Liquidity Crisis in Banks: Check How much Liquidity injected or absorbed by RBI

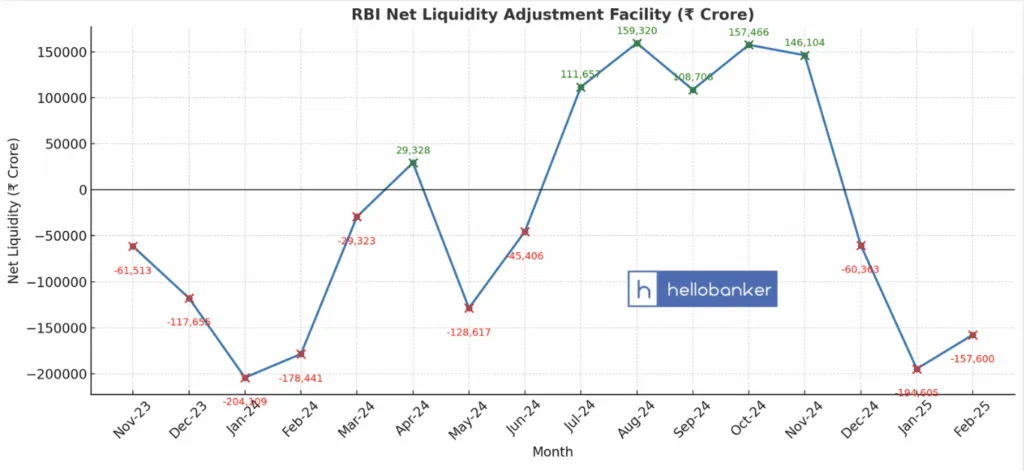

The Reserve Bank of India’s (RBI) liquidity management data shows sharp fluctuations between injection and absorption of funds in the financial system over the past 16 months, reflecting changing market conditions and seasonal pressures.

Net Liquid Adjustment Facility (Amount in ₹ Crore)

| Month | Net Absorption (+) / Injection (–) – Monthly Average |

|---|---|

| Nov-23 | -61,513 |

| Dec-23 | -1,17,655 |

| Jan-24 | -2,04,109 |

| Feb-24 | -1,78,441 |

| Mar-24 | -29,323 |

| Apr-24 | 29,328 |

| May-24 | -1,28,617 |

| Jun-24 | -45,406 |

| Jul-24 | 1,11,657 |

| Aug-24 | 1,59,320 |

| Sep-24 | 1,08,706 |

| Oct-24 | 1,57,466 |

| Nov-24 | 1,46,104 |

| Dec-24 | -60,363 |

| Jan-25 | -1,94,605 |

| Feb-25 | -1,57,600 |

The data shows how the Reserve Bank of India (RBI) manages money in the banking system by either giving funds to banks or taking money back from them, depending on the situation. When banks face a shortage of cash, RBI steps in and provides money — this is shown as negative figures in the table. For example, in January 2024, banks were short of funds and RBI had to give them more than ₹2 lakh crore.

On the other hand, when banks have excess money lying idle, RBI takes some of it back to maintain balance — this appears as positive figures. For instance, in August 2024, banks had surplus liquidity and RBI absorbed about ₹1.59 lakh crore. In simple terms, RBI works like a regulator of a water tank: it fills the tank when water is low and drains it when water is overflowing, ensuring that the financial system always stays stable.

Between Nov 2023 – Feb 2024, RBI had to give large amounts of money to banks (inject liquidity).

- Peak shortage was in Jan 2024: RBI injected ₹2.04 lakh crore.

- In Feb 2024: RBI injected ₹1.78 lakh crore.

In Apr 2024, liquidity turned surplus with RBI absorbing ₹29,328 crore.

- But in May 2024: RBI again injected ₹1.28 lakh crore.

- In Jun 2024: RBI injected ₹45,406 crore.

From Jul – Nov 2024, banks had excess money and RBI absorbed it.

- Jul 2024: Absorption of ₹1.11 lakh crore.

- Aug 2024: Absorption of ₹1.59 lakh crore.

- Oct 2024: Highest absorption of ₹1.57 lakh crore.

At the start of 2025, shortage returned.

- Jan 2025: RBI injected ₹1.94 lakh crore.

- Feb 2025: RBI injected ₹1.57 lakh crore.

Economists say these fluctuations reflect a mix of factors — including government cash balances, festival season demand, global capital flows, and RBI’s own monetary policy operations. “The liquidity situation has been volatile. RBI is walking a tightrope between managing inflation and ensuring adequate credit availability,” said a senior banking analyst.