What FM Sitharaman said about High-Level Committee for Banking Reforms

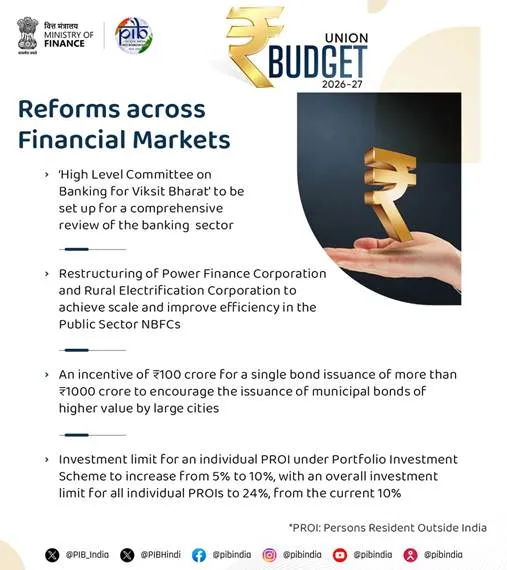

In Budget 2026, Finance Minister Nirmala Sitharaman announced the formation of a High-Level Committee for Banking Reforms. This announcement caused concern across the banking sector. Many people began speculating about possible bank mergers and privatisation.

Today, FM Sitharaman explained about this in an interview to Economic Times

In the interview, she said:

Today, banks’ health is very good. Banks have overcome the problems they faced earlier. We are in a position of strength, but equally, we have a deadline–Viksit Bharat by 2047. Funding our growth, funding individuals who want to make lives better. Aspirational Indians who want to become businessmen of their own standing. Also, India’s energy, security needs and India’s own requirement of extraction, mining, which are long tenure. You need Indian banks to be able to do all that, at that scale. So essentially (it will look at) what would be the necessary steps required from the government to prepare the entire banking system for these needs.

Also Read: SBI, PNB or BoB: In which Bank does Government keep its Money?

What will this committee do?

In simple terms, this committee will review the entire banking system and suggest changes to support India’s next stage of economic growth. It will also focus on financial stability, inclusion, and protecting consumers. In future, banks may be merger or privatised.

Also Read: Net Worth of Elon Musk crosses $850 billion, Only 22 countries are richer than Him

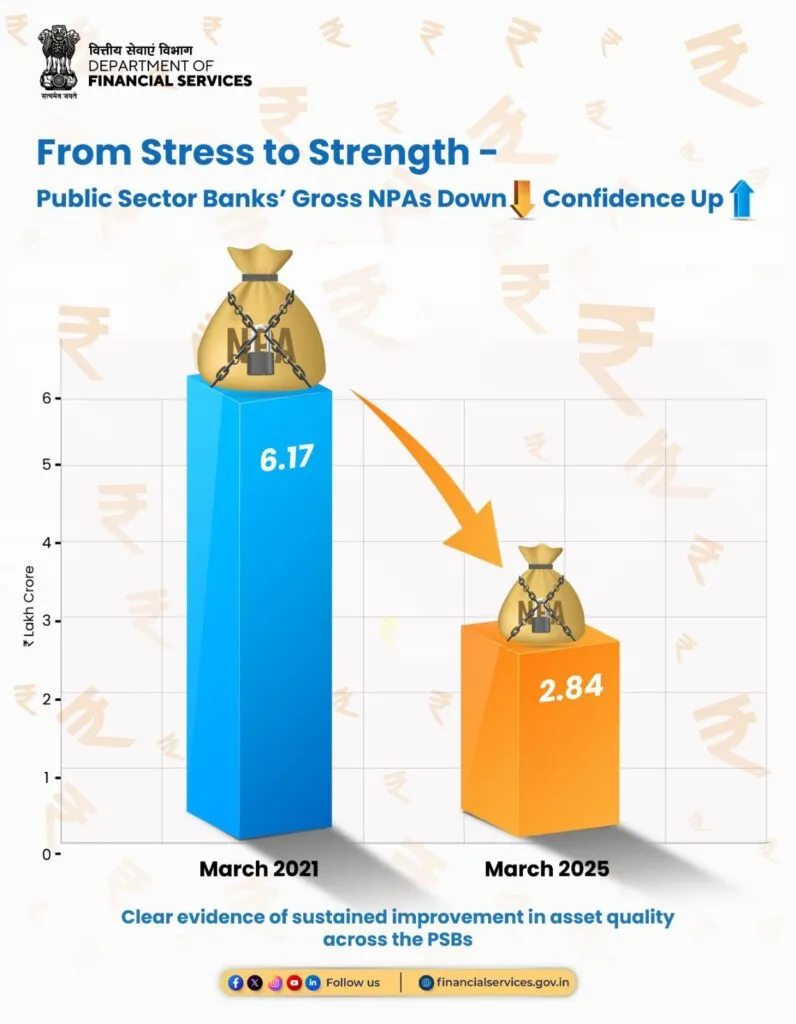

DFS praises Public Sector Banks

Today, DFS praised public sector banks for decline in NPA. In a post on X (formerly Twitter), DFS said:

PSBs continue to demonstrate resilience and strong asset quality improvement. Gross NPAs have declined sharply from ₹6.17 lakh crore (March 2021) to ₹2.84 lakh crore (March 2025) — a clear outcome of sustained reforms and stronger balance sheets. A healthier banking system is boosting confidence and supporting India’s economic growth.

Also Read: Is Officer the new Bank Clerk? No. of Clerks decreasing Shockingly