Canara Bank issues Explanation Call to Staff for not sourcing Savings Accounts

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

Canara Bank – one of the largest public sector banks in India has issued explanation call to one of its staff for not sourcing savings accounts. Canara Bank has launched a new campaign – Each 1 Source 5 Campaign. In this campaign, each staff of Canara Bank has to open 5 savings accounts. Staff who have not opened accounts in this campaign are being issued explanation call.

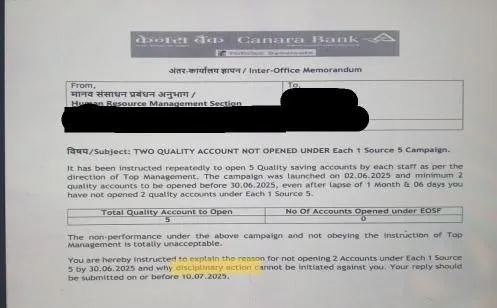

Canara Bank Letter Issued

विषय / Subject: TWO QUALITY ACCOUNT NOT OPENED UNDER Each 1 Source 5 Campaign.

It has been instructed repeatedly to open 5 Quality saving accounts by each staff as per the direction of Top Management. The campaign was launched on 02.06.2025 and minimum quality accounts to open is 2 before 30.06.2025. Even after lapse of 1 Month & 06 days you have not opened 2 quality accounts under Each 1 Source 5.

| Total Accounts to be opened | Account opened |

| 5 | 0 |

The non-performance under the above campaign and not obeying the instruction of Top Management is totally unacceptable.

You are hereby instructed to explain the reason for not opening 2 Accounts under Each 1 Source 5 by 30.06.2025 and why disciplinary action cannot be initiated against you. Your reply should be submitted on or before 10.07.2025.

Issues in Opening Bank Accounts under Pressure

Opening Accounts is good but it has to be done properly and meticulously. Recently, 8.5 lakh mule (fake) accounts have been opened across several banks in India and now CBI is planning to start a detailed investigation. CBI has found that over 8.5 lakh mule accounts were opened in more than 700 branches of different banks across India. Many of these accounts were opened without following proper guidelines and were used to move money stolen through cyber scams.

In investigations related to these mule accounts, it has been found that Banks in India are opening accounts without proper due diligence. CBI has also found that there are various lapses in the process of opening of bank accounts. Click here to read this report in detail.

They treating staff as slaves..

Using Threatening words . Executives treat officers as a dogs…

Finding faults with each and every instructions of the management, has become order of the day. These are the part of business expansion. If the business is not expanded, nobody would be able to reap the benefits of increasing profits such as PLI. Management would not resort to calling for explanation on the first instance itself. The concerned staff might not have respected the call given by the management to involve himself in process of business development on many occasions. Committment and involvement is required every where. Without business development, nobody can expect financial growth and the job of business development can not be done by executives alone…

Sir, I think, either you are new to Banking Industry or don’t know the Reality of the Banking Industry. Forget, above scenario, in short, now a days Banker is a white collared slave. Irrespective of Rank and File, so much stress and overburned with targets. Kindly go through the Atrocities against Bankers even by the Customers(Borrowers) and by the Management also, they are not treating as Humans.

Yes. True. But the management should understand where people don’t have capacity to deposit good amount, how it’s possible.

Raju bhaiyya Hatao ,Canara Bank bachao..

Aap ko kya ye nhi pata ki banking ko choice aur sip ke chakkar me barbad karke CASA kam karne wale log bhi yahi log hai

Do not give any explanation we are not scared of these threats..and by the way union sucks management big time.

What union are doing… They are doing job of management only… Wording of Management and union are same … Then what is the difference between union and management…Why we were in union?? …

One side Top management promote” no minimum balance required in saving account”to make their no to govt other side they push their staffs to open quality accounts

Horrible….it came to notice that under pressure staffs are putting their own money in other’s newly opened account then hold the particular amount deposited or transferred by staffs to fulfill the target.

Routine works are disturbed and pressure work is going on.

Pathetic condition of staff is unexplainable as they have to do jobs to fulfill their family needs and Top management is enjoying this psychological pressure fully to get a higher post.

MD Ceo Raju hatao Canara Bank Bachao.

Union just wants 300Rs a month for their own visits, meetings and expenses. CBOA murdabaad.

He is anyway retiring by the end of this year. But with bloated results, he can end up in a top post at RBI.

The Growth of any institution is need of the time. But there should be reasonable targets. All fingers are not same. All branches in particular Size will not have same scope. Some DCC Banks lend 0% interest by support of State Government. But for public sector banks, GOI should lend 0% loans to improve business for some sectors

Instead of penalizing or seeking explanation, bank management should reward the performers may be financially or some elevation etc etc This will not bring fake or unwanted accounts

Most of these accounts are used by fraudsters to transfer money

Instead of penalizing or seeking explanation, bank management should reward the performers may be financially or some elevation etc etc This will not bring fake or unwanted accounts

Most of these accounts are used by fraudsters to transfer money