Waaree Energies Q4 FY25 Results: Profit Soars 34% to ₹619 Crore

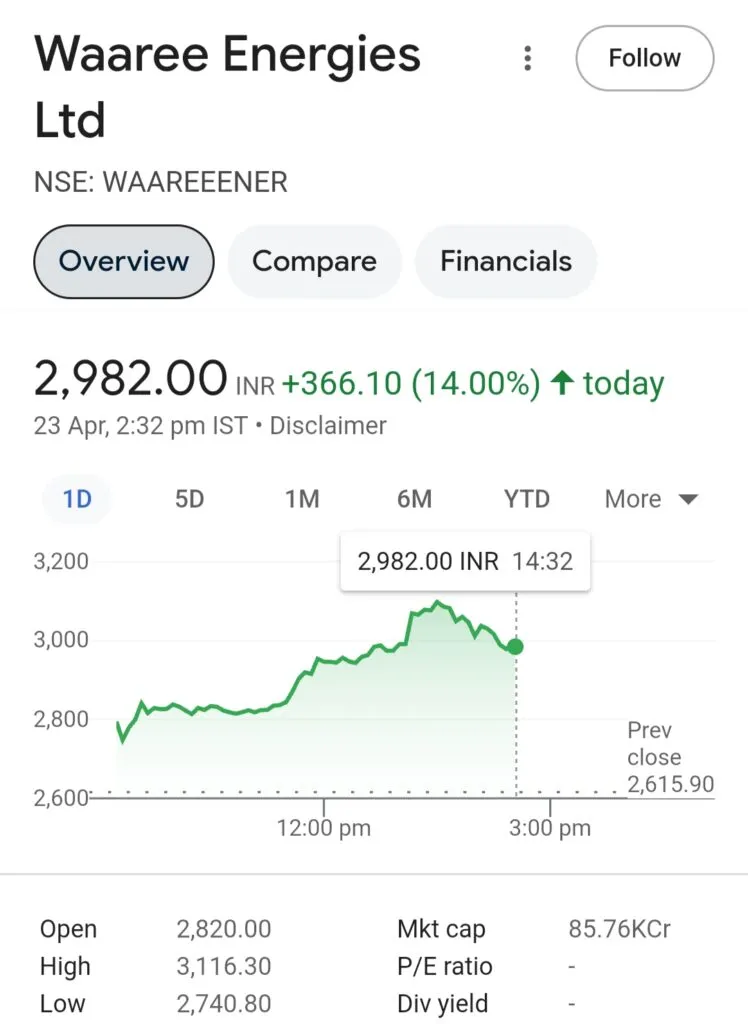

Shares of Waaree Energies Ltd. saw an increase of over 7% ahead of its March quarter earnings announcement on April 22, 2024. The positive movement in the stock price was partly driven by the recent decision by the United States to impose anti-dumping duties on solar equipment imported from Southeast Asian countries, including Vietnam, Malaysia, Cambodia, and Thailand. This move has boosted investor confidence in companies like Waaree Energies, and their strong financial performance for the fourth quarter of FY25 further supports this optimism.

Strong Q4 Results for Waaree Energies

Waaree Energies, which is one of India’s leading manufacturers of solar modules, posted impressive results for the March quarter of FY25. This performance was driven by higher production volumes and better operational efficiencies.

Net Profit and Revenue Growth

The company’s consolidated net profit for the quarter reached ₹619 crore, reflecting a 34% year-on-year growth compared to the same period last year. Revenue also saw a significant increase of 36.4%, rising to ₹4,004 crore from ₹2,936 crore in the previous year. This surge in revenue was mainly due to the increase in production volumes, which rose to 2.06 GW in Q4 FY25, up from 1.35 GW in Q4 FY24.

Profitability and Margin Expansion

The company’s operating earnings also showed strong improvement. EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortisation) jumped by 121% to ₹923 crore from ₹418 crore. This impressive growth in EBITDA indicates strong margin expansion, with the EBITDA margin reaching 23% for the quarter, up from 14.2% in the same period last year.

This strong performance is a result of both increased production and improved cost efficiencies, which helped the company achieve better operating leverage. Waaree Energies also benefited from higher capacity utilization and a favorable product mix, which likely contributed to the improvement in margins.

Strong Order Book and Future Outlook

At the end of Q4 FY25, Waaree Energies had a robust order book of 25 GW, valued at ₹47,000 crore. This healthy order pipeline indicates strong demand visibility and sets a solid foundation for continued growth.

Looking ahead, the company has expressed optimism for its future performance. For FY26, Waaree Energies expects its EBITDA to fall in the range of ₹5,500 crore to ₹6,000 crore. According to Amit Paithankar, the Whole-Time Director and CEO, the company’s existing order book and strong execution capabilities will be key factors in achieving this target.