Is Indian Overseas Bank forcing Staff to mark Lien in Accounts? Staff asks for Written Order

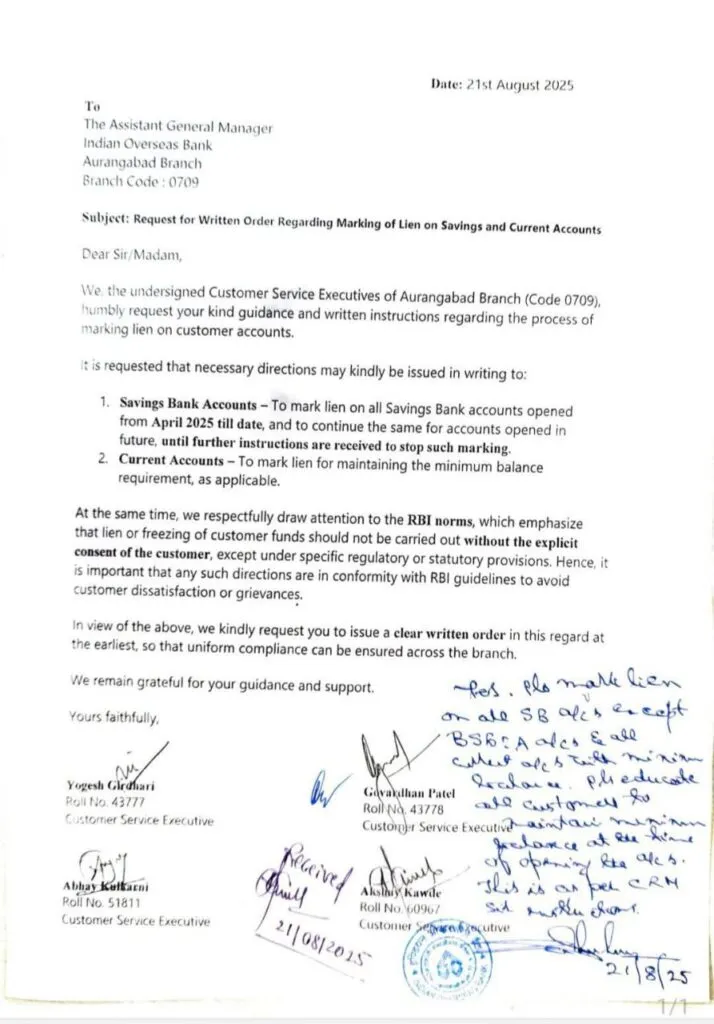

Customer Service Executives of Indian Overseas Bank (IOB), Aurangabad branch, have written to the Assistant General Manager seeking clear written instructions on marking lien on savings and current accounts.

In their letter, the employees said that they have been asked to mark lien on all savings bank accounts opened since April 2025 and continue the practice for new accounts as well, until further orders are issued. They also mentioned that liens are being placed on current accounts to maintain minimum balance requirements.

However, the staff pointed out that as per RBI norms, customer funds cannot be frozen or marked with lien without the explicit consent of the account holder, except in cases where specific regulatory or legal provisions apply. They requested a written order so that uniform compliance can be ensured across the branch and to avoid any customer grievances.

The employees also highlighted the need to follow RBI guidelines carefully to maintain transparency and prevent dissatisfaction among account holders. The Reserve Bank of India (RBI) has not released any guidelines to mark lien in accounts of customers for non-maintenance of minimum balance. Moreover, Banks impose penal charges in case of non-maintenance of minimum balance.

Banks are suffering from huge liquidity crisis. The Reserve Bank of India’s (RBI) liquidity management data shows sharp fluctuations between injection and absorption of funds in the financial system over the past 16 months, reflecting changing market conditions and seasonal pressures. Click here to check data.

The move comes at a time when banks are facing a severe liquidity crisis, with rising loan disbursals, stressed assets, and tight cash flows putting additional pressure on resources. By marking lien and ensuring minimum balances, banks are trying to protect their cash reserves and maintain liquidity to meet day-to-day operational requirements such as loan disbursement, settlement of interbank transactions, and handling large customer withdrawals.

Even small measures like enforcing minimum balance rules and restricting the misuse of savings accounts are helping banks improve their short-term liquidity position. This not only ensures smooth operations but also helps in complying with regulatory norms on maintaining a healthy liquidity coverage ratio (LCR).

But this clearly goes against RBI guidelines as Banks can’t mark lien in accounts without consent of customer. Lien can only be imposed in case of Loan. A lien can be placed on a specific deposit account to recover a loan when the borrower defaults on the loan.