Bangladesh MPC Highlights – Policy rate unchanged at 10 percent

The 11th meeting of the Monetary Policy Committee (MPC) of Bangladesh Bank was held on 22 January 2026. The meeting was chaired by Dr. Ahsan H. Mansur, Governor of Bangladesh Bank. After reviewing all economic conditions, the MPC unanimously decided to:

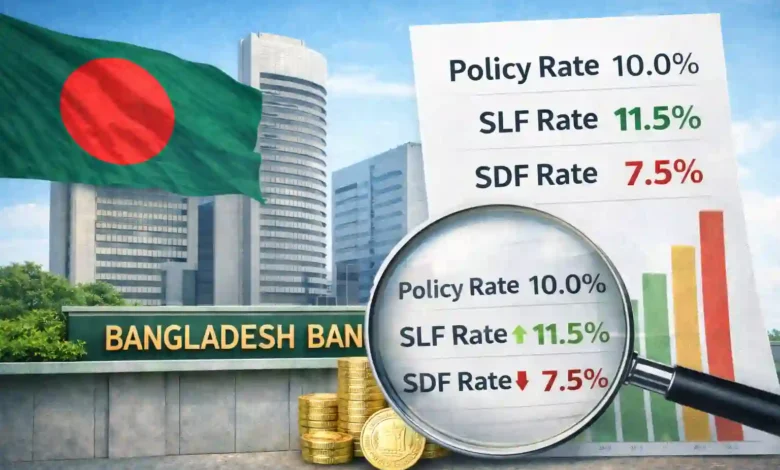

- Keep the policy rate unchanged at 10.0 percent.

- Keep the Standing Lending Facility (SLF) rate unchanged at 11.5 percent.

- Reduce the Standing Deposit Facility (SDF) rate by 50 basis points, from 8.0 percent to 7.5 percent.

The committee stated that this policy stance will continue until inflation reaches the desired level.

Review of Economic Situation

The committee reviewed the current economic situation and checked the implementation of decisions taken in the previous (10th) meeting. Members discussed both domestic and global economic conditions. They analyzed inflation trends, employment, economic growth, financial markets, and the external sector.

The committee noted that inflation risks could increase due to the upcoming national election, the Ramadan period, and the possible implementation of the 9th National Pay Scale. These events could increase demand and consumer spending, which may push prices higher.

Impact of Contractionary Monetary Policy

The MPC observed that Bangladesh Bank’s tight monetary policy has produced positive results despite many challenges. The exchange rate has become stable, foreign exchange reserves have started to improve, and the real policy rate has turned positive. This has supported savings and improved confidence in monetary policy. Inflationary pressure is gradually reducing, which shows that the economy is slowly moving toward stability.

Need for Broader Inflation Control Strategy

The committee emphasized that controlling inflation requires more than just adjusting policy rates. A combined strategy is necessary. This includes proper estimation of food demand and domestic production, timely import of food under government supervision, and better distribution management to control food prices.

The MPC noted that existing trade policies did not respond effectively to supply shocks. As a result, domestic prices remained high even though global commodity prices declined. Therefore, inflation did not decrease as expected. The committee recommended that the upcoming Monetary Policy Statement (MPS) for the second half of FY26 should clearly explain why inflation did not fall despite maintaining a tight monetary policy.

Standing Deposit Facility (SDF) and Liquidity Management

The MPC observed that at the current SDF rate, some banks preferred to keep their excess liquidity with the central bank instead of lending in the interbank market or to the private sector. To encourage banks to use their funds more actively, Bangladesh Bank may consider reducing the SDF rate while keeping the policy rate and the Standing Lending Facility (SLF) rate unchanged. This would improve interbank transactions and increase credit flow to the private sector.

Impact of Possible New Pay Scale

The committee discussed the possible implementation of salary increases for public sector employees as recommended by the National Pay Commission 2025. If the government increases salaries without raising revenue significantly, it may need to borrow more, leading to deficit financing. This could put pressure on the money market and result in higher interest rates. Therefore, the government should take proper revenue measures to reduce the impact of the new pay scale on the money market.

Exchange Rate and Banking Sector Challenges

The MPC suggested that Bangladesh Bank should continue maintaining a market-based exchange rate to keep the foreign exchange market stable. The committee also noted that the banking sector faces serious challenges due to high levels of non-performing loans (NPLs). These bad loans have created liquidity pressure, especially for weaker banks and non-bank financial institutions.

Bangladesh Bank has started a comprehensive reform program to improve governance, stability, transparency, and public trust in the financial system. These reforms aim to improve asset quality and strengthen the financial system over the long term.