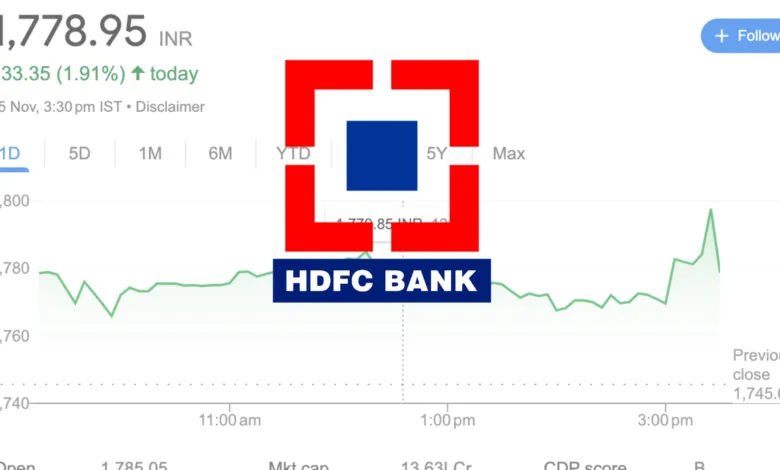

On November 25, HDFC Bank’s share price surged past ₹1,800 to reach a fresh all-time high, driven by extraordinary trading activity as the MSCI November rebalancing took effect. Over 21.5 crore shares of HDFC Bank were traded across the NSE and BSE, marking a staggering 8.6 times its 20-day moving average volume of 2.5 crore shares. Notably, 19 crore shares exchanged hands in the final 30 minutes of the session, after 3:00 PM.

Today the highest share price went up to Rs.1,803.55 and the lowest share price was Rs.1,764.90. The stock closed at price of Rs.1,778.95.

What Happened?

- HDFC Bank’s Share Price Surge: On November 25, 2024, HDFC Bank’s share price crossed ₹1,800 for the first time, hitting an all-time high of ₹1,803.55 during the trading session. It eventually settled at ₹1,785.6, marking a 2.3% gain from the previous closing price.

- Unusual Trading Activity: More than 21.5 crore shares of HDFC Bank were traded in a single day, which is nearly 9 times its average daily trading volume. Most of this activity (19 crore shares) occurred in the last 30 minutes of trading.

Why Did It Happen?

The surge in trading and price was primarily driven by MSCI’s November rebalancing, a periodic process where global indices adjust the weights of stocks based on market capitalization and foreign ownership limits.

- MSCI Rebalancing Explained:

- MSCI (Morgan Stanley Capital International) creates stock indices used by global investors to build their portfolios.

- HDFC Bank’s inclusion in MSCI indices means passive investors (those who follow MSCI indices) had to buy more shares of the bank to match the updated index weightage.

- This change brought a huge inflow of money, estimated at $1.88 billion, into HDFC Bank shares.

The Bigger Picture

- Market Capitalization Growth: With a current valuation of ₹13.63 lakh crore, HDFC Bank is one of India’s largest companies. The stock has grown by 16% in the last year, although it has slightly underperformed compared to the 22% growth of the Nifty index.

- Impact of Foreign Investments:

- HDFC Bank’s foreign ownership is regulated by limits set for Indian companies. Earlier in August 2024, MSCI increased HDFC Bank’s Foreign Inclusion Factor (FIF) — a parameter determining how much of the company foreign investors can buy — from 0.37 to 0.56.

- This move unlocked $1.8 billion (₹15,000 crore) in foreign inflows at that time.

- The November rebalancing completed this process, ensuring further inflows as HDFC Bank crossed the 20% foreign ownership threshold required for full inclusion in MSCI indices.

Key Takeaways

- Trading Volume Surge: MSCI changes caused extraordinary demand for HDFC Bank shares, especially in the last half-hour of the trading session.

- Foreign Investor Confidence: The bank’s high weightage in MSCI indices reflects strong confidence from international investors.

- Ongoing Growth: HDFC Bank remains a top performer, even as its gains slightly trail the broader market.

The rise is a testament to how global events, like MSCI rebalancing, can significantly impact local stock prices, especially for market leaders like HDFC Bank.

HDFC Bank Share Price in November 2024

| Date | Open | High | Low |

|---|---|---|---|

| Nov 25, 2024 | 1,785.05 | 1,803.55 | 1,764.90 |

| Nov 22, 2024 | 1,743.55 | 1,754.30 | 1,729.55 |

| Nov 21, 2024 | 1,749.40 | 1,759.00 | 1,734.20 |

| Nov 19, 2024 | 1,714.00 | 1,753.75 | 1,702.70 |

| Nov 18, 2024 | 1,700.00 | 1,718.90 | 1,695.00 |

| Nov 14, 2024 | 1,673.10 | 1,704.85 | 1,672.10 |

| Nov 13, 2024 | 1,716.75 | 1,729.40 | 1,673.00 |

| Nov 12, 2024 | 1,772.00 | 1,775.00 | 1,708.65 |

| Nov 11, 2024 | 1,754.55 | 1,782.80 | 1,751.20 |

| Nov 08, 2024 | 1,752.00 | 1,761.80 | 1,745.85 |

| Nov 07, 2024 | 1,744.30 | 1,760.95 | 1,738.00 |

| Nov 06, 2024 | 1,771.50 | 1,771.50 | 1,745.35 |

| Nov 05, 2024 | 1,703.00 | 1,762.70 | 1,697.90 |

| Nov 04, 2024 | 1,745.00 | 1,745.00 | 1,710.90 |

| Nov 01, 2024 | 1,733.00 | 1,744.10 | 1,726.10 |