Now you can get Loans upto Rs.10 Lacs on Flipkart, RBI Gives License to Flipkart

Walmart-owned Flipkart has received an important lending licence from the Reserve Bank of India (RBI). This licence allows Flipkart to directly offer loans to its customers and sellers on its platform. This is a big deal because Flipkart is the first major e-commerce company in India to get this kind of licence, called a Non-Banking Finance Company (NBFC) licence.

This move marks an important step in how financial services are evolving within India’s online shopping world.

How to Get Loans From Flipkart?

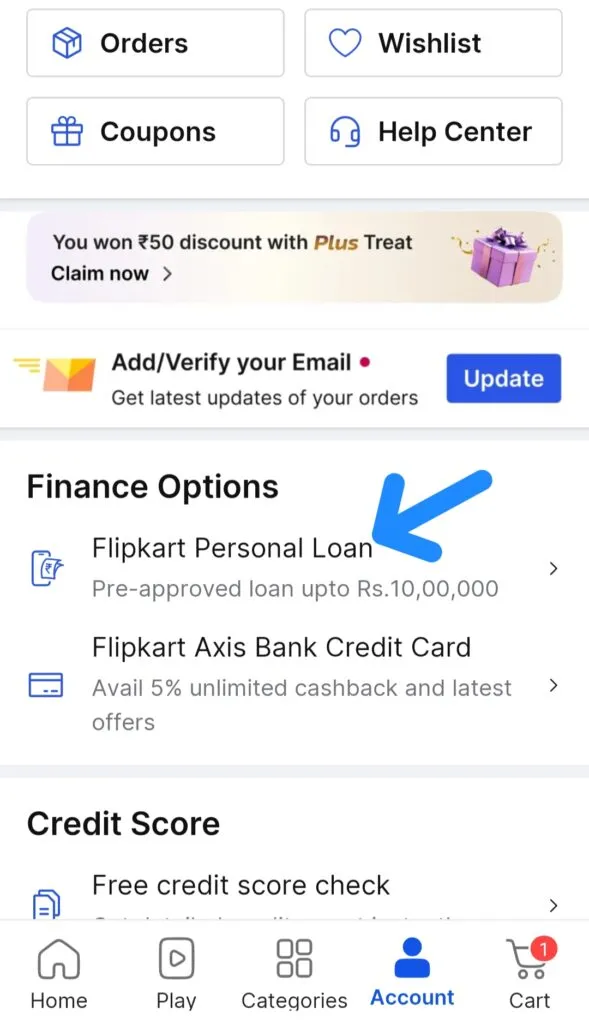

You can easily take Loan from Flipkart in just a few clicks. Just open Flipkart app, click on Account and then click on ‘Flipkart Personal Loan’. Then enter your details and you can easily get loan. You can below image for reference.

What Does the Licence Allow Flipkart to Do?

The licence, granted on March 13, lets Flipkart provide loans directly, but it cannot accept deposits like a bank. This means Flipkart can now lend money to buyers and sellers without going through a third-party bank. This will help Flipkart offer more customized financial products right on its shopping platform. For users, this could mean easier access to loans while shopping or running their businesses on Flipkart.

How Were Loans Provided Before?

Until now, Flipkart offered personal loans through partnerships with banks such as Axis Bank and IDFC Bank. This means if a customer wanted a loan, Flipkart would help connect them to these banks, which actually gave the money. But with the new licence, Flipkart can now lend money directly, which can make the process faster, simpler, and more profitable for Flipkart.

How Will Flipkart Use This Licence?

Flipkart plans to start giving loans directly through its website and also through its fintech app called super.money. This will help both buyers and sellers get financing easily. For example, sellers might get working capital loans to grow their businesses, and customers could get personal loans or credit for shopping. Flipkart is currently working on finalising the details and appointing the right team to run this new service. The launch is expected within a few months.

Why Is This Licence Important for Flipkart and Walmart?

Flipkart is a huge company valued at around $37 billion after a $1 billion investment led by Walmart in 2024. This new licence strengthens Flipkart’s financial services, which is a key part of Walmart’s plan to take Flipkart public (launch its stock on the stock market). Flipkart is also moving its holding company from Singapore to India to better fit local laws and market needs. This move shows Walmart’s long-term commitment to growing Flipkart as a leading company in India.

What About Competition?

Other big e-commerce players like Amazon are also moving into financial services. For example, Amazon bought Axio, a non-bank lender based in Bengaluru, but still needs RBI approval. Flipkart’s licence gives it an early advantage in offering loans directly to users. The competition in financial services is becoming very important in e-commerce because it helps companies attract and keep customers by offering more than just products.

RBI Approval Shows Growing Trend

Flipkart applied for the NBFC licence back in 2022. The RBI’s approval shows how financial services are becoming a natural part of e-commerce platforms in India. Flipkart is carefully preparing to launch this service smoothly because offering financial products requires strict planning and management. This preparation is important for building trust and providing good customer service.

What Could This Mean for Shoppers and Sellers?

For users, Flipkart’s new lending licence means easier and faster access to loans without needing to visit banks or third-party lenders. Buyers might get personal loans for shopping, while sellers can get funds to grow their business. This change can improve the overall shopping experience by making payments and credit more flexible.

In the bigger picture, this licence could change how online shopping works in India. More e-commerce companies may start offering their own financial services, making it simpler for people to buy and sell online. This also creates a more integrated ecosystem where shopping and finance come together, improving convenience for everyone involved.