Data

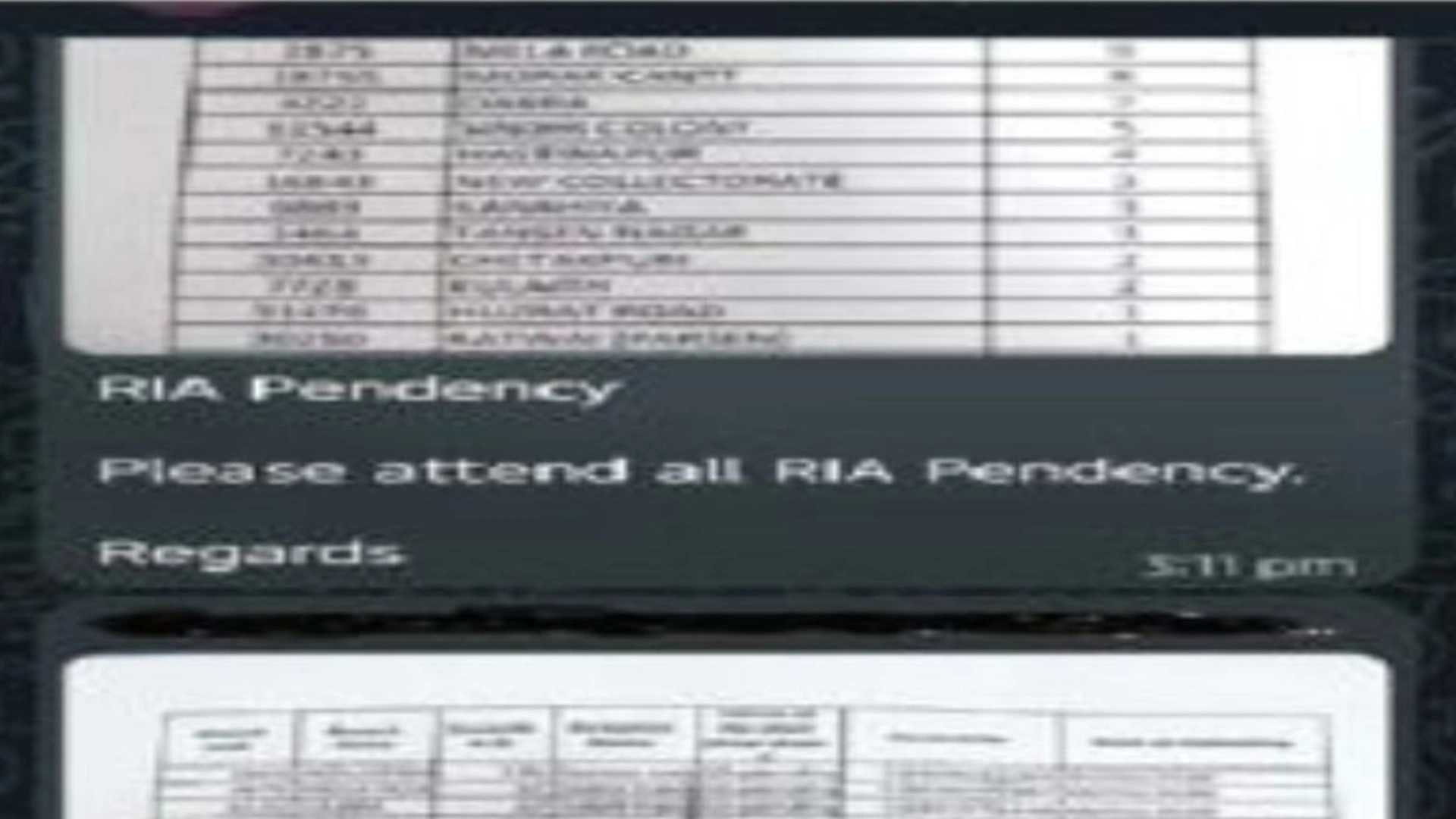

Overseas Direct Investment Data July 2025

Connect with Us

The Reserve Bank of India has today released the data on Overseas Direct Investment, both under Automatic Route and the Approval Route, for the month of July 2025.

Overseas Direct Investment (ODI) means when a person or company from one country invests directly in a business entity located in another country.

In simple words, if an Indian company (or even an individual in certain cases) sets up, acquires, or invests in a company outside India, it is called Overseas Direct Investment.

Advertisement

Key Points about ODI:

- Nature of investment: Usually made in equity shares, compulsory convertible preference shares, or other ownership instruments that give control or significant influence over the foreign company.

- Forms of investment:

- Setting up a Wholly Owned Subsidiary (WOS) abroad.

- Entering into a Joint Venture (JV) with a foreign partner.

- Regulation in India: Governed by the Foreign Exchange Management Act (FEMA), 1999 and rules issued by the Reserve Bank of India (RBI).

- Purpose: Helps Indian companies expand globally, access new markets, technology, and resources.

- Difference from Foreign Portfolio Investment (FPI): ODI means taking significant ownership/control in a foreign company, while FPI means buying foreign shares just for returns, without management control.

Example: If Tata Motors sets up a manufacturing unit in South Africa, or acquires shares in a foreign automobile company with management rights, that is ODI.

Advertisement