bank of Baroda required Positive Pay confirmation only for cheques of ₹5 lakh and above. But starting May 1, 2025, the bank is reducing this limit in stages:

- From May 1, 2025: Positive Pay will be mandatory for cheques of ₹4 lakh and above

- From August 1, 2025: The limit lowers to ₹3 lakh and above

- From November 1, 2025: It will apply to cheques of ₹2 lakh and above

This means that more customers will need to use the Positive Pay system to make their cheque payments safer.

How to Use Positive Pay in Bank of Baroda

Bank of Baroda customers need not worry about PPS. They can submit PPS easily online without visiting bank branch. PPS can be submitted online via mobile banking, net banking, and other modes. The online link to apply PPS in Bank of Baroda is given at last.

Mobile Banking (Baroda M-Connect Plus)

- Log in to the mobile banking app.

- Go to Request Services > Positive Pay Confirmation.

- Select the account from which the cheque is issued.

- Enter the cheque number, amount, date, payee’s name, and transaction code.

- Confirm using your MPIN.

Net Banking (BOB iBanking)

- Log in to your net banking account.

- Go to Services > Cheque Book > Centralized Positive Pay Mechanism.

- Fill in the required cheque details.

- Confirm the request using your transaction password.

Other Channels Available for PPS

- Branch: You can visit your nearest Bank of Baroda branch and provide cheque details.

- SMS

- Call Center

- WhatsApp Banking

- Bank of Baroda’s official website

Important Note for Customers

If you are issuing a cheque for ₹2 lakh or more (from November 2025 onward), make sure you submit the Positive Pay details before giving the cheque to the person or organization. This will help avoid any delays or rejection during cheque processing. This has been done to avoid frauds in Cheques and in long term, it will prove to be highly beneficial for bank customers.