IndusInd Bank’s shares fall by 19%, MCap decreased due to poor Q2 Results

On Friday, IndusInd Bank’s stock plunged by nearly 19%, marking its largest single-day decline since March 2020. This dramatic drop followed the release of disappointing earnings for the July–September quarter (Q2) of FY25, causing a major sell-off that erased ₹18,500 crore from its market capitalization. The bank’s market cap now stands at ₹81,136 crore, and the stock closed at ₹1,037, its lowest price in over 19 months. Click here to download IndusInd Bank Financial Results Q2 2024-25.

The share price of IndusInd Bank at closing was Rs.1037 as of 25 October 2024. The share price fell by 18.99%. The opening price was Rs.1163 and the lowest price was Rs.1025.50.

The Market capitalization of IndusInd Bank was Rs.81,136.03 crore. The MCap has decreased significantly in comparison to previous month and previous year.

| Year | Marketcap |

|---|---|

| 2024 | ₹811.39 B |

| 2023 | ₹1.244 T |

| 2022 | ₹946.19 B |

| 2021 | ₹687.91 B |

| 2020 | ₹677.57 B |

Also Read: Net Profit of all Banks in September 2024 Quarter

The bank’s net profit for Q2 stood at Rs 1,325 crore. Despite the profit decline, the bank’s net interest income (NII) rose by 5% YoY to Rs 5,347 crore. However, the net interest margin (NIM) for the quarter dropped to 4.08%, a decline of 21 basis points (bps) from 4.29% in the same period last year, and 18 bps lower on a quarter-on-quarter (QoQ) basis. Additionally, asset quality deteriorated, with gross non-performing assets (NPA) rising to 2.11% and net NPA increasing to 0.64%, compared to 1.93% and 0.57% YoY, respectively.

Financial services company Societe Generale on Friday sold private sector lender IndusInd Bank’s shares for Rs 421 crore through an open market transaction. According to the bulk deal data available on the National Stock Exchange (NSE), Paris-headquartered Societe Generale offloaded 39.30 lakh shares or 0.50 per cent stake in IndusInd Bank.

Also Read: IndusInd Bank Financial Results Q2 2024-25 [Download PDF]

Q2 FY 2024-25 Key Highlights

- Deposits crosses ₹4 trillion mark, grew by 15% YoY to ₹4,12,317 crores from ₹3,59,548 crores

- Loans grew by 13% YoY to ₹3,57,159 crores from ₹3,15,454 crores

- Net Interest Income (NII) grew by 5% YoY to ₹5,347 crores from ₹5,077 crores

- NIM at 4.08% as compared to 4.29% for Q2FY24 and 4.25% for Q1FY25.

- Gross NPA and Net NPA ratios stands at 2.11% and 0.64% against 1.93% and 0.57% YoY respectively and PCR at 70% as at September 30, 2024

- The Bank, as a prudent measure, increased contingent provision buffer by ₹525 crores during the quarter

- Net Profit at ₹1,331 crores for Q2-FY 25 as compared to ₹2,202 crores at Q2-FY 24. Net Profit for Q2-FY25 adjusted for increase in contingent provision buffer was at ₹1,725 crores.

Earnings Miss Expectations Due to High Provisions and Slippages

In its Q2 report, IndusInd Bank reported a 40% year-on-year drop in net profit, largely due to an increase in provisions. These provisions were primarily required due to rising slippages in its microfinance portfolio, which has been under pressure. The pre-provision operating profit also fell by 8% compared to the previous year, impacted by lower margins and a shrinking microfinance loan book.

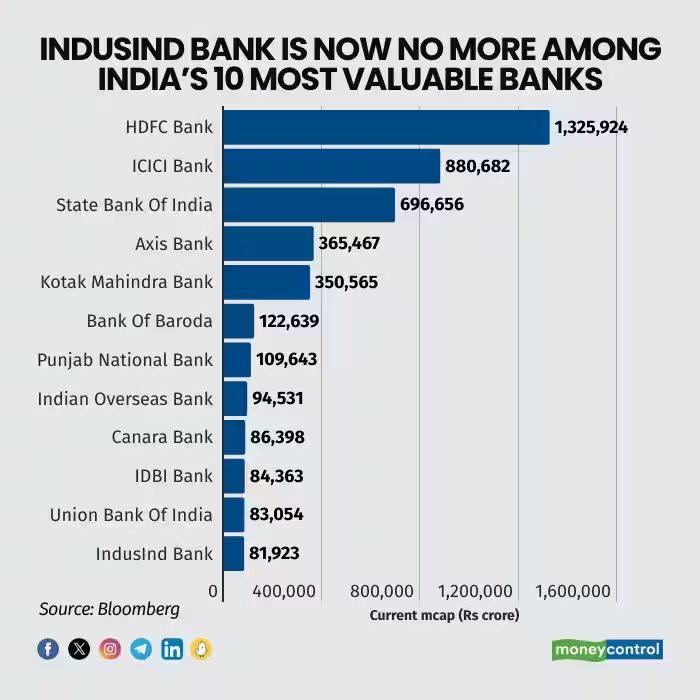

Market Capitalization and Ranking Impacted by Stock Drop

Following the stock decline, IndusInd Bank dropped out of the top 10 most valued banks in India by market capitalization, falling to the 12th position. This decline has allowed banks like Canara Bank, IDBI Bank, and Union Bank to move up in the rankings. Leading the list are HDFC Bank, with a market cap of ₹13.25 lakh crore, followed by ICICI Bank and State Bank of India.

Microfinance Segment Faces High Slippages

According to Suresh Ganapathy, MD and Head of Financial Services Research at Macquarie Capital, the microfinance sector has become a significant issue for IndusInd Bank. While overall slippages are at a manageable 2%, the microfinance segment is struggling with low recovery rates. The bank’s credit costs surged from 1.2% in Q1 to 2.1% in Q2, driven by increased slippages. The gross non-performing assets (GNPA) in microfinance rose from 5.2% in Q1 to 6.5% in Q2.

Bank Revises Loan Growth Expectations Amid Economic Uncertainty

In light of the current economic climate and challenges in the microfinance sector, IndusInd Bank’s management has revised its loan growth outlook from 18-23% to 16-18%. The bank remains cautious about the microfinance sector due to rising stress levels but hopes for improvement with growth in the rural economy.

Decline in Asset Quality and Interest Margins

IndusInd Bank’s net interest margin (NIM) declined to 4.08% in Q2 FY25 from 4.29% a year earlier, affected by rising costs and slower growth in high-yield assets. Fresh slippages, particularly from consumer finance, have also impacted asset quality. The gross NPA ratio increased by 9 basis points to 2.11%, and the net NPA ratio rose by 7 basis points to 0.64%.

Brokerages Cut Target Price Amid Profit Decline

Several brokerages have lowered their target prices for IndusInd Bank’s stock due to the weak performance in Q2. The consensus 12-month target price has been revised down by 11% to ₹1,549. Motilal Oswal Research noted that while stress is expected to persist in the microfinance and card businesses, overall slippages should remain manageable, supporting stable asset quality in the long term.

Surge in Public Sector Bank Stocks

In contrast to IndusInd Bank, several Public Sector Banks (PSUs) like Bank of Baroda, Punjab National Bank, Indian Overseas Bank, Union Bank of India, and Canara Bank have experienced a rally over the past year. These banks have seen strong earnings growth, lower provisioning, and a drop in non-performing assets, each crossing a market cap of ₹1 lakh crore.