Huge Pressure on PSU Banks for Social Security Schemes

As per various reports, the Government of India has asked Public Sector Banks to maximise enrollments under Social Security Schemes – PMJJBY, PMSBY. To fulfil this, Banks are putting extreme pressure on branches to enroll maximum customers under this scheme.

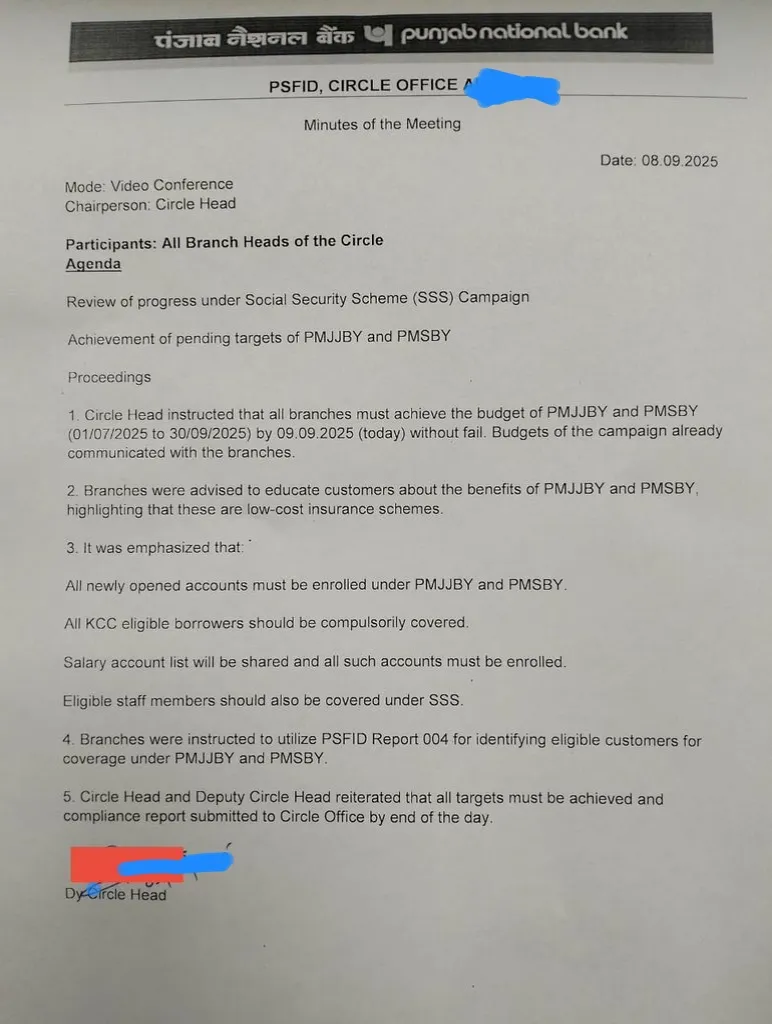

