Selected candidates not joining PSU Banks, Silent Staff Crisis growing within Govt Banks

In recent years, India’s public sector banks have been struggling with a growing problem that is often overlooked—candidates are simply not joining, even after being selected. Most of the talented candidates who join banks, leave the job within a few years in search of better opportunity. This leads to staff shortage and loss of talent.

This trend is becoming more evident with each passing year and is now raising serious concerns about the future of the banking workforce, especially at the clerical level.

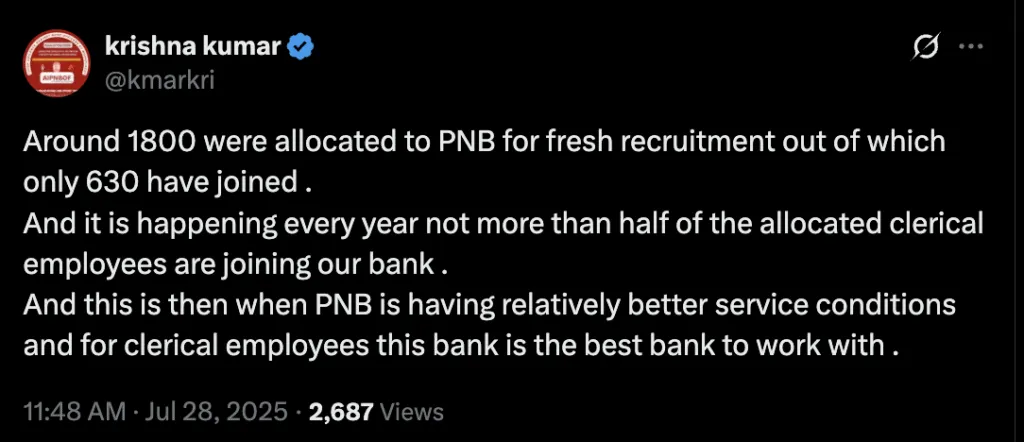

One of the most notable examples of this issue is Punjab National Bank (PNB). In the latest recruitment cycle, around 1,800 candidates were allotted to PNB for clerical posts, but shockingly, only 630 candidates actually joined. That means less than 35% of those who were offered a job chose to take it up. And this isn’t an isolated case—similar trends have been observed in previous years too.

JOINING SCHEDULE OF CSAs in Punjab National Bank

This is the example of only clerical recruitment. This is the same situation in case of POs (Probationary Officers). Candidates who join banks as POs regularly keep searching for better opportunities and leave bank as soon as they any better job.

A Declining Trend: Why Candidates Are Not Joining

Traditionally, a job in a public sector bank—especially in clerical roles—was considered a secure and respectable career option. In fact, PNB is known to offer some of the best service conditions for clerical employees among all public sector banks. It has long been considered one of the most employee-friendly banks to work with.

Despite these advantages, the number of candidates who actually join after selection continues to fall. So, what exactly is causing this shift?

Youth Preferences Are Changing

Today’s job aspirants have different goals. Many young candidates today are looking for:

- More flexible work environments

- Higher starting salaries

- Faster career growth

- Work-life balance

- Modern and tech-savvy office culture

In contrast, clerical jobs in banks are seen as demanding and slow-moving in terms of career growth, despite offering job security. The work environment, high-pressure environment, and outdated management systems are turning off a generation that wants dynamic and forward-looking work opportunities.

With the rise of private sector jobs, start-ups, tech companies, freelancing, and remote work, banking jobs no longer have the same appeal they once had.

Click here to apply for Bank Jobs

Yearly Recruitment Cycle, Permanent Seat Loss

Another important issue is the nature of the recruitment process itself. Clerical recruitment in public sector banks is conducted only once a year. This means if selected candidates don’t join, those seats remain vacant until the next recruitment cycle.

In this particular case, with over 1,100 candidates not joining, PNB will now face a direct shortage of staff in multiple branches. There won’t be any fresh recruitment until the next year, and these posts will be left vacant—leading to a permanent seat loss for the current cycle.

While the candidates who didn’t join will find other opportunities elsewhere, the bank will suffer due to understaffing, increased pressure on current employees, and potential delays in services. This mismatch creates a serious manpower gap that directly affects productivity and customer experience.

Impact on the Banking System

The staff shortage caused by low joining rates creates operational challenges. It affects day-to-day functioning at branches, especially in rural and semi-urban areas, where banks are already struggling with limited manpower. This situation results in:

- Overburdened existing staff

- Declining service quality

- Longer wait times for customers

- Lower employee morale

If this trend continues unchecked, it could lead to a crisis in human resource management in public sector banks.

What Banks Must Do to Attract Talent

To reverse this trend, banks need to seriously rethink their approach to recruitment, work culture, and employee satisfaction. Here are a few steps that could make a difference:

1. Improve Working Conditions

Banks must reduce unnecessary workloads and ensure fair distribution of tasks among staff.

2. Faster Career Progression

Clear, time-bound promotion pathways can attract ambitious candidates who want to grow in their careers.

3. Flexible and Modern Work Environment

Introducing work-from-home options for back-office roles, digital transformation, and training programs can appeal to today’s tech-savvy youth.

4. Enhance Work-Life Balance

Regulating working hours, giving regular breaks, and respecting employee time off can build a healthier and more positive work culture.

The example of PNB receiving 1,800 candidates and getting only 630 joiners reveals a harsh truth: the public sector banking job, once highly sought after, is now struggling to attract young talent. With yearly recruitment cycles and no provision to immediately fill unclaimed posts, banks like PNB are losing valuable manpower while selected candidates move on to other industries.

Unless urgent steps are taken to modernize banking jobs and improve employee experience, the sector will continue to face recruitment shortfalls and operational strain. Public sector banks need to evolve—not just to keep up with the changing job market but to survive and stay relevant in the years to come.