Acts

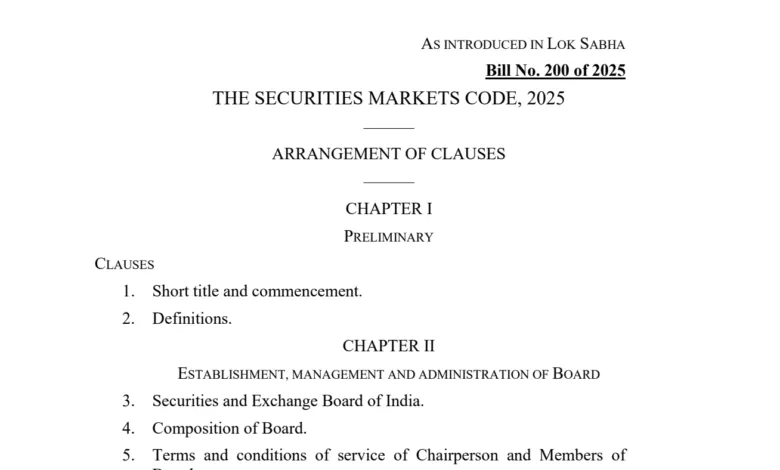

The Securities Markets Code 2025

Connect with Us

2025 Securities Markets Code Bill aims to replace the 1992 Securities and Exchange Board of India Act, the 1956 Securities Contracts Regulation Act, and the 1996 Depositories Act. It also proposes measures to better protect investors and make it easier to do business in India’s financial markets. The Bill seeks to consolidate and amend the laws relating to the securities markets.

The Securities Markets Code Bill 2025 seeks to merge the provisions of the Securities and Exchange Board of India Act, 1992, the Depositories Act, 1996 and the Securities Contracts (Regulation) Act, 1956 into a unified code.

The Securities Markets Code 2025: Important Changes

Governance Reforms

- The number of SEBI Board members may be increased from 9 to up to 15 members.

- A SEBI member may be removed if they gain any financial or personal interest that could affect their fair functioning.

- Members must disclose any direct or indirect interest, including interests of family members, in matters discussed in Board meetings. They must not participate where such interests exist.

- SEBI will have additional responsibilities such as:

- Reviewing its own performance

- Evaluating whether its rules are effective and reasonable

- Improving staff skills through training

- Conducting regular research and studies

- Laying down principles for implementing its Code of Conduct

- The Bill creates a transparent, consultative rule-making process where public consultation becomes mandatory for SEBI, Market Infrastructure Institutions (MIIs), and the central government.

- The Bill ensures a clear separation between SEBI’s investigation activities (inspections, audits) and enforcement actions (notices, penalties, adjudication).

Ease of Compliance and Ease of Doing Business

- Decriminalisation of securities laws:

- Lesser violations (fraudulent or unfair practices) will no longer attract criminal charges, only civil penalties.

- Serious violations (market abuse affecting market integrity or public interest) may still attract criminal action along with civil penalties.

- The Bill strengthens Market Infrastructure Institutions (MIIs) like stock exchanges, clearing corporations, and depositories; the government may also notify new types of MIIs.

- MIIs can frame bye-laws to:

- Ensure fair and non-discriminatory access

- Reduce market abuse

- Enable interoperability between MIIs

- Improve transparency

- SEBI can delegate some registration functions to MIIs and Self-Regulatory Organizations to simplify processes.

- A Regulatory Sandbox will be introduced to allow testing of new financial products, services, or technologies in a controlled setting.

Investor Protection Reforms

- SEBI will introduce an Investor Charter to guide investor protection and improve participation in the securities market.

- SEBI will strengthen the investor grievance redressal system and may require market service providers and issuers to establish similar systems.

- SEBI can appoint Ombudspersons to resolve investor complaints quickly and effectively.

Inter-Regulatory Coordination

- The Bill provides a framework for SEBI to coordinate with other regulators to:

- Enable easy listing of financial instruments regulated by other authorities

- Improve cooperation among MIIs

- Ensure smooth interoperability across market platforms

Click here to download Securities Markets Code 2025 PDF

Advertisement

Advertisement