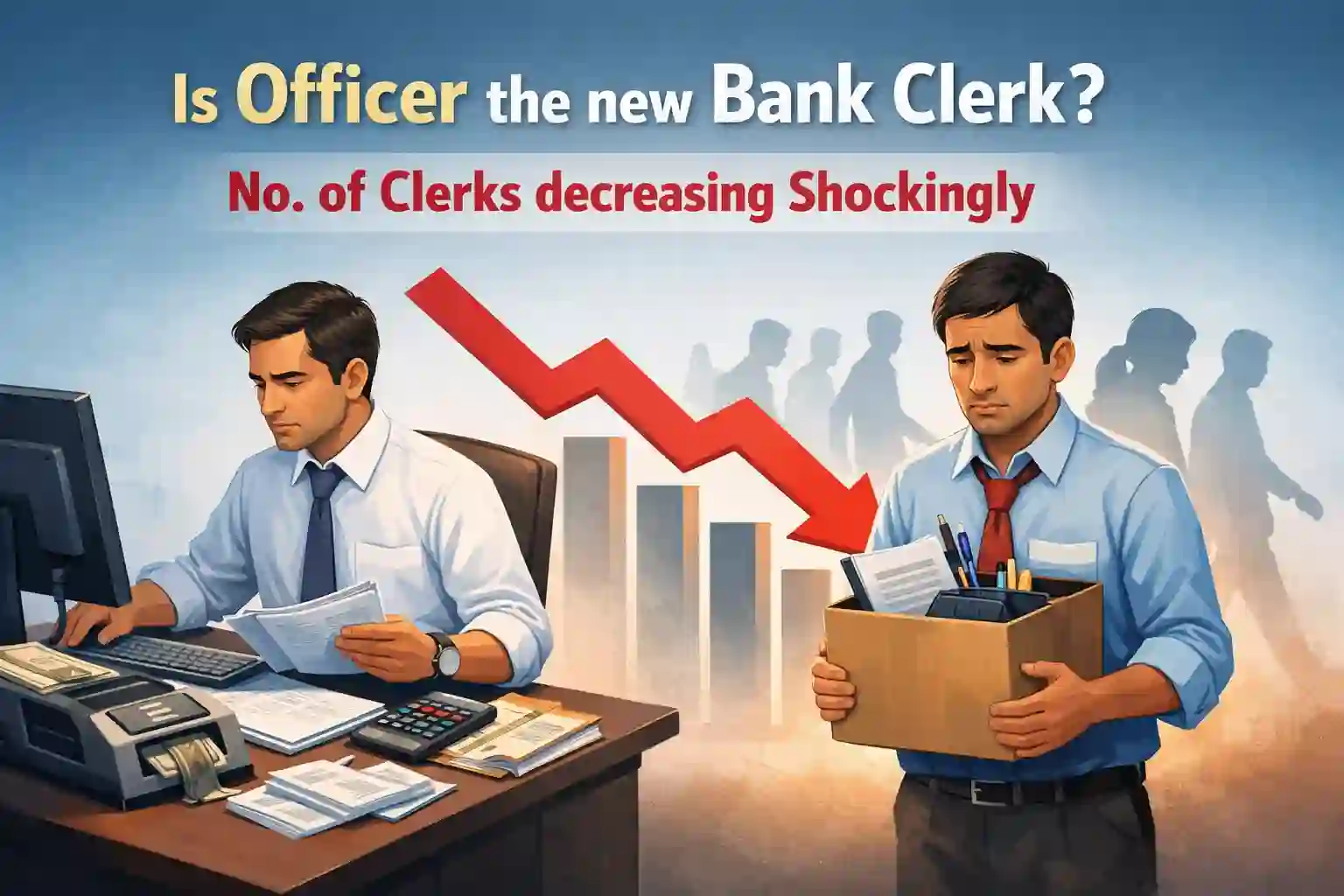

Over the last 20 years, the number of bank clerks has decreased significantly. Clerks, once considered the lifeline of banking, now seem to be disappearing. Bank clerks handle daily operations such as customer service, loans, RTGS, NEFT, mutual funds, SIPs, and digital app downloads. However, their share in the banking workforce has fallen to just 17% in 2025, according to a report.

- In FY 2005:

- Clerks made up 44% of bank employees

- Officers were 36%

- Sub-staff accounted for 20%

- In FY 2025:

- Officers now dominate with 76% share

- Clerks have fallen sharply to 17%

- Sub-staff reduced further to just 7%

Many people believe this change is due to the digitisation of banking services. With digitisation, most clerical work has been automated, and therefore fewer clerks are required in banks.

Also Read: Maternity Leave is a Right, Cannot Be Treated Like Other Regular Leaves

However, the reality may be different. Some people with deep knowledge of banking say that banks no longer want clerks. The main reason is that the duties and working hours of clerks are fixed, whereas banks prefer officers who can be assigned multiple responsibilities.

This raises an important question: Are officers becoming the new clerks? Clerical work has not ended in banks even today. Clerks are still needed for all entry-related work. Traditionally, officers verified the work done by clerks. But due to the sharp decline in the number of clerks, officers are now forced to perform clerical duties.

For example, officers are required to do entry-related work, and in some banks, if a cashier is on leave, an officer has to handle cash. This is not justified, as officers are paid higher salaries, and such work does not match their job role.

Also Read: Net Profit of Banks in Q3FY26, Check Top Bank

It is also clear that even today, most bank customers do not fully use digital services. The situation is worse in rural India. In such a scenario, clerks are essential for smooth branch operations.Moreover, the number of sub-staff has fallen to just 7%.

Sub-staff play a crucial role in maintaining physical records and files in branches. This is an important responsibility but is often ignored by banks. To manage this work, banks are increasingly hiring private individuals.

These private individuals are not properly accountable for any wrongdoing. At the same time, RBI guidelines require banks to maintain records of daily transactions for at least five years. Due to the shortage of sub-staff, records are often not maintained properly, which may lead to legal complications in the future.

Also Read: All Agency Banks will remain open on 31 March, RBI gives Order

What do you think about this issue? Let us know in the comments section below.

Also Read: IIBF JAIIB CAIIB Exam Dates 2026 Released, Download IIBF Exam Calendar