Bank Nationalisation not provided desired result, Privatisation of PSU Banks will not hurt Nation

| Get instant news updates: Click here to join our Whatsapp Group |

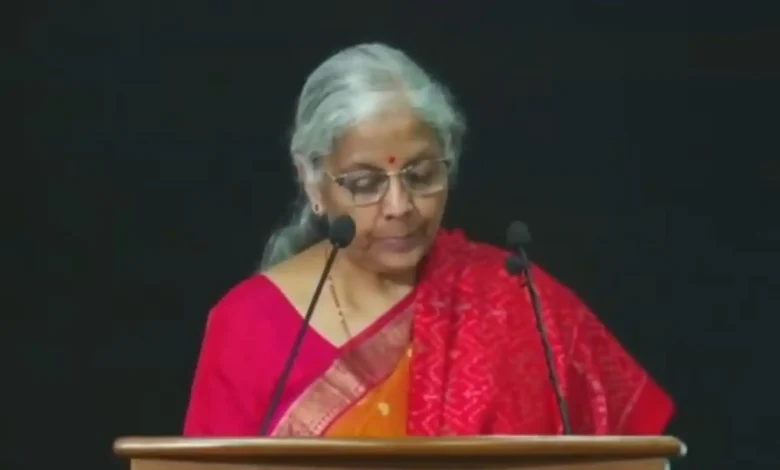

Finance Minister Nirmala Sitharaman on Tuesday said that privatisation of state-owned banks would not hurt financial inclusion and national interest. She said that the bank nationalisation done in 1969 has not yielded the desired result as far as financial inclusion was concerned.

Addressing the student at the Diamond Jubilee Valedictory Lecture at Delhi School of Economics (DSE), University of Delhi here, FM Sitharaman said that the nationalisation did help in pushing priority sector lending and government programmes but government control made public sector banks unprofessional.

Watch Video What She Said 👇

She said that despite 50 years of nationalisation, the objectives that were not entirely achieved. She also stated that after the government professionalised the banks, those objectives are still being beautifully achieved.

“So, this perception that when you try to make them professional, and if you want to privatise them, which is a Cabinet decision, that objective of reaching to all people, taking banking to everybody will be lost… is incorrect.”

She said that public sector banks have been misused in the past. The finance minister said India’s banking system has undergone a remarkable recovery from the “twin balance sheet” stress that public sector banks faced nearly a decade ago.

“You must have heard this expression of twin balance sheet problem in 2012-13 and to correct that, it took us nearly six years after Prime Minister Narendra Modi came into power. Now I am confident to say our Indian banks stand out exemplary in terms of the asset quality, in terms of the NIM, in terms in terms of credit and deposit growth and also in terms of financial inclusion,” she said.

She emphasised that when banks are allowed to function professionally and the decisions are board driven, “every objective of the national interest and also the banking interest, will be served”.

“What is making us literally stand out is the fast movement from the tenth largest economy in 2014 to fifth and the fourth, and now sooner, probably to the third,” Sitharaman said, adding that 25 million people have been pulled out of multidimensional poverty in recent years.

Gai bhains paani mein

Yes, please sell everything.

Then Why Niti Ayog is purchasing BMW cars for members??

Is it a symbol of Professionalism??

Madam why you want to sell everything ???

she wants to sell because she doesn’t have account in PSB.. just like onion

Govt of India can be privatised or not… If it can… It will give more positive output….

बंदर के हाथ में जैसे उस्तरा हानिकारक है ऐसे ही इस अयोग्य अम्मा को वित्त विभाग देना हानिकारक है । इसकी नीतियों से ऐसा न हो कि हमारे देश का हाल नेपाल श्रीलंका जैसा हो

Hmne ministers isliye chune the ki wo kaam kre or desh ko aage badhaye… Agar ministers wo kaam nhi kr skte h to unko private hi kr dete h .. na pension ka kharcha na inke chai paani or khane ka kharcha na inke foreign trip ka kharcha … Itna paisa bach jayega ki desh ko bechne ki jarurat nhi padegi

When we go any official place as any hospital,police station our government office there is no timing to come .There is work is pending for many years,I have question for these thing what our government is doing.

Are u A minister

Hello madam we know that You are just rubber stamp. U DONT DESRVE TO BE A MINISTER. But it is our bad luck to serve under your governance.

Before privatisation better you ask yourself

And you cabinet ministers weather they deserve to be minister without serving the the people fairly.

You peaple have any target to work as minister or any benchmark measure your performance?Nothing

Don’t sale the nation to Ambani and Adani like persons.Do good for common man or poor peaples.