Latest News

Get Rs.2 Lakh Loan easily on PhonePe, Follow these steps

Connect with Us

ICICI Bank has teamed up with PhonePe to offer instant credit to its pre-approved customers using the PhonePe app. This means that eligible customers can quickly access a short-term credit line to make payments through UPI. This option provides you with an easy way to manage your expenses without the need for immediate payment.

- Credit Limit: Customers can get a credit line of up to ₹2 lakh.

- Repayment Period: You will have 45 days to pay back the amount you use.

- Purpose: This credit facility is especially useful for making big purchases, such as electronics, travel bookings, hotel stays, and paying bills, especially during the festive season.

How to Avail the Credit Facility:

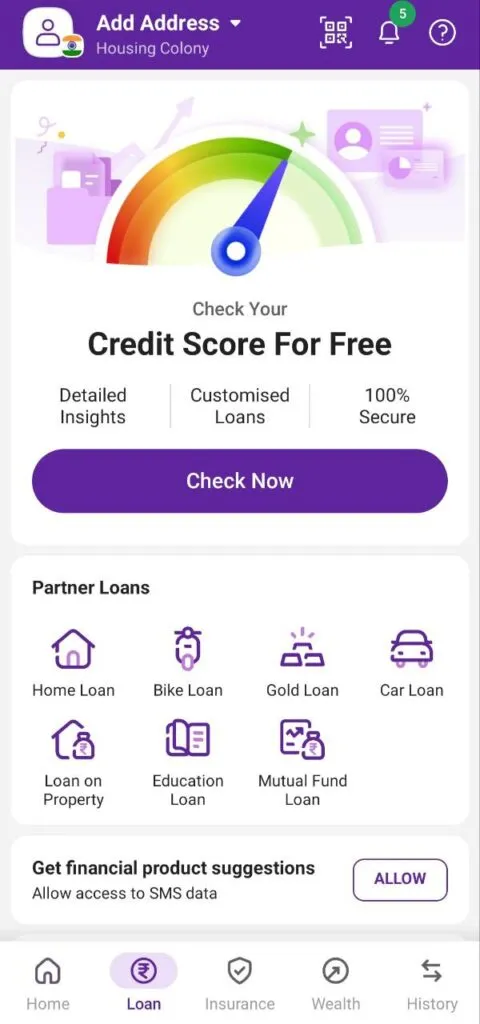

- Log in to Your PhonePe App: Open the PhonePe app on your smartphone.

- Find the Credit Activation Banner: Look for a banner on the app that talks about activating credit.

- Check Features and Charges: Click on the banner to review the product features and any charges that apply.

- Activate the Credit Line: Follow the steps provided to complete the activation process.

- Complete Authentication: You may need to verify your identity by following additional steps.

- Set Up UPI: Once approved, you can link the credit line to UPI, set up a UPI PIN, and start using it for transactions.

Advertisement