Big Legal Battle between Trump and Largest US Bank! JPMorgan Closed Accounts of US President

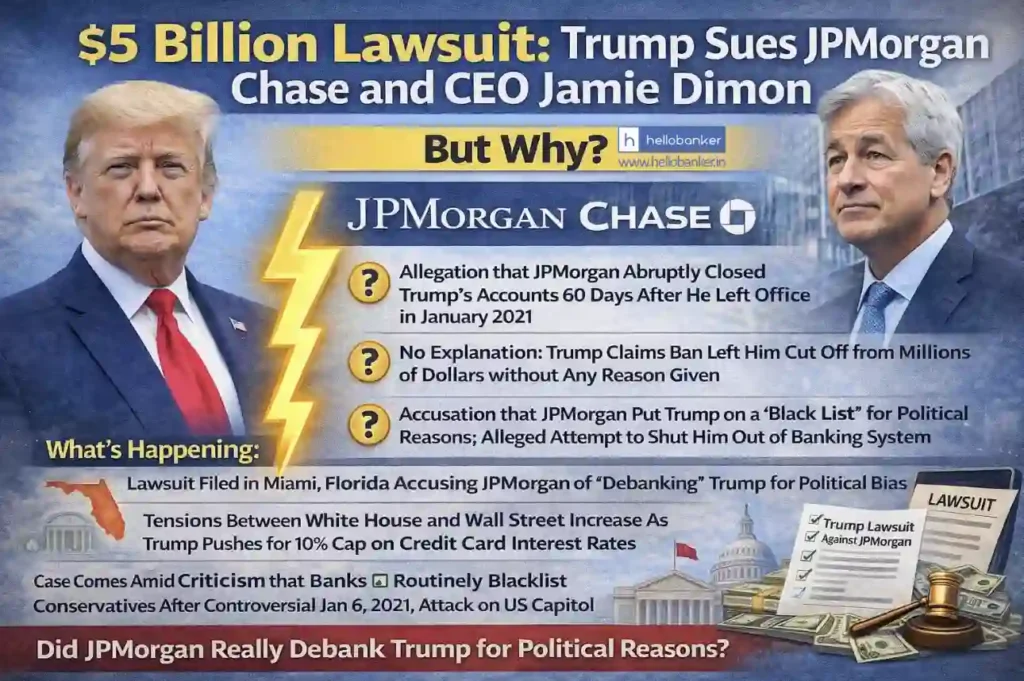

President Donald Trump sued banking giant JPMorgan Chase and its CEO Jamie Dimon for $5 billion on Thursday (January 22, 2026). But Why? There are allegations that JPMorgan stopped providing banking services to him and his businesses for political reasons after he left office in January 2021.

The lawsuit, filed in Miami-Dade County court in Florida, alleges that JPMorgan abruptly closed multiple accounts in February 2021 with just 60 days notice and no explanation. Mr. Trump claims JPMorgan and Mr. Dimon cut the President and his businesses off from millions of dollars, disrupted their operations and forced Mr. Trump and the businesses to urgently open bank accounts elsewhere. JPMC debanked Mr. Trump and his businesses because it believed that the political tide at the moment favoured doing so.

In the lawsuit, Mr. Trump alleges he tried to raise the issue personally with Mr. Dimon after the bank started to close his accounts, and that Mr. Dimon assured Mr. Trump he would figure out what was happening. The lawsuit alleges Mr. Dimon failed to follow up with Mr. Trump. Further, Mr. Trump’s lawyers allege that JPMorgan placed the President and his companies on a reputational “blacklist” that both JPMorgan and other banks use to keep clients from opening accounts with them in the future.

This case has come at a time of heightened tensions between the White House and Wall Street. The President said he wanted to cap interest rates on credit cards at 10%. Chase is one of the largest issuers of credit cards in the country and a bank official told reporters that it would fight any effort by the White House or Congress to implement a rate cap on credit cards.

Debanking has become a politically charged issue in recent years, with conservative politicians arguing that banks have discriminated against them and their affiliated interests.

Mr. Trump and other conservative figures have alleged that banks cut them off from their accounts under the umbrella term of “reputational risk” after the Jan 6, 2021, attack on the U.S. Capitol. Since Mr. Trump came back into office, the President’s banking regulators have moved to stop any banks from using “reputational risk” as a reason for denying service to customers.