The State Bank of India (SBI), which is the largest bank in the country, is expected to achieve a total business of ₹100 trillion in the next financial year. This means the combined value of all loans given by the bank and deposits made by customers will reach this massive amount. The business of SBI was Rs.90 Trillion as on 30 September. SBI opens 65,000 savings accounts in a day on an average.

According to SBI Chairman C.S. Setty, this target is achievable if the bank continues to grow at the same pace as it is now. Currently, SBI’s loans are increasing by 14-16% every year, while deposits are growing by about 10%. If these growth rates continue, the bank will easily cross the ₹100 trillion mark in the coming year.

He said that the net profit conversion from operating profit is approaching 70%, reflecting efforts across all areas. SBI is well-positioned in terms of liquidity, with an overall credit-deposit (CD) ratio at a moderate 68%. The bank aims to sustain an incremental CD ratio of 100%.

This milestone highlights SBI’s significant role in the Indian banking sector and its steady expansion in both lending and attracting deposits from customers.

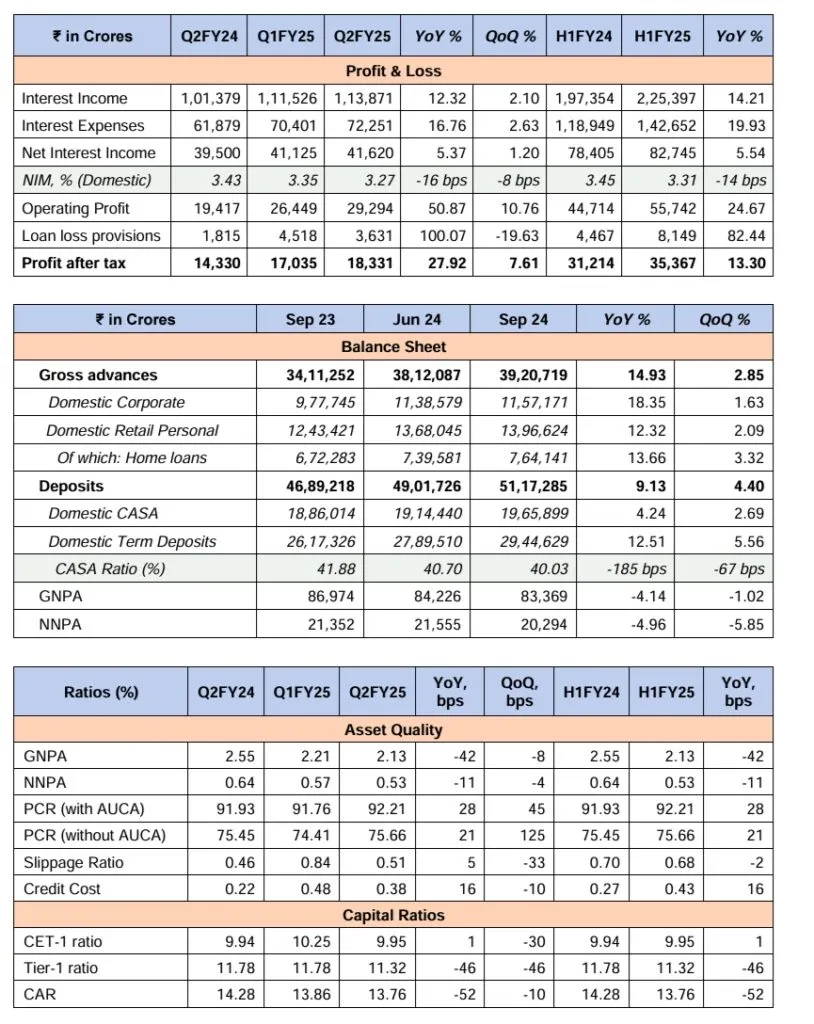

SBI Data as on 30.09.2024

| Parameter | Value (in Cr) |

|---|---|

| Deposits | ₹51,17,285 |

| Advances | ₹39,20,719 |

| Net Profit | ₹18,331 |

| Gross NPA | ₹83,369 |

| Market Share-DMP (%) | 22.26 (June 24) |

| Market Share-ADV (%) | 19.64 (June 24) |

| CASA (%) | 40.03 |

| Gross NPA (%) | 2.13 |

| RoA (%) | 1.17 |

| RoE (%) | 21.78 |

| Cost to Income (%) | 48.51 |

| Number of Customers (crore) | 51.36 |