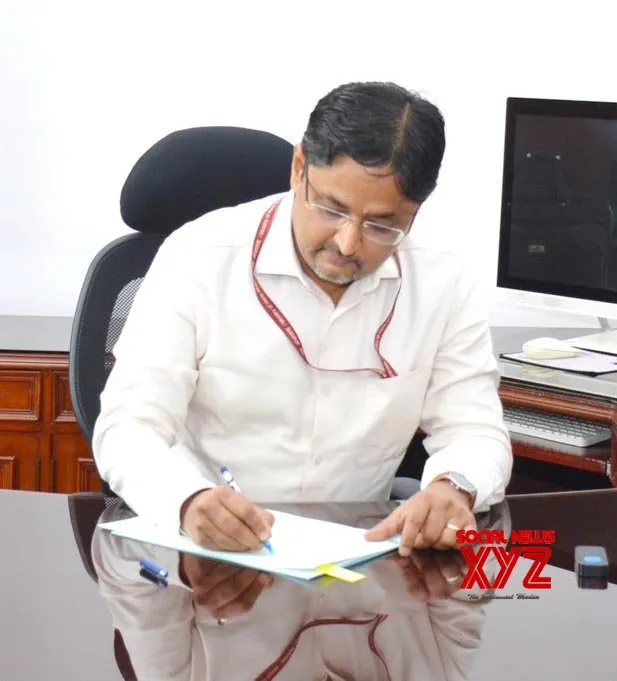

Arvind Shrivastava Appointed as Revenue Secretary in Finance Ministry, Know About Him

Arvind Shrivastava, a senior IAS officer from the 1994 batch of the Karnataka cadre, officially took charge as the Revenue Secretary in the Ministry of Finance on May 1, 2025. His appointment marks an important leadership change in the country’s financial administration.

Appointment Approved by Cabinet

The Appointments Committee of the Cabinet approved Shrivastava’s appointment on April 18, 2025. His selection came as part of a wider reshuffle of senior bureaucratic positions across various departments.

A Rich Career in Finance and Governance

Before becoming Revenue Secretary, Arvind Shrivastava served in several important roles. He worked as Joint Secretary and later as Additional Secretary in the Prime Minister’s Office (PMO).

Earlier in his career, Shrivastava held key positions related to finance and urban development. He was:

- Joint Secretary (Budget) in the Department of Economic Affairs

- Development Officer at the Asian Development Bank

- Finance Secretary and Urban Development Secretary in the Karnataka government

- Managing Director of Karnataka’s Urban Infrastructure Development & Finance Corporation

What Does the Revenue Secretary Do?

The Department of Revenue, headed by the Revenue Secretary, plays a crucial role in managing India’s tax system under the guidance of the Finance Minister. The department oversees two major bodies:

- Central Board of Direct Taxes (CBDT): responsible for collecting income tax

- Central Board of Indirect Taxes and Customs (CBIC): responsible for collecting GST, customs duties, and other indirect taxes

In recent years, the Department of Revenue has focused on making tax processes more taxpayer-friendly. For example, in 2024, the CBDT expanded faceless return processing to make income tax filings more transparent and less dependent on physical interaction. Meanwhile, the CBIC introduced advanced data analytics and tighter registration checks to prevent GST fraud.

Strong Revenue Collections Ahead of New Budget

These reforms have been showing positive results. In March 2025, India’s gross GST collections reached ₹1.96 trillion, a 10% increase compared to the same month last year.

Arvind Shrivastava takes over as Revenue Secretary at a crucial time. The government is preparing for the Union Budget 2025‑26, which is expected to include major tax reforms aimed at simplifying the Income Tax Act and reducing compliance burdens for taxpayers.

Experts believe that Shrivastava’s deep experience in the PMO and finance ministry will be valuable as he works to implement these reforms while helping the government meet its revenue targets.