PNB Orders Branches to achieve targets under PMJJBY, PMSBY

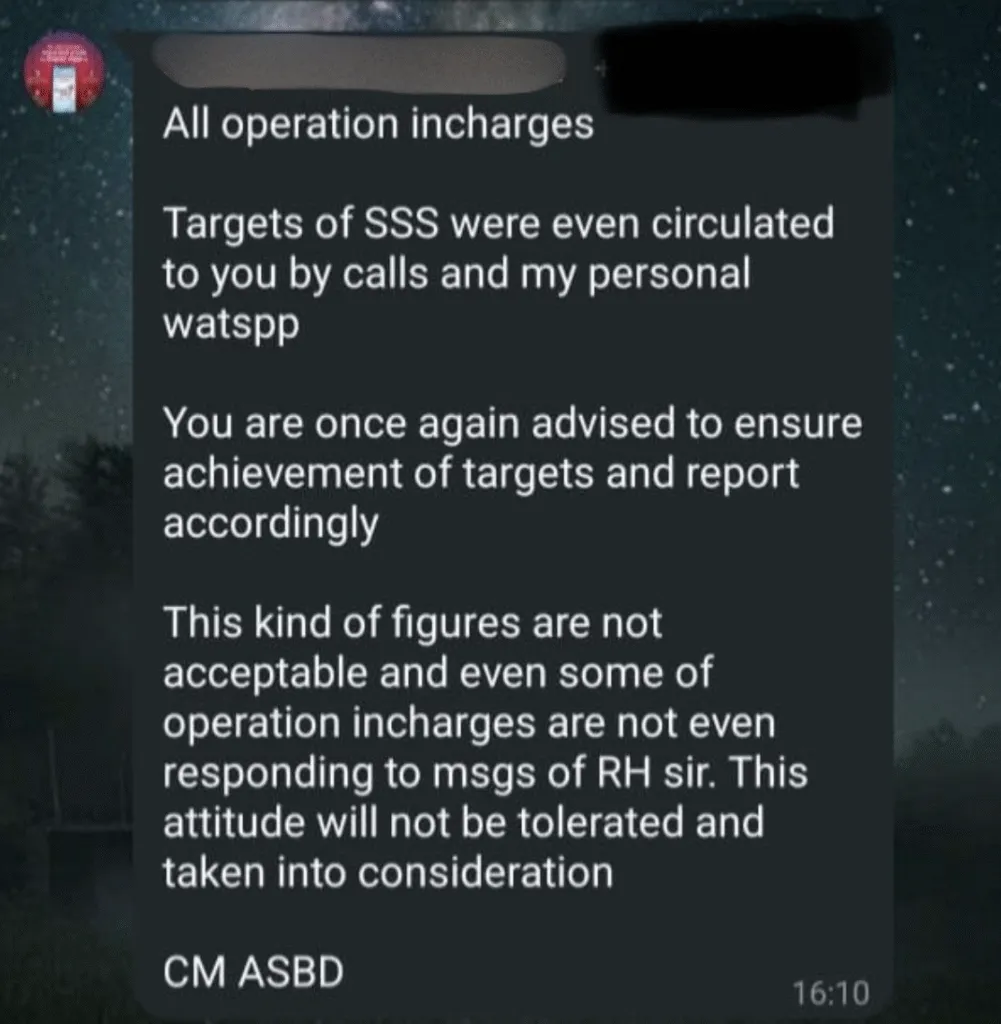

Whatsapp message from Central Bank of India to Branches

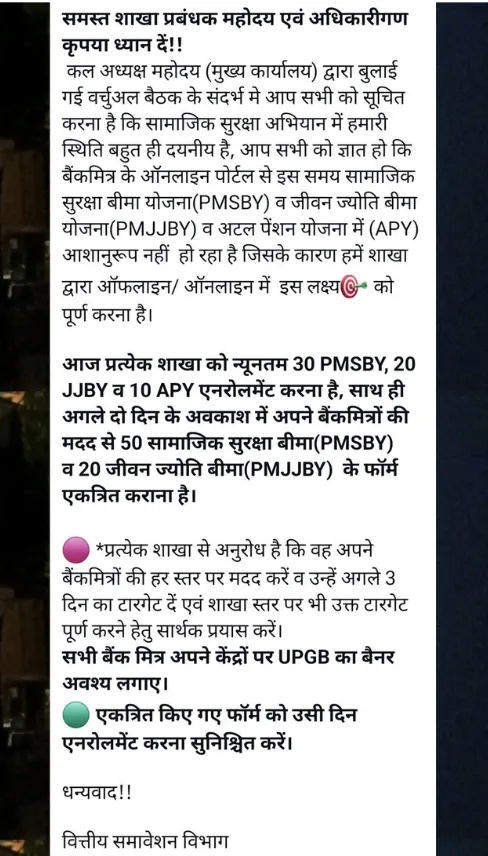

Whatsapp message from Uttar Pradesh Gramin Bank to Branches

These messages and letters show the huge pressure being put by Banks on branches to maximise enrollments under social security schemes.

