UCO Bank Revises MCLR and Other Benchmark Rates; Check New Rates

UCO Bank Revises MCLR and Other Benchmark Rates

UCO Bank Revises MCLR and Other Benchmark Rates

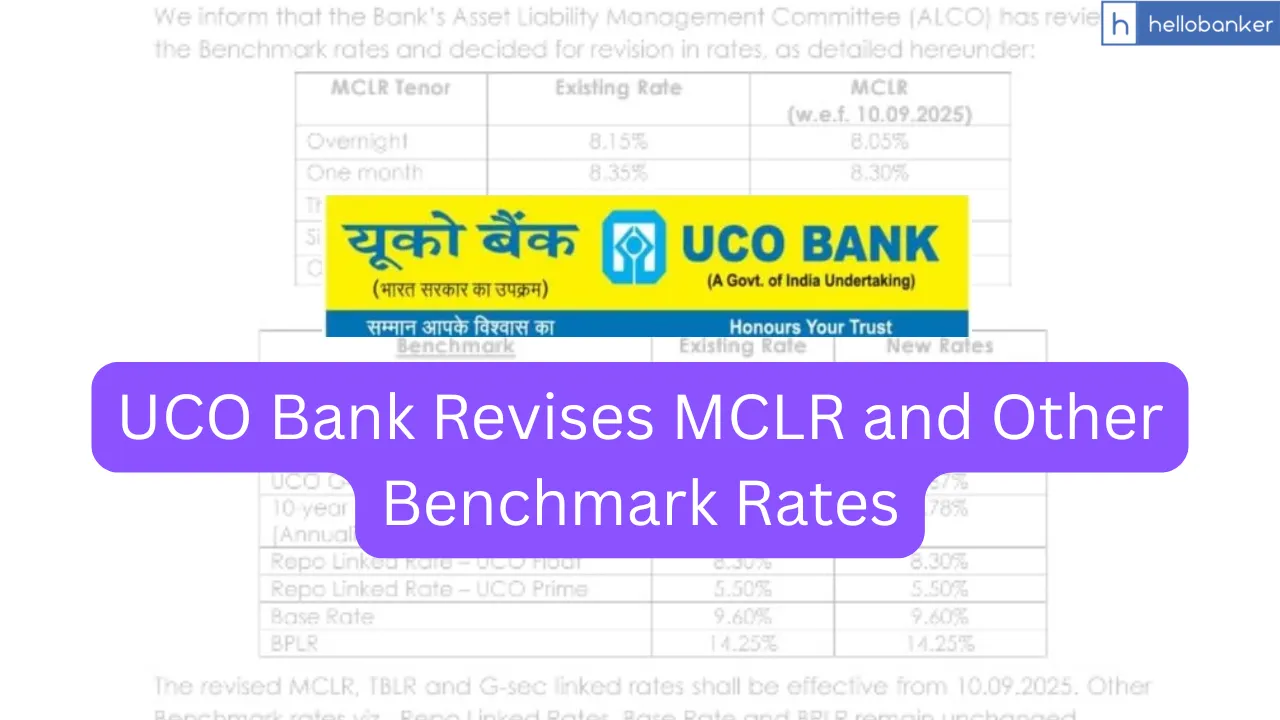

UCO Bank – one of the public sector banks in India has revised its MCLR and other Benchmark rates. The new rates are given below:

