IDBI Bank will be Privatised, Govt has Officially Confirmed it

| Get instant news updates: Click here to join our Whatsapp Group |

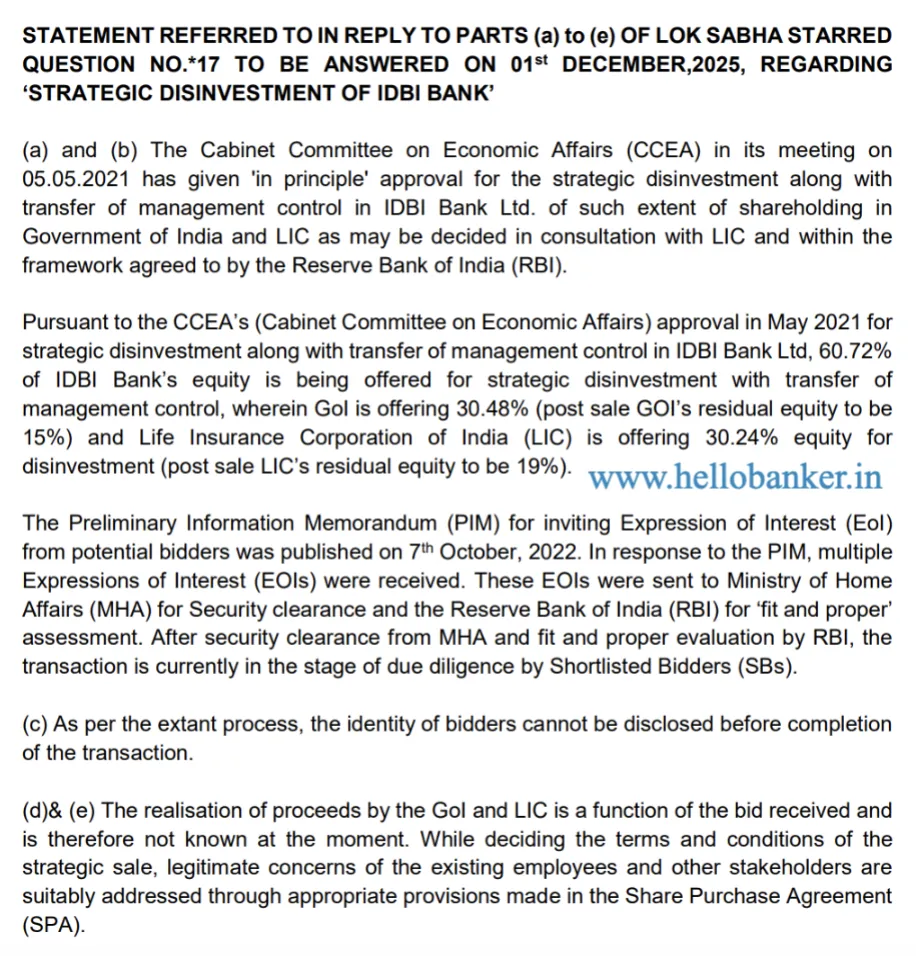

The Government of India has confirmed that the strategic disinvestment (sale of stake) in IDBI Bank is officially underway. This includes handing over management control to the new buyer. The information was shared in the Lok Sabha in reply to a question on the status of the sale.

Cabinet Approval Already Granted

The Government informed that the Cabinet Committee on Economic Affairs had approved the plan in May 2021. The sale covers 60.72% of IDBI Bank’s shares, which are jointly held by:

- Government of India: 30.48% (After sale, Govt will hold 15%)

- LIC of India: 30.24% (After sale, LIC will hold 19%)

The new buyer will also get management control of the bank. A preliminary document inviting buyers was issued on 7 October 2022. Several bidders showed interest. Their applications were screened by the Ministry of Home Affairs (for security clearance) and the Reserve Bank of India (for fitness and eligibility). The shortlisted bidders are now conducting due diligence — a detailed examination of the bank before making their final offer.

Names of Bidders Kept Confidential

The government clearly stated that the identity of the bidders will not be disclosed until the entire transaction is completed.

Sale Value Not Final Yet

How much money the Government and LIC will earn from the sale depends on the final bid price. So, the exact revenue is not known at this stage.

Employees’ Concerns Considered

The Finance Ministry said that the concerns of IDBI Bank employees will be taken care of. Provisions to protect their interests will be added in the Share Purchase Agreement (SPA) at the time of the final deal.

Government Reply in Lok Sabha related to Privatisation of IDBI Bank👇