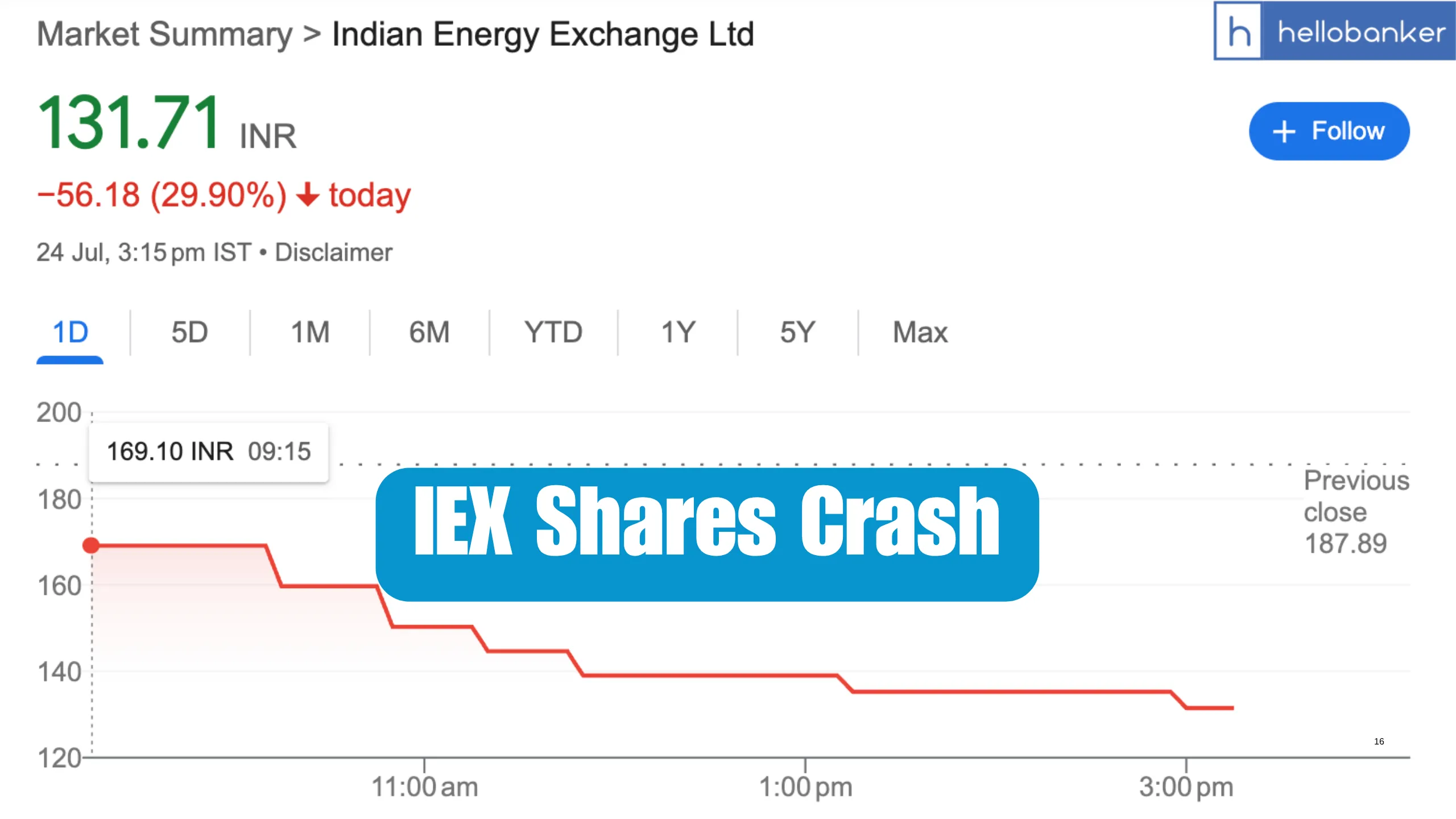

On Thursday, shares of Indian Energy Exchange (IEX) dropped sharply by 26%, marking their biggest one-day fall since the company got listed in 2017. This sudden crash came after the Central Electricity Regulatory Commission (CERC) announced a major change in how electricity prices will be decided in India. The new system is called market coupling.

