Is Central Bank of India being Merged with other Public Sector Banks?

Is Central Bank of India being Merged with other Public Sector Banks? Recently, a lot of news is going on around the next round of bank merger. Amidst this, a letter has been written to PM Modi not to merge Central Bank of India.

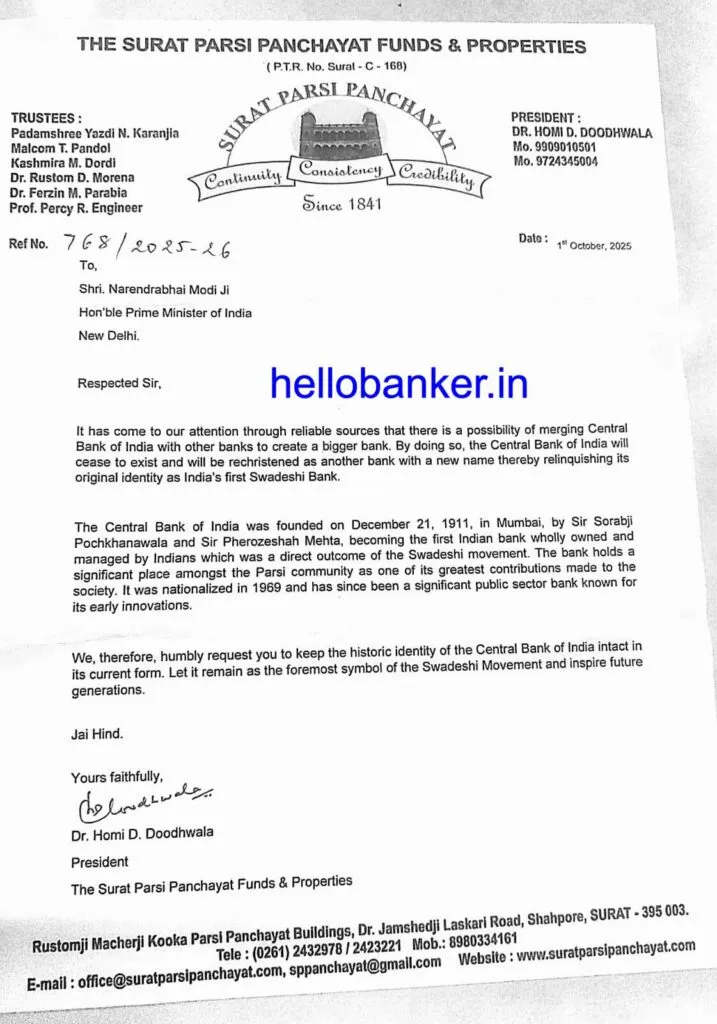

The Surat Parsi Panchayat has written to Prime Minister Narendra Modi, urging him not to merge the 114-year-old Central Bank of India with other public-sector banks. Calling it India’s first “swadeshi bank”—owned and managed by Indians—the charitable trust’s president, Homi Doodhwala, requested the prime minister keep the bank’s historical identity intact.

“It has come to our attention through reliable sources that there is a possibility of merging Central Bank of India with other banks to create a bigger bank,” the letter said. “By doing so, the Central Bank of India will cease to exist and will be rechristened as another bank with a new name, thereby relinquishing its original identity as India’s first Swadeshi Bank.”

The Central Bank of India was founded by two Parsis, Sorabji Pochkhanawala and Pherozeshah Mehta, in Mumbai in December 1911. It holds a significant place among the Parsi community as one of its greatest contributions to society. The panchayat’s letter says that the formation of the bank was a direct outcome of the Swadeshi movement that began in 1905. It was nationalised in 1969 and has since been a significant public sector bank known for its early innovations.

Earlier reports have said the central government may lower its ownership in five public sector banks via stake sales or the banks themselves selling shares to big investors, which will help them meet minimum public holding norms. Central Bank of India, UCO Bank, Bank of Maharashtra, Indian Overseas Bank, and Punjab and Sind Bank are the banks in which the Centre could allow share sales by the Department of Investment and Public Asset Management, sources said.

Recently, The Finance Ministry had organised a two-day PSB Manthan in September 2025. MD&CEOs of all Public Sector Banks were invited to the event. Various discussions were held to improve the performance of PSU Banks. One major highlight was that – Government has put forward its wish to create two Global level Banks like SBI. This is possible only with merger of Banks. Earlier also, the Government had announced that there will be only 4 public sector organisations in important sectors like banking. This also hints about merger in the near future.