Punjab National Bank, one of India’s largest public sector banks, has launched a Digital Mudra Loan facility. Customers can now apply online and avail loans without any collateral security. PNB has introduced this facility on a pilot basis in select zones and plans to expand it across India soon.

The Digital Mudra Loan aims to empower small business owners, shopkeepers, and micro enterprises by removing traditional barriers to credit. Earlier, applicants had to visit bank branches, submit lengthy paperwork, and often provide collateral to secure loans. With this digital platform, the entire process — from loan application to approval and disbursal — can be completed online.

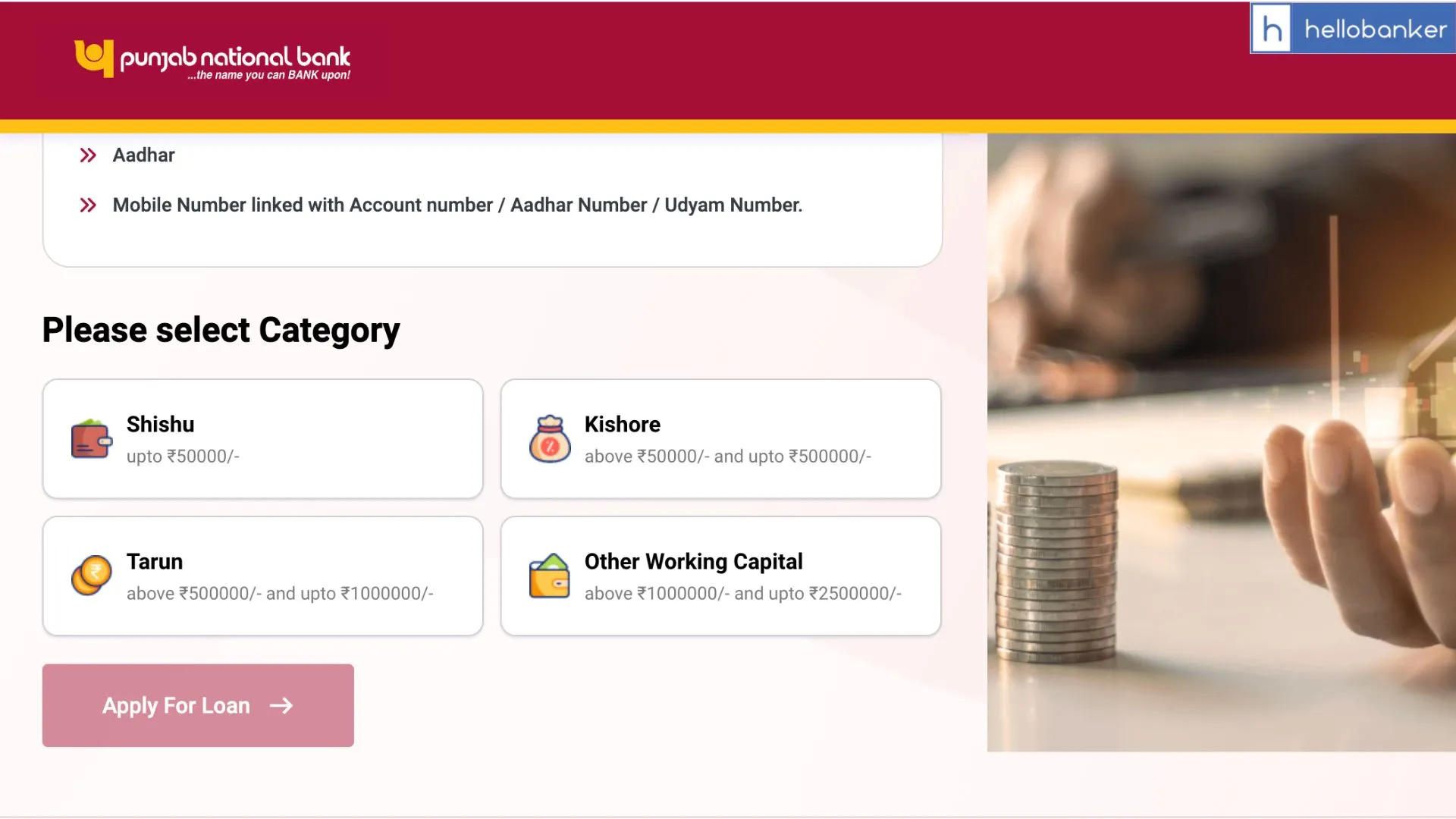

With this online facility, you can get mudra loan upto Rs.10 lakhs online. Under the Pradhan Mantri Mudra Yojana (PMMY), loans are classified into three categories — Shishu, Kishore, and Tarun — based on the business stage and funding needs. The Shishu category offers loans up to ₹50,000 for small startups or new ventures to cover initial expenses like raw materials or equipment. The Kishore category provides loans from ₹50,001 to ₹5 lakh for growing businesses that need funds for expansion or working capital. The Tarun category extends loans between ₹5 lakh and ₹10 lakh. To apply for the PNB Digital Mudra Loan, applicants must meet the following eligibility conditions:

- Applicant Type: Individual or Sole Proprietor

- Bank Account: Must have an active KYC-compliant Current or Savings Account with at least 12 months of history, or can apply even with no prior banking relationship

- Business Registration: Valid Udyam Registration Certificate required

- Age Limit: Between 18 and 65 years

- Loan Restrictions: Applicant should not be availing any fund-based revolving business loan (CC/OD) from any other bank or financial institution

Loan Amount

- Loan up to ₹25 lakh available

- For projection-based loans or loans based on credit summation in savings accounts, the maximum limit is ₹10 lakh

Interest Rate

- Competitive and linked to the Repo Linked Lending Rate (RLLR)

- Starting from 10.10%* per annum

Collateral Security

- No collateral required

- Loan covered under CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

Financial Documentation

- Documentation waived for loans up to ₹10 lakh (projection-based)

- For projection-based loans, details such as sales, purchase, and expenditure are captured digitally

Special Benefits

- Concessional unified processing fee

- Fully digital renewal facility

- Zero margin requirement

Assessment Methods

1. Credit Summation-Based:

Eligible for up to 25% of total credits in the applicant’s bank account over the last 12 months

2. Projection-Based:

Eligible for up to 20% of realistic, accepted projected turnover

Click here to apply online for Loan