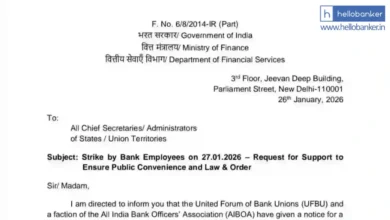

UFBU and IBA meeting postponed to 30 April

The Conciliation meeting between UFBU and IBA that was scheduled to be held on 22 April has been postponed to 30 April.

Bank Employees are protesting against non-fulfillment of demands such as 5 Day Banking and adequate recruitment of staff. Earlier, meeting was held on 18.03.2025 but any decision would not be arrived at. So next meeting was scheduled for 21.03.2025. In that meeting, the strike was deferred and UFBU said that a consensus had been arrived for most of the demands.

What UFBU said in last meeting on 21.03.2025?

The adjourned conciliation meeting was held today, starting in the morning, with serious discussions on our demands. Representatives from the Indian Banks’ Association (IBA) and the Department of Financial Services (DFS) were present.

During the meeting, the Joint Secretary of DFS joined via video call and conveyed that the Finance Minister (FM) and the DFS Secretary had a positive discussion on the demand for five-day banking.

IBA proposed further discussions on key issues such as recruitment, Performance-Linked Incentive (PLI), and other concerns. The Chief Labour Commissioner (CLC) assured that he would personally monitor the issues, including the implementation of five-day banking.

The meeting has been adjourned and will resume in the third week of April. Given these positive developments, it was decided to postpone the strike planned for the 24th and 25th by a month or two.

All units are hereby informed that the strike has been postponed, and a detailed circular will be issued soon.

Key Demands Raised by Bank Employees

- Adequate Recruitment: Address the shortage of staff across all cadres in banks.

- Five-Day Work Week: Implement a five-day work week for the banking industry.

- Withdrawal of DFS Directives: Demand the immediate withdrawal of the Department of Financial Services (DFS) directives on performance reviews and the Performance Linked Incentive (PLI) scheme, which threaten job security, create divisions among employees, and undermine the autonomy of public sector banks (PSBs).

- Safety of Bank Staff: Ensure protection for bank officers and staff against customer assaults and abuses.

- Fill Vacant Posts: Expedite the appointment of workmen and officer directors in PSBs.

- Resolution of Pending Issues: Resolve residual issues with the Indian Banks’ Association (IBA).

- Amend the Gratuity Act: Increase the gratuity ceiling to ₹25 lakhs, similar to government employees’ schemes, and provide income tax exemptions.