IEX Share Price History

| Date | Price | Open | High | Low | Vol. | Change % |

|---|---|---|---|---|---|---|

| Jul 24, 2025 | 135.26 | 169.10 | 169.10 | 135.26 | 37.50M | -28.01% |

| Jul 23, 2025 | 187.89 | 192.70 | 193.41 | 186.61 | 9.21M | -2.43% |

| Jul 22, 2025 | 192.56 | 196.94 | 200.00 | 191.54 | 9.71M | -1.75% |

| Jul 21, 2025 | 195.99 | 202.01 | 205.00 | 195.18 | 7.84M | -3.52% |

| Jul 18, 2025 | 203.14 | 205.60 | 206.47 | 202.66 | 1.94M | -1.27% |

| Jul 17, 2025 | 205.75 | 208.01 | 208.99 | 204.60 | 4.65M | -1.23% |

| Jul 16, 2025 | 208.31 | 208.50 | 209.99 | 207.32 | 3.66M | -0.32% |

| Jul 15, 2025 | 208.98 | 207.06 | 209.40 | 206.30 | 3.06M | +0.89% |

| Jul 14, 2025 | 207.13 | 205.70 | 208.60 | 205.10 | 4.40M | +0.34% |

| Jul 11, 2025 | 206.43 | 205.50 | 208.00 | 203.20 | 3.54M | +0.02% |

| Jul 10, 2025 | 206.38 | 208.00 | 209.70 | 205.51 | 5.12M | -0.76% |

| Jul 09, 2025 | 207.96 | 201.00 | 211.75 | 199.05 | 23.17M | +3.47% |

| Jul 08, 2025 | 200.99 | 198.92 | 202.50 | 198.00 | 8.01M | +0.83% |

| Jul 07, 2025 | 199.33 | 197.50 | 199.60 | 196.22 | 3.41M | +0.86% |

| Jul 04, 2025 | 197.63 | 198.80 | 200.69 | 196.01 | 5.51M | -0.06% |

| Jul 03, 2025 | 197.75 | 195.90 | 199.00 | 194.20 | 5.98M | +1.29% |

| Jul 02, 2025 | 195.24 | 193.09 | 196.80 | 192.96 | 7.02M | +1.11% |

| Jul 01, 2025 | 193.09 | 194.00 | 194.11 | 191.61 | 5.05M | -0.01% |

What Is Market Coupling?

Market coupling is a method used in the electricity sector to bring all power exchanges under one pricing system. Currently, multiple platforms, like IEX, allow buyers and sellers to trade electricity separately and set their own prices. But under market coupling, all bids and offers from various power exchanges will be collected together and cleared at the same time. This will lead to a single uniform price for electricity, especially in the day-ahead and real-time markets.

Today, IEX is the dominant player in discovering spot electricity prices. With this change, its exclusive role in price discovery may end.

Why Is Market Coupling Being Introduced?

The CERC said that market coupling is being introduced to:

- Improve price transparency

- Increase market efficiency

- Ensure better use of electricity transmission lines

- Maximize economic benefit for buyers and sellers

This change will happen in phases. By January 2026, the day-ahead market will move to a round-robin model, where different exchanges take turns running the price-setting process. Real-time and term-ahead markets will follow later after trial runs and further consultations.

How Will Market Coupling Work?

Under the new system:

- All power exchanges will share their market data with Grid-India and CERC.

- One exchange at a time will act as the Market Coupling Operator.

- Grid-India will serve as a backup and oversee the process to ensure fairness.

- The idea is to centralize the price discovery process while still allowing buyers and sellers to use any exchange platform for placing bids.

Why Now? What Did the Pilot Study Show?

Before making this decision, the government conducted a shadow pilot programme between December 2024 and March 2025. In this trial:

- Market coupling in the day-ahead market brought ₹38 crore in overall gains, though it had little impact on prices due to low trading volume on smaller exchanges.

- Coupling in the real-time market gave ₹72 lakh in gains, again with minor effects on prices.

- Combining real-time market with Security Constrained Economic Dispatch (SCED) gave savings of around ₹1.4 crore per day, reduced price swings, and made the system more stable—even though it slightly raised the average electricity cost.

However, the trial also showed that different exchanges must align their systems and algorithms for the reform to work smoothly.

What Happens Next?

The CERC has instructed:

- Grid-India to develop special software and conduct more shadow pilots for term-ahead markets.

- Power exchanges like IEX to share data and help with testing and planning.

- Start the process of regulatory changes needed to bring market coupling into full effect.

What Does This Mean for IEX?

For Indian Energy Exchange, this is a serious challenge. Right now, IEX has a near-monopoly in setting spot electricity prices. But once market coupling begins, IEX will lose its exclusive role. It will just become one of the platforms where buyers and sellers place bids. The final price will be decided centrally, not on IEX’s own system.

Because of this, analysts and investors are worried. Brokerage firm Bernstein called the reform “worse than expected” and cut its target price for IEX shares from ₹160 to ₹122, reflecting the potential impact of this change.

As a result, IEX stock is facing pressure for the seventh day in a row, as people expect the new system to increase competition, reduce profit margins, and weaken IEX’s leadership in the power trading market.