Bank issued notice to son of cabinet minister for depositing Rs 51 crore NPA Loan

| ➡️ Get instant news updates on Whatsapp. Click here to join our Whatsapp Group. |

The Nashik District Central Cooperative Bank has issued a notice to Armstrong Infrastructure Pvt Ltd, a sugar firm owned by cabinet minister Chhagan Bhujbal’s son and nephew, for outstanding dues exceeding Rs 51 crore. The firm, owned by former Nashik MP Sameer Bhujbal and former Nandgaon MLA Pankaj Bhujbal, had borrowed Rs 30 crore in 2011 for a sugar factory in rural Nashik, leaving Rs 12 crore unpaid.

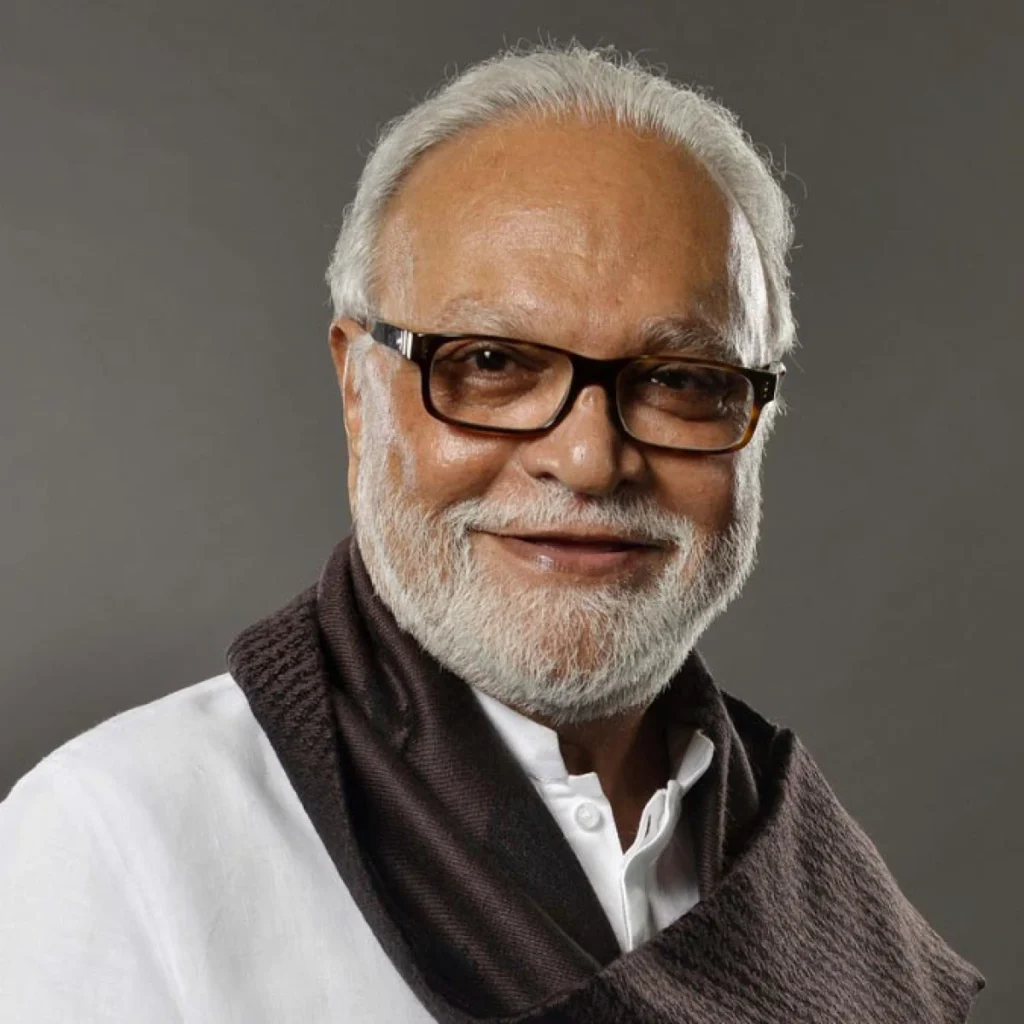

Chhagan Bhujbal is an Indian politician from Maharashtra, who is the member of current Government of Maharashtra, headed by Eknath Shinde. Currently he is Member of 14th Legislative Assembly of Maharashtra from Yeola Assembly.

Pankaj, Chhagan Bhujbal’s son, and Sameer, the nephew of the state civil supplies minister, are both directors of the company. G K Nikam, the Nashik District Central Cooperative (NDCC) bank officer for Armstrong Infrastructure Pvt Ltd, clarified that the bank provided a non-agriculture loan. While a portion of the loan was repaid, the remaining unpaid part converted into a non-performing asset (NPA) in 2013.

Nikam explained the loan details, stating that the demand for Rs 30 crore was made in November 2011, and by January 2012, it was sanctioned against the mortgage of the company’s property at Dabhadi in Malegaon (formerly Girna sugar factory). The company repaid Rs 18 crore, but the outstanding Rs 12 crore was declared an NPA in March 2013.

As of now, the outstanding dues, including interest, stand at Rs 51.6 crore. Consequently, the bank has served a notice to Satyen Kesarkar, Pankaj Bhujbal, and Sameer Bhujbal, instructing them to settle the amount within 60 days under the SARFAESI Act, 2002. Failure to comply would result in another notice. If the loan remains unpaid within seven days of the second notice, the bank will proceed to attach the company’s property.

Sameer Bhujbal responded, noting that the property had already been attached by the Enforcement Directorate (ED), and relief had been sought with the tribunal. He mentioned that the next hearing is scheduled for March, and decisions about the future course of action will be made accordingly.