Tata Communications Reports 115% Profit Surge in Q4 FY25, Announces ₹25 Dividend

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

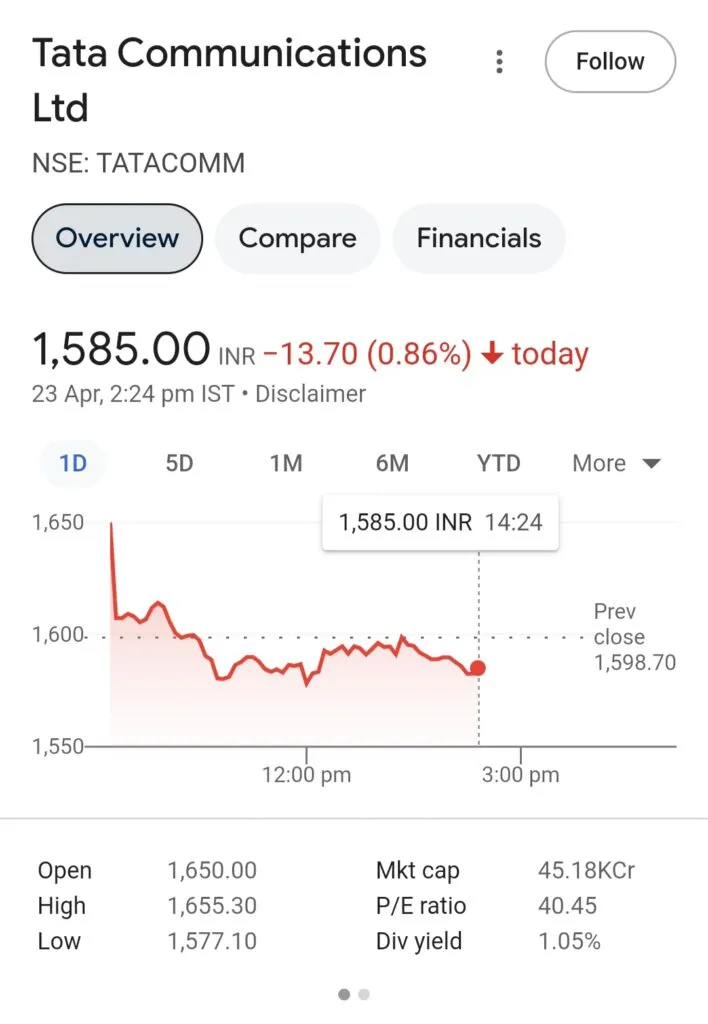

Tata Communications, part of the Tata Group, has shared its financial performance for the fourth quarter (Q4) of the fiscal year 2024-25 (FY25). As of now, the company’s share price stands at ₹1,587.50, showing a small drop of 0.62%.

Q4 Financial Highlights

The company experienced a 6% growth in its revenue from operations in Q4, reaching ₹5,990.35 crore. This compares to ₹5,645.07 crore in the same quarter of the previous year. The growth was mainly driven by a strong 9.8% increase in revenue from its core data services division. For the entire year, Tata Communications achieved a total revenue of ₹23,238 crore.

A significant highlight of the quarter was the company’s net profit, which saw a remarkable 115% increase. The net profit surged to ₹761.17 crore, up from ₹354.57 crore in Q4 FY24. This was a major achievement for Tata Communications, but it was boosted by some one-off gains. These included ₹577 crore earned from selling land in Chennai to an associate company, and ₹311 crore from selling its stake in Tata Communications Payments Solutions.

Excluding One-Time Gains

Without these exceptional gains, the company’s profit margins showed a slight dip compared to the previous quarter (October to December). Still, the overall growth in revenue was driven by higher demand for Tata Communications’ data services, including services like data connections and cybersecurity for businesses.

Plans for Future Growth

Looking ahead, Tata Communications plans to boost its capital expenditure (CapEx) to over $300 million in FY26, up from an estimated $265–270 million in FY25. The increased spending will focus on key growth areas such as undersea cables and cloud platforms. The company plans to keep its maintenance costs low, capped at under 2% of its total revenue. Despite the rise in investments, Tata Communications is aiming to increase its pre-tax profit margins to 23–25% over the next two years, compared to 19.8% in Q4 FY25.

The company is also restructuring its operations and selling off non-core assets to concentrate on areas like cloud services, networking, media, and entertainment.

Revenue Growth Plans

Earlier in January, Tata Communications set an ambitious target to double its revenue to ₹28,000 crore by FY27. However, the company’s CFO, Mr. Kabir Shaikh, mentioned that this goal might be delayed, with a revised timeline to be announced during the next investor day.

Foreign Operations and Dividend Announcement

The company is also considering reducing its stake in a foreign subsidiary that is currently not performing well. This subsidiary reported a ₹105 crore loss on ₹33 crore in revenue for FY25.

Tata Communications’ board has proposed a final dividend of ₹25 per share for the year ended March 31, 2025, subject to approval by shareholders at the Annual General Meeting.