New Tax on Car: Now you will have to pay 18% GST on sale of your Car

Recently, the government announced the imposition of an 18% Goods and Services Tax (GST) on the sale of old cars. This decision has significant implications for a large number of Indian citizens, as the used car market plays a major role in the economy and caters to millions of buyers and sellers. Many people have raised objections to this tax, with some calling it “Tax Terrorism,” reflecting their dissatisfaction with the financial burden it adds. To understand the issue fully, let us explore how this new rule works and its potential impact.

How the 18% GST on Old Cars Works

The GST is calculated on the transaction value of the car at the time of resale. For instance:

- Suppose you purchase a car for ₹10 lakhs.

- After a few years, you decide to sell the car for ₹5 lakhs.

- Under the new rule, an 18% GST will be levied on the resale price of ₹5 lakhs.

- This means you will need to pay ₹90,000 (18% of ₹5 lakhs) as GST.

Petrol and diesel vehicles already attract the highest GST bracket. In fact, cars more than four metres in length, with 1,500cc engines and above, and greater than 170 mm of ground clearance attract a humongous 50 per cent tax — 28 per cent GST and 22 per cent cess, according to the Society of Indian Automobiles Manufacturers, a body representing major vehicle and vehicular engine manufacturers in India.

The Indian Blue Book 2023 report by Das Welt Auto (Volkswagen’s certified pre-owned car company) and Car&Bike highlights that India’s used car market is set to grow rapidly. This growth is driven by a growing middle class with higher incomes and an increasing demand for personal mobility.

In 2022-23, the used car market in India was valued at $31.33 billion. By 2027-28, it is expected to more than double, reaching $70.48 billion. Between FY2017 and FY2022, the market grew at an average rate of 6% per year. However, this growth is expected to jump to 16% per year between FY2023 and FY2028. In comparison, the new car market is predicted to grow at a slower rate, from 1% to 6% during the same period.

Factors Driving Growth

- Higher Disposable Income & Mobility Needs:

As people earn more and need better transportation, they are increasingly turning to used cars. - Expansion of the Organised Sector:

Companies like Spinny and Cars24 have improved the trust and transparency in the used car market, boosting consumer confidence. The organised sector’s share in this market rose from 10% in FY2011 to 29% in FY2023 and is expected to reach 45% by FY2028. - Improved Quality of Used Cars:

Car owners are replacing their vehicles faster than before. The average age of used cars dropped from 6 years in FY2011 to about 4 years now and is expected to be just 3.5 years by FY2028. However, this has led to higher prices, with the average cost of a used car rising from ₹4 lakh in FY2021 to ₹5.3 lakh in FY2023.

Changing Trends in Car Ownership

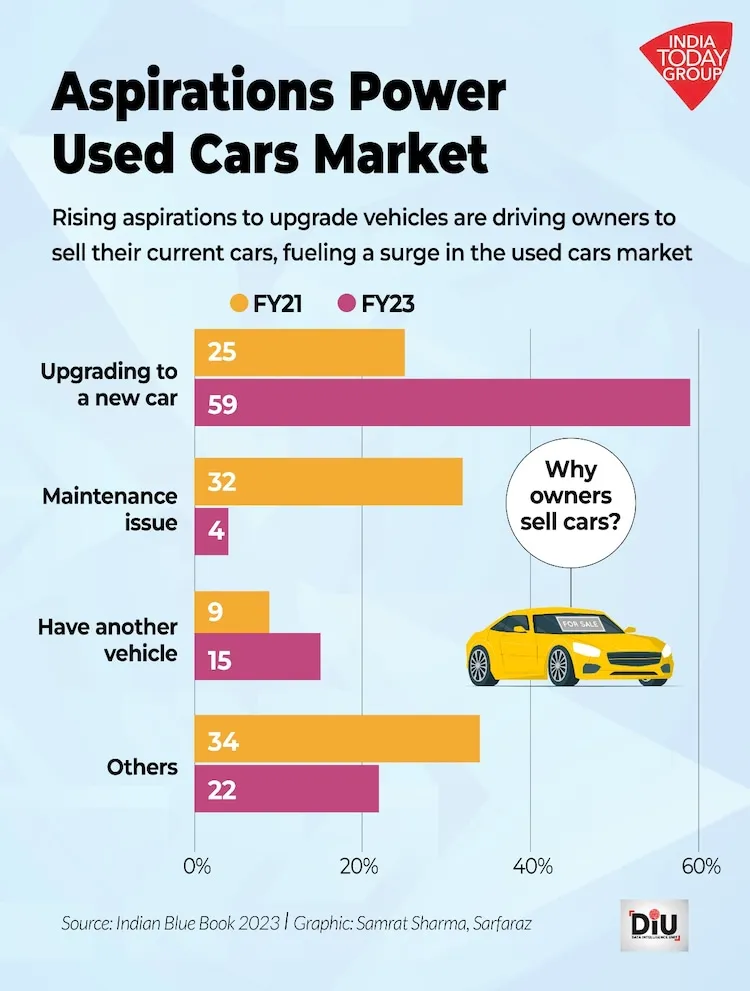

Previously, most car owners sold their cars due to maintenance problems. In FY2021, 32% of owners sold their cars for this reason, while only 25% upgraded to a new car. By FY2023, this trend had reversed: 59% sold their old cars to upgrade, and only 4% sold due to maintenance issues.

Used Cars vs. New Cars

Sales of used cars are expected to grow from over 5 million units in FY2023 to more than 8 million by FY2028. The ratio of used cars sold to new cars sold is also set to increase from 1.4 to 1.9 during this period.

Untapped Potential

India has one of the lowest car ownership rates globally, with only 20 cars per 1,000 people. In comparison, China has 150, Germany has 380, and the US has 510. This highlights the enormous potential for growth in India’s car market, particularly in the used car segment, as living standards continue to improve.

Impact on Citizens

- Increased Costs for Sellers:

The imposition of GST makes selling old cars more expensive. Individuals looking to recover some value from their vehicles might see a significant portion of their earnings go toward taxes. - Effect on the Used Car Market:

The used car market thrives on affordability, especially for middle-class families who prefer second-hand vehicles over new ones due to budget constraints. Higher taxes may discourage transactions in this segment, potentially reducing demand. - Burden on Small Businesses:

Dealers and small-scale resellers of used cars will face increased compliance and financial burdens, which might reduce their profit margins. - Public Backlash:

Many citizens believe this move disproportionately affects the middle and lower-income groups. The term “Tax Terrorism” has been used by critics to describe the perceived excessive taxation policies of the government.

Key Takeaways

The 18% GST on the sale of old cars aims to streamline tax collection and bring transparency to the used car market. However, it has raised concerns among citizens who feel it adds to their financial strain. While the government claims this step will benefit the economy in the long run, it is essential to balance revenue generation with the public’s affordability and sentiment.

This tax reform has sparked a debate across the country, with many advocating for its reconsideration to make it more favorable for the common man.