Repo Rate fixed at 5.50%, Read RBI Monetary Policy Committee Meeting Highlights

The 56th meeting of the Monetary Policy Committee (MPC) was held from August 4 to 6, 2025, under the chairmanship of Shri Sanjay Malhotra, Governor of the Reserve Bank of India. The meeting was attended by Dr. Nagesh Kumar, Shri Saugata Bhattacharya, Prof. Ram Singh, Dr. Poonam Gupta, and Dr. Rajiv Ranjan.

The minutes of the MPC’s meeting will be published on August 20, 2025. The next meeting of the MPC is scheduled from September 29 to October 1, 2025.

The Monetary Policy Committee (MPC), after carefully assessing the current and evolving macroeconomic situation, has decided to keep the policy repo rate unchanged at 5.50 per cent. As a result, the Standing Deposit Facility (SDF) rate remains at 5.25 per cent, while both the Marginal Standing Facility (MSF) rate and the Bank Rate continue at 5.75 per cent.

| Policy Repo Rate | 5.50% |

|---|---|

| Standing Deposit Facility Rate | 5.25% |

| Marginal Standing Facility Rate | 5.75% |

| Bank Rate | 5.75% |

| Fixed Reverse Repo Rate | 3.35% |

| CRR | 4% |

| SLR | 18% |

This decision aligns with the Reserve Bank of India’s objective of maintaining consumer price index (CPI) inflation at a medium-term target of 4 per cent, within a tolerance band of plus or minus 2 per cent. At the same time, the move is intended to support the ongoing economic growth by not increasing borrowing costs, thereby ensuring a balanced approach between inflation control and growth promotion.

The global environment continues to be challenging. Although financial market volatility and geopolitical uncertainties have abated somewhat from their peaks in recent months, trade negotiation challenges continue to linger. Global growth, though revised upwards by the IMF, remains muted. The pace of disinflation is slowing down, with some advanced economies even witnessing an uptick in inflation.

Domestic growth remains resilient and is broadly evolving along the lines of our assessment. Private consumption, aided by rural demand, and fixed investment, supported by buoyant government capex, continue to boost economic activity. On the supply side, a steady south-west monsoon is supporting kharif sowing, replenishing reservoir levels and boosting agriculture activity. Moreover, services sector and construction activity remain robust. However, growth in industrial sector remained subdued and uneven across segments, pulled down by electricity and mining.

As for the growth outlook, the above normal southwest monsoon, lower inflation, rising capacity utilization and congenial financial conditions continue to support domestic economic activity. The supportive monetary, regulatory and fiscal policies including robust government capital expenditure should also boost demand. The services sector is expected to remain buoyant, with sustained growth in construction and trade in the coming months.

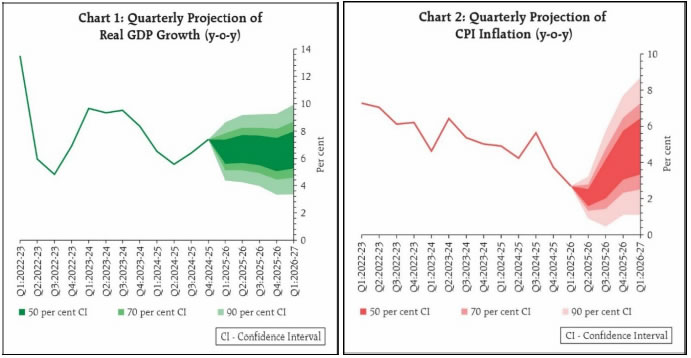

Prospects of external demand, however, remain uncertain amidst ongoing tariff announcements and trade negotiations. The headwinds emanating from prolonged geopolitical tensions, persisting global uncertainties, and volatility in global financial markets pose risks to the growth outlook. Taking all these factors into account, projection for real GDP growth for 2025-26 has been retained at 6.5 per cent, with Q1 at 6.5 per cent, Q2 at 6.7 per cent, Q3 at 6.6 per cent, and Q4 at 6.3 per cent. Real GDP growth for Q1:2026-27 is projected at 6.6 per cent. The risks are evenly balanced.

CPI headline inflation declined for the eighth consecutive month to a 77-month low of 2.1 per cent (y-o-y) in June 2025. This was driven primarily by a sharp decline in food inflation led by improved agricultural activity and various supply side measures. Food inflation recorded its first negative print since February 2019 at (-) 0.2 per cent in June. High-frequency price indicators signal a continuation of the lower price momentum in food prices this year to July as well. Core inflation, which remained within a narrow range of 4.1-4.2 per cent during February-May, increased to 4.4 per cent in June, driven partly by a continued increase in gold prices.

The inflation outlook for 2025-26 has become more benign than expected in June. Large favourable base effects combined with steady progress of the southwest monsoon, healthy kharif sowing, adequate reservoir levels and comfortable buffer stocks of foodgrains have contributed to this moderation. CPI inflation, however, is likely to edge up above 4 per cent by Q4:2025-26 and beyond, as unfavourable base effects, and demand side factors from policy actions come into play. Barring any major negative shock to input prices, core inflation is likely to remain moderately above 4 per cent during the year. Weather-related shocks pose risks to inflation outlook. Considering all these factors, CPI inflation for 2025-26 is now projected at 3.1 per cent with Q2 at 2.1 per cent; Q3 at 3.1 per cent; and Q4 at 4.4 per cent. CPI inflation for Q1:2026-27 is projected at 4.9 per cent. The risks are evenly balanced.

The Monetary Policy Committee (MPC) observed that the inflation outlook for the near term has improved and is more favorable than previously expected. The average Consumer Price Index (CPI) inflation for the year is now projected to stay well below the 4% target, mainly due to a sharp drop in food prices, with food inflation even entering negative territory in June. However, the committee also cautioned that inflation is likely to rise above the 4% target starting from the fourth quarter of 2025–26. In addition, core inflation—which excludes volatile items like food and fuel—has been gradually increasing. It had dropped to a low of 3.6% in December–January 2024–25 but rose to an average of 4.3% in the first quarter of this year. Even the core inflation excluding precious metals has picked up, averaging 3.4% in the same period.

On the growth front, the Indian economy is performing steadily. Growth remains in line with the earlier estimate of 6.5% for the financial year 2025–26, and a further boost is expected during the upcoming festive season. However, the MPC acknowledged that while headline inflation is currently low, this is largely due to the fluctuation in food prices—particularly vegetables—rather than a broad-based easing of price pressures. Meanwhile, core inflation has stayed steady around the 4% mark, just as projected earlier. The committee also pointed out that the effects of the recent 100 basis points rate cuts since February 2025 are still working their way through the economy, and monetary policy transmission is ongoing.

Given this mix of lower-than-expected headline inflation, steady core inflation, moderate economic growth, and the still-unfolding effects of earlier rate cuts, the MPC decided that it would be prudent to maintain the current policy repo rate at 5.5%. The goal is to allow more time for the earlier rate reductions to impact the economy fully. Therefore, the committee unanimously voted to keep the repo rate unchanged and agreed to maintain a neutral policy stance. The MPC also emphasized that it will continue to closely monitor incoming data and the evolving balance between inflation and growth to guide future monetary policy decisions.