Govt Likely to Raise KCC Loan Limit to Rs.5 Lakh from Next Fiscal

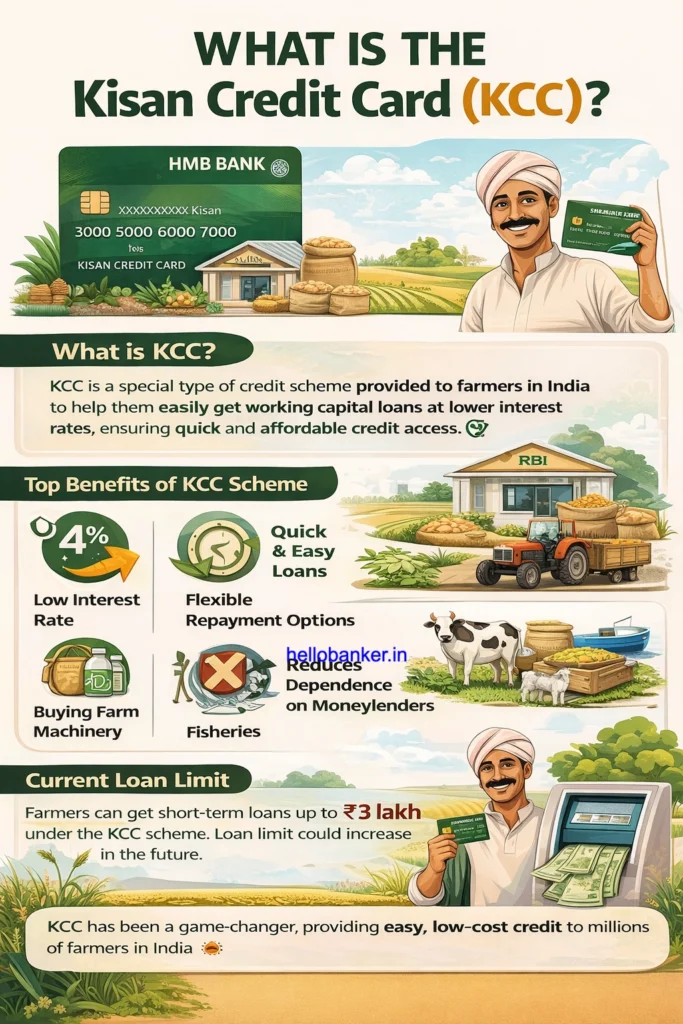

The government is preparing to give a big boost to farmers by increasing short-term loan limits under the Kisan Credit Card (KCC) scheme from the next financial year.

Finance Minister Nirmala Sitharaman had announced in the Union Budget 2025–26 that the loan limit under the Modified Interest Subvention Scheme (MISS) would be raised from ₹3 lakh to ₹5 lakh for loans taken through KCC. This benefit is meant for nearly 77 million farmers, fishermen and dairy farmers across the country. Now, officials say this long-awaited announcement is likely to be implemented starting next fiscal year.

According to official sources, an external evaluation of the interest subvention scheme has been completed, which is a mandatory step before any major rollout. The evaluation report is currently being examined by the Expenditure Finance Committee. Once approved, the enhanced short-term credit limit for KCC holders is expected to come into force.

At present, even though the loan limit is ₹3 lakh, the average short-term loan taken by a KCC holder is around ₹1.6 lakh. The proposed increase to ₹5 lakh is expected to give farmers more financial flexibility, especially to meet rising input costs such as seeds, fertilisers, labour, and allied activities.

Under the MISS scheme, KCC holders can currently take loans of up to ₹3 lakh at 7% interest for working capital needs. Farmers who repay on time get an additional 3% interest subvention, effectively bringing the interest rate down to just 4%. This benefit has played a major role in reducing farmers’ dependence on private moneylenders.

As of now, there are 77.1 million active KCCs in India. This includes around 1.24 lakh cards for fisheries and 44.4 lakh cards for animal husbandry. For allied activities other than crop farming, the short-term loan limit is capped at ₹2 lakh.

The scale of government support is also reflected in the numbers. Interest subvention disbursement under MISS stood at ₹17,811 crore in FY25, and between 2020-21 and 2024-25, farmers received nearly ₹89,328 crore as interest subsidy. Today, about 72% of farm credit comes from institutional sources like banks and financial institutions, showing a steady shift towards formal credit.

Meanwhile, agricultural credit in India is growing at a rapid pace. NABARD has projected that total agricultural credit from banks and regional rural banks could cross a record ₹32.5 lakh crore in FY26. Overall agri-credit has risen sharply from ₹15.75 lakh crore in FY21 to ₹28.67 lakh crore in FY25, with a significant increase in lending to small and marginal farmers.

Adding to this, the RBI increased the collateral-free loan limit under KCC to ₹2 lakh from January 2025. This step has further improved credit access for small farmers by removing the need for security.

The main aim of the MISS scheme is to ensure timely, affordable credit to farmers, improve farm-level liquidity, boost agricultural productivity, and reduce dependence on informal loans. With the proposed hike in KCC loan limits, farmers may soon get stronger financial support at a time when costs and risks in agriculture are steadily rising.