The controversy of insurance in Banks is not yet over. Despite repeated communications from Finance Minister and RBI Governor, the Banks are pressurising their staff to get involved in insurance business. Recently, Central Bank of India Bengaluru Regional Office has issued an explanation letter to a branch manager for poor performance in insurance business.

First Read the Letter issued to Bank Manager

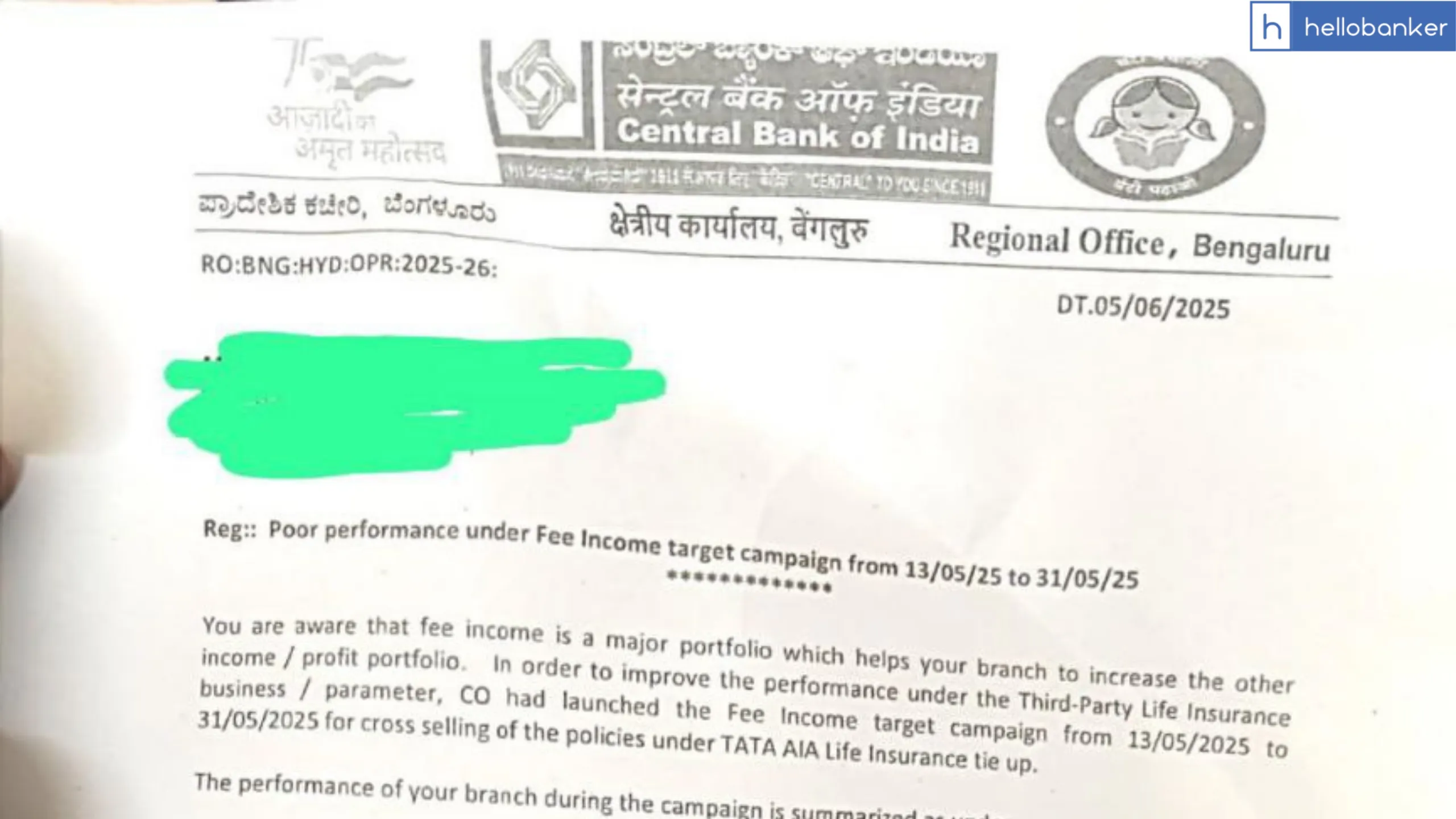

Reg: Poor performance under Fee Income target campaign from 13/05/25 to 31/05/25

You are aware that fee income is a major portfolio which helps your branch to increase the other income / profit portfolio. In order to improve the performance under the Third-Party Life Insurance business / parameter, CO had launched the Fee Income target campaign from 13/05/2025 to 31/05/2025 for cross selling of the policies under TATA AIA life Insurance tie up.

The performance of your branch during the campaign is summarized as under:-

| Name of the branch | Target | Achievement | Achievement % | Gap |

|---|---|---|---|---|

| – | – | – | – | – |

From the above figures, it is evident that your branch is showing very poor progress despite having huge potential. It seems that serious efforts are not being put into for improving / developing the business which has given set back to the branch and negated good work done by other branches.

In view of the above, you are advised to bestow your personal attention to the matter, activate and gear up the team so as to ensure that going forward, such performance is not repeated. You are hereby advised to submit your explanation for poor performance under the campaign along with strategies to ensure that premium / fee income target is achieved invariably this month onwards.

[P K DAS]

ASST. GENERAL MANAGER

What is the issue?

Recently, Banks in India are suffering from liquidity crisis. The Deposit in Banks has decreased as a lot of customers are investing money in mutual funds and stock market instead of investing money in Fixed Deposits. Moreover, such insurance targets force bank employees to invest customer’s money in insurance sector and the deposit in Banks is continuously decreasing.

Second Point is – When Bank enters into a tieup with any insurance company, the insurance company posts one of its employee in the branches of bank. Now, it should be the duty of insurance employee to look after the insurance business but instead, branch manager is forced to source insurance business and the insurance employee gets salary for free. If insurance employee is posted in bank branch then he/she should be asked to source insurance business and bank manager should not be punished for the same.

Third Point is – Banks are suffering from huge staff crisis and imposing the responsibility of insurance business on existing staff is not a good approach. Banks should ask insurance companies to ask their staff in branches to source business and not force their own staff to sell insurance.

Fourth Point is – Such pressure leads to mis-selling of insurance products. Insurance products should be sold by a professional having good knowledge of insurance.

Why Banks sell insurance?

Banks sell insurance to earn a commission fee. The insurance companies give commission to Banks for selling insurance to their customers. Moreover, there are various reports, that these insurance companies also organize lavish parties for senior bank officers. After the news of these parties leaked online, the Government had stepped in and asked Banks to stop such parties.