MCLR Rates

| MCLR Tenor | Existing Rate | MCLR (w.e.f. 10.09.2025) |

|---|

| Overnight | 8.15% | 8.20% |

| One month | 8.35% | 8.40% |

| Three months | 8.50% | 8.55% |

| Six months | 8.70% | 8.75% |

| One year | 8.95% | 9.00% |

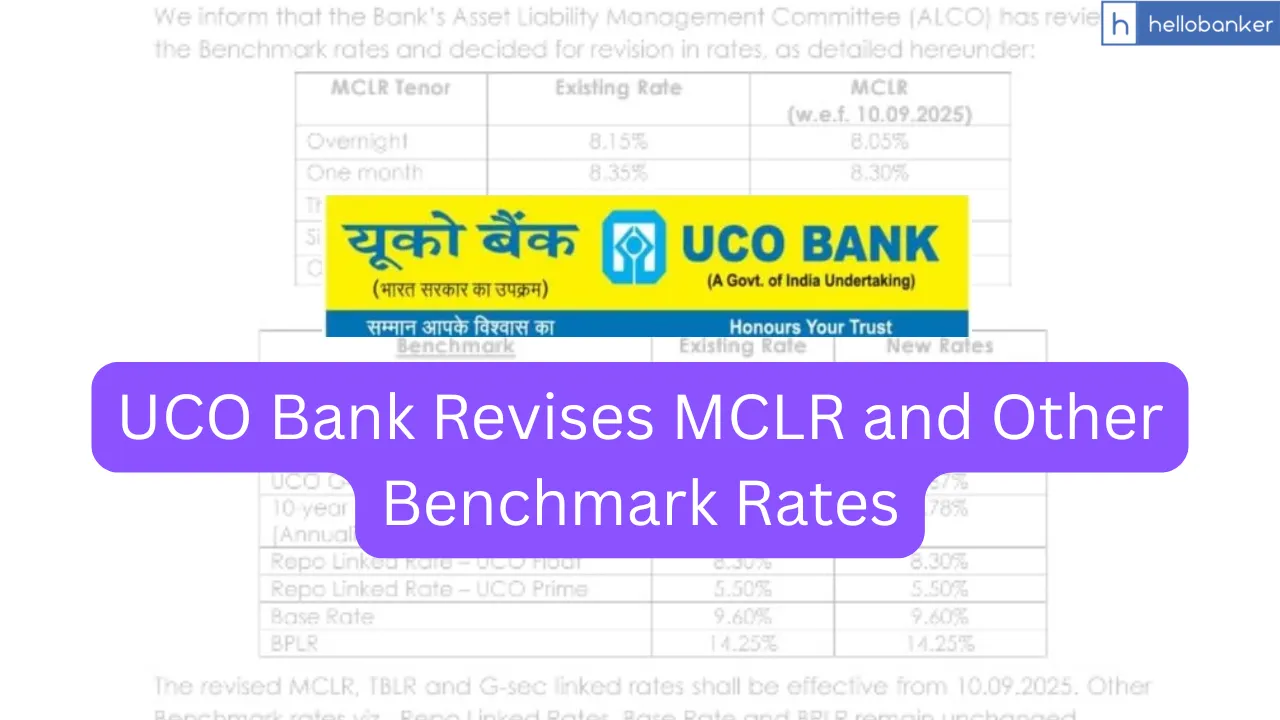

Other Benchmark Rates

| Benchmark | Existing Rate | New Rates (w.e.f. 10.09.2025) |

|---|

| TBLR (3 month) | 5.35% | 5.35% |

| TBLR (6 month) | 5.50% | 5.50% |

| TBLR (12 month) | 5.55% | 5.55% |

| 10-year G-Sec (Prev. Year) | 6.68% | 6.81% |

| UCO 10-Year G-Sec Linked YTM % p.a. | 6.80% | 6.80% |

| Repo Linked Rate – UCO Float | 8.30% | 8.30% |

| Repo Linked Rate – UCO Prime | 5.50% | 5.50% |

| Base Rate | 9.60% | 9.60% |

| BPLR | 14.25% | 14.25% |

Related Articles

-

RBI’s New Decisions: No Mis-selling, KCC Tenure 6 Years, Free loans upto Rs.20 Lacs

RBI’s New Decisions: No Mis-selling, KCC Tenure 6 Years, Free loans upto Rs.20 Lacs

-

Repo Rate unchanged at 5.25%, RBI MPC Meeting Updates!

Repo Rate unchanged at 5.25%, RBI MPC Meeting Updates!

-

SBI Manager Sets Example of Honesty, Returns Customer’s Gold Ornament

SBI Manager Sets Example of Honesty, Returns Customer’s Gold Ornament

-

‘Bharat Taxi’ launched: Can it compete with Ola, Uber?

‘Bharat Taxi’ launched: Can it compete with Ola, Uber?

-

Did SBI Allot Bank Locker to someone else? What is SBI Faridabad Locker Issue

Did SBI Allot Bank Locker to someone else? What is SBI Faridabad Locker Issue

-

What FM Sitharaman said about High-Level Committee for Banking Reforms

What FM Sitharaman said about High-Level Committee for Banking Reforms

-

Minutes of meeting between IOB Bank Union, Management, DFS and CLC over Strike

Minutes of meeting between IOB Bank Union, Management, DFS and CLC over Strike

-

SBI, PNB or BoB: In which Bank does Government keep its Money?

SBI, PNB or BoB: In which Bank does Government keep its Money?

-

Net Worth of Elon Musk crosses $850 billion, Only 22 countries are richer than Him

Net Worth of Elon Musk crosses $850 billion, Only 22 countries are richer than Him

-

Employee strength of Public Sector Banks; Check Number of Staff in SBI, PNB, BOB and All PSU Banks

Employee strength of Public Sector Banks; Check Number of Staff in SBI, PNB, BOB and All PSU Banks

-

Is Officer the new Bank Clerk? No. of Clerks decreasing Shockingly

Is Officer the new Bank Clerk? No. of Clerks decreasing Shockingly

-

Supreme Court Slams ED, CBI Over Delay in Bank Fraud Probe involving Anil Ambani

Supreme Court Slams ED, CBI Over Delay in Bank Fraud Probe involving Anil Ambani