Since bank branches interact with customers on a daily basis, they naturally serve as the most direct and trusted touchpoints for spreading awareness about government schemes. Customers often approach banks not only for financial services but also for advice and guidance, which makes them more receptive to information shared by bank staff.

Banks today are playing a dual role – while continuing to function as financial service providers, they are also acting as key partners in implementing the government’s social welfare agenda. This has turned banks into a bridge between citizens and the government, ensuring that welfare schemes reach the grassroots level where they are most needed.

The role of banks goes far beyond deposits, loans, and payments. They are now an integral part of nation-building, helping expand the reach of financial inclusion and providing a safety net to millions through government-backed schemes.

Is this Pressure Correct?

Whether this pressure on bank branches is correct or not depends on how it is implemented. On one hand, the government’s goal is noble — schemes like PMJJBY and PMSBY provide affordable insurance to crores of Indians who otherwise remain outside the safety net. Banks, being the most trusted financial institutions with direct customer access, are naturally the best medium to spread awareness and boost enrollments.

However, the concern arises when the targets set for branches become unrealistic and staff are forced to push enrollments aggressively. In such cases, it can lead to mis-selling, customer dissatisfaction, and additional workload stress for employees. Instead of voluntary awareness and informed choice, the schemes risk being perceived as a burden both by staff and customers.

Ideally, the focus should be on education and awareness, not just numbers. If banks explain the benefits clearly and encourage genuine participation, enrollment will increase in a sustainable way. But if pressure is excessive, it might create resentment among staff and mistrust among customers.

What benefits are offered by these schemes?

Pradhan Mantri Suraksha Bima Yojana is a government-backed accident insurance scheme in India. Pradhan Mantri Suraksha Bima Yojana is available to people (Indian Resident or NRI) between 18 and 70 years of age with bank accounts at an annual premium of ₹20. In case of death or full disability, the payment to the nominee will be ₹2 Lakh and in case of partial permanent disability it would be ₹1 Lakh.

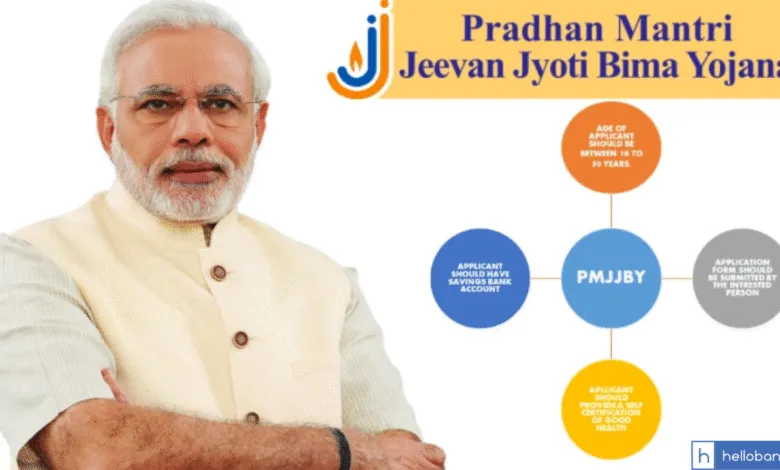

Pradhan Mantri Jeevan Jyoti Bima Yojana is a Government-backed life insurance scheme in India. Pradhan Mantri Jeevan Jyoti Bima Yojana is available to people between 18 and 50 years of age with bank accounts at an annual premium of ₹436. Rs.2 lakh is payable on a subscriber’s death due to any cause.

Atal Pension Yojana is a government-backed pension scheme in India, primarily targeted at the unorganised sector. Any Indian citizen within the age group of 18 – 40 years, can join APY Scheme. Each subscriber under APY shall receive a guaranteed minimum pension of Rs. 1000/- per month or Rs. 2000/- per month or Rs. 3000/- per month or Rs. 4000/- per month or Rs. 5000/- per month, after the age of 60 years until death.