Repo Rate unchanged at 5.25%, RBI MPC Meeting Updates!

The Monetary Policy Committee (MPC) of the RBI held its 59th meeting from February 4 to 6, 2026, under the chairmanship of Shri Sanjay Malhotra, Governor, Reserve Bank of India. The MPC meeting was attended by members – Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta and Shri Indranil Bhattacharyya.

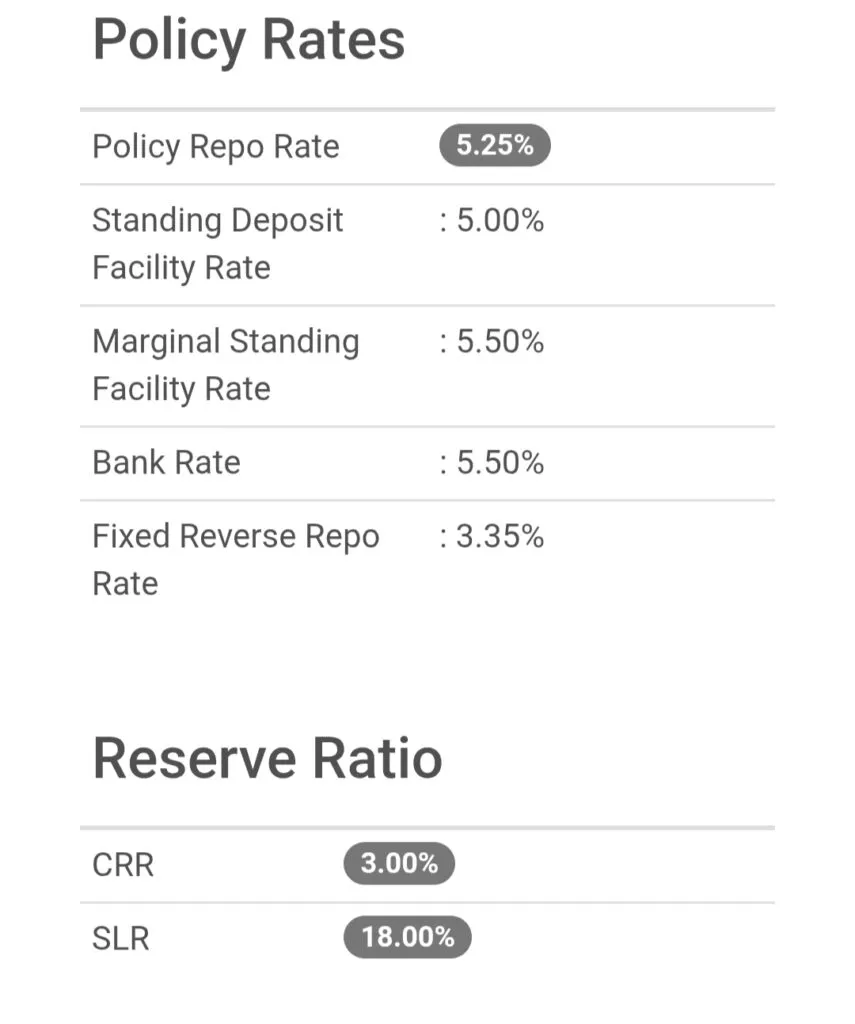

The policy repo rate under the liquidity adjustment facility (LAF) remains unchanged at 5.25 per cent. Consequently, the standing deposit facility (SDF) rate remains at 5.00 per cent and the marginal standing facility (MSF) rate and the Bank Rate remains at 5.50 per cent. The MPC also decided to continue with the neutral stance.

Also Read: Big Update! All MD&CEO posts in Nationalised Banks opened for Private Sector

On the domestic front, Real gross domestic product (GDP), as per the First Advance Estimates (FAE), is estimated to grow at 7.4 per cent (y-o-y) in 2025-26. On the supply side, real GVA growth of 7.3 per cent is driven by buoyant services sector, resilient agricultural sector and revival in manufacturing activity.

The real GDP growth projections for Q1:2026-27 and Q2 are revised upwards to 6.9 per cent and 7.0 per cent.

Also Read: PNB Bank Apprentice Recruitment 2026 Notification PDF Out for 5138 Posts

Headline CPI inflation remained low at 0.7 per cent in November and 1.3 per cent in December, 2025. Excluding gold, core inflation remained stable at 2.6 per cent in December.

CPI inflation for 2025-26 is now projected at 2.1 per cent with Q4 at 3.2 per cent. CPI inflation for Q1:2026-27 and Q2 are projected at 4.0 per cent and 4.2 per cent, respectively.

The minutes of the MPC’s meeting will be published on February 20, 2026. The next meeting of the MPC is scheduled for April 6 – 8, 2026.

Loading…

Loading…

Loading…

Loading…