1.5 million PMJDY Accounts Closed by PSU Banks

Did You Know? In April this year, public-sector banks (PSBs) have closed around 1.5 million inoperative zero-balance accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY). Out of 560.3 million PMJDY accounts at the end of July, 130.4 million (approximately 23%) were inoperative, said Minister of State for Finance Pankaj Chaudhary.

The Pradhan Mantri Jan Dhan Yojana (PMJDY), launched in 2014, is often celebrated as one of India’s most successful financial inclusion schemes. With more than 560 million accounts opened, it has given millions of people access to basic banking facilities for the first time. Zero-balance accounts, RuPay debit cards, and direct benefit transfers have made the scheme a game-changer for the poor.

But behind this success lies a growing burden on public sector bank (PSB) employees.

The Progress Report of PMJDY is given at last.

First, Open Accounts in Bulk

When the scheme began, bank staff were under immense pressure to open crores of accounts in a short span of time. Targets were high, and branches were often flooded with applicants. Employees worked extra hours to ensure the government’s ambitious goals were met.

Then, Close Inactive Accounts

Over time, many Jan Dhan accounts became inactive or duplicate. Recently, around 1.5 million inoperative zero-balance accounts were closed as part of a cleanup exercise. While this step helps maintain the system’s efficiency, the responsibility once again falls on already overburdened bank staff.

Continuous Monitoring and Cash Withdrawals

Employees also need to monitor the large number of inoperative accounts. If an account falls inoperative, Employees need to contact customers and make it operative. At the same time, they face heavy customer footfall, particularly for cash withdrawals. This dual task of supervision and service creates additional stress at branch level.

The Staff Shortage Problem

The real challenge is that all this is happening amid a staff crisis in PSBs. Many branches are operating with fewer employees than required. Retirements, limited fresh recruitment, and rising workloads have left frontline staff struggling to balance routine banking, government schemes, and customer service.

The Bigger Picture

There is no doubt that PMJDY has transformed India’s financial landscape. But unless the government and banks address the manpower issue, the pressure will keep mounting on employees. For sustained success, financial inclusion must go hand in hand with adequate staffing and improved infrastructure in banks.

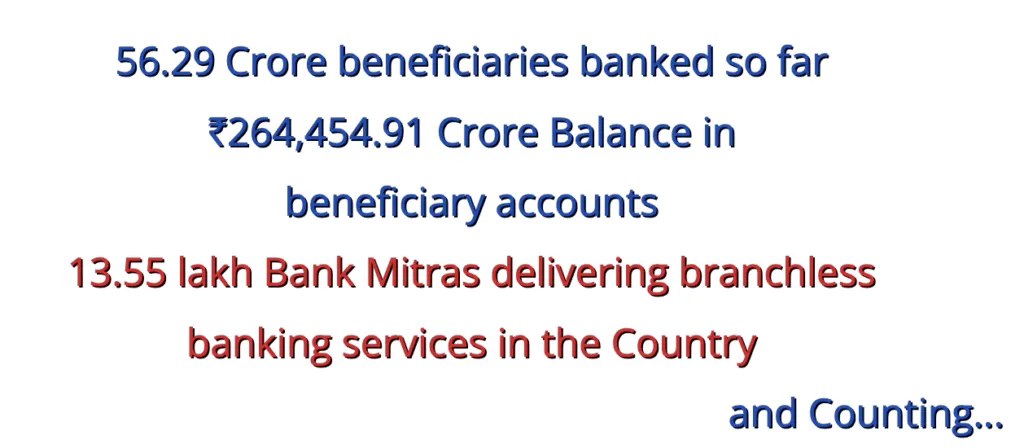

PMJDY Progress Report as on 27/08/2025 (Figure in Cr)

| Bank Name / Type | Number of Beneficiaries at rural/semiurban centre bank branches | Number of Beneficiaries at urban metro centre bank branches | No Of Rural-Urban Female Beneficiaries | Number of Total Beneficiaries | Deposits in Accounts(In Crore) | Number of Rupay Debit Cards issued to beneficiaries |

|---|---|---|---|---|---|---|

| Public Sector Banks | 27.52 | 16.15 | 24.08 | 43.66 | 206069.87 | 33.45 |

| Regional Rural Banks | 9.09 | 1.50 | 6.16 | 10.59 | 50693.10 | 3.85 |

| Private Sector Banks | 0.78 | 1.07 | 1.04 | 1.85 | 7691.93 | 1.50 |

| Rural Cooperative Banks | 0.19 | 0.00 | 0.10 | 0.19 | 0.01 | 0.00 |

| Grand Total | 37.58 | 18.72 | 31.38 | 56.29 | 264454.91 | 38.80 |