Bank of Baroda has announced a new rule regarding its Positive Pay System (PPS). From now on, a PPS limit of ₹2 lakh will apply to all cheques.This means if you plan to issue a cheque of or above ₹2 lakh, you must submit the PPS form to the bank in advance. Failure to do so may result in the cheque being returned or not cleared.

Why is PPS important?

PPS (Positive Pay System) is a security feature introduced by banks to prevent cheque fraud. Here’s how it works 👇

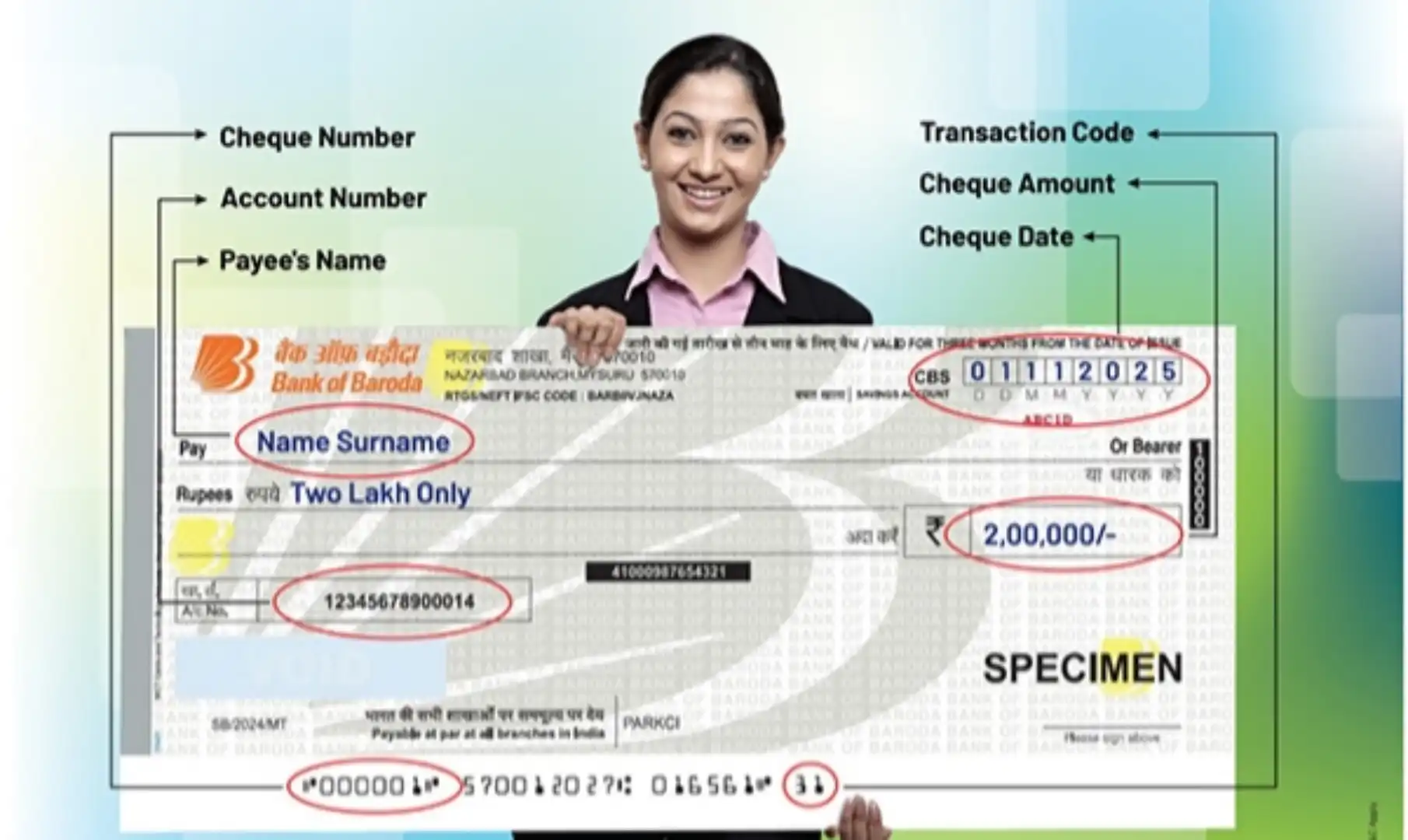

When you apply for the Positive Pay System (PPS), you have to give your bank the main details of your cheque — like the cheque number, date, amount, and the name of the person you are giving it to.Later, when that person submits your cheque for clearing, the bank checks these details again. If both sets of details match, the cheque is cleared. If they don’t match, the cheque is stopped or rejected. This system helps protect you from cheque fraud. For example, if your cheque is lost and someone tries to misuse it, the bank will not clear it because you didn’t submit the PPS details. Only the real account holder can give PPS details, so it becomes very difficult for anyone else to commit fraud using your cheque.

In short, PPS helps protect customers from cheque fraud by ensuring only the cheque actually issued by the account holder gets cleared.

So, if you are a customer of Bank of Baroda, then you should remember to submit PPS in case of cheques of Rs.2 lakh or more.

How to submit PPS in Bank of Baroda?

Positive Pay Confirmation can be done through various channels viz. Branch (Base Branch only), Mobile Banking (bob World), Net Banking (bob World Internet), SMS (8422009988), Contact Centre (18005700), WhatsApp Banking (8433888777) and Bank’s Website. For more details, please visit your base branch or Bank’s website https://bankofbaroda.bank.in announcement section – “Positive Pay”.