SBI QIP: Who purchased Shares of SBI? Check All Details

SBI had launched Rs.25,000-crore qualified institutional placement (QIP) on 16th July 2025. The State Bank of India received a strong response from the market and the QIP was subscribed three-times its offer size in less than a day. [Click here to know what is QIP]

This is the first time since 2017 that SBI has tapped the equity market to raise capital. The SBI had last used the QIP method in the financial year 2017-18 (Apr-Mar), to raise Rs 15,000 crore. Let’s know Who purchased shares of SBI in this QIP.

SBI QIP: Who Purchased Shares of SBI?

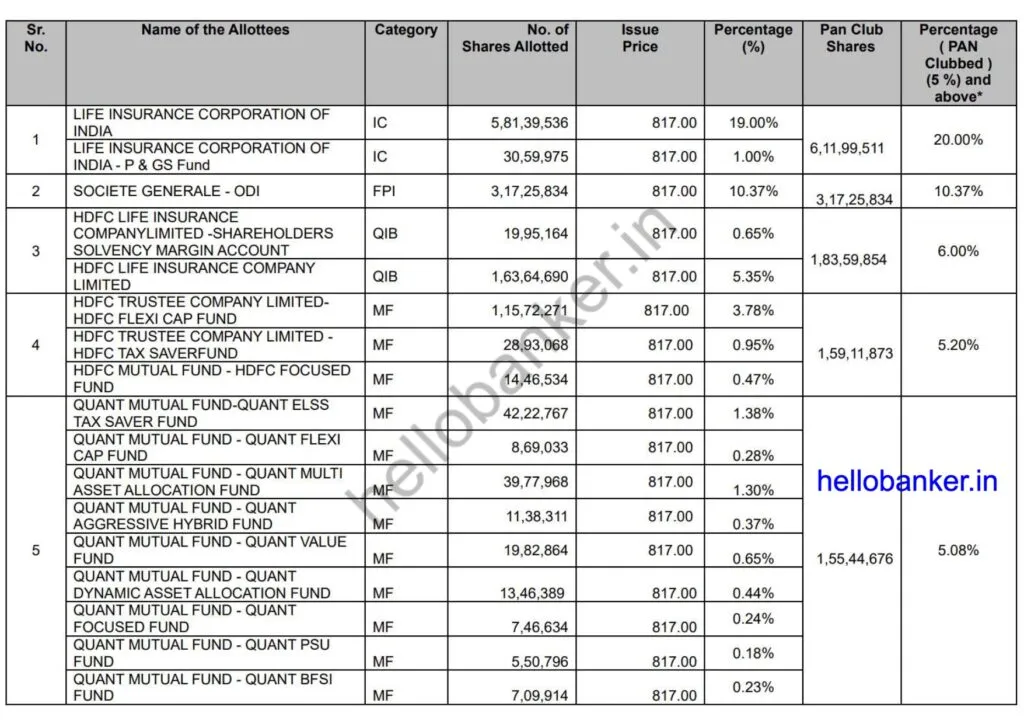

| Sr. No. | Name of the Allottees | Category | No. of Shares Allotted | Issue Price | Percentage (%) | PAN Club Shares | Percentage (PAN Clubbed) (5%) and above* |

|---|---|---|---|---|---|---|---|

| 1 | LIFE INSURANCE CORPORATION OF INDIA | IC | 5,81,39,536 | 817.00 | 19.00% | 6,11,99,511 | 20.00% |

| LIFE INSURANCE CORPORATION OF INDIA – P & GS Fund | IC | 30,59,975 | 817.00 | 1.00% | |||

| 2 | SOCIETE GENERALE – ODI | FPI | 3,17,25,834 | 817.00 | 10.37% | 3,17,25,834 | 10.37% |

| 3 | HDFC LIFE INSURANCE COMPANY LIMITED – SHAREHOLDERS SOLVENCY MARGIN ACCOUNT | QIB | 19,95,164 | 817.00 | 0.65% | 1,83,59,854 | 6.00% |

| HDFC LIFE INSURANCE COMPANY LIMITED | QIB | 1,63,64,690 | 817.00 | 5.35% | |||

| 4 | HDFC TRUSTEE COMPANY LIMITED – HDFC FLEXI CAP FUND | MF | 1,15,72,271 | 817.00 | 3.78% | 1,59,11,873 | 5.20% |

| HDFC TRUSTEE COMPANY LIMITED – HDFC TAX SAVER FUND | MF | 28,93,068 | 817.00 | 0.95% | |||

| HDFC MUTUAL FUND – HDFC FOCUSED FUND | MF | 14,46,534 | 817.00 | 0.47% | |||

| 5 | QUANT MUTUAL FUND – QUANT ELSS TAX SAVER FUND | MF | 42,22,767 | 817.00 | 1.38% | 1,55,44,676 | 5.08% |

| QUANT MUTUAL FUND – QUANT FLEXI CAP FUND | MF | 8,69,033 | 817.00 | 0.28% | |||

| QUANT MUTUAL FUND – QUANT MULTI ASSET ALLOCATION FUND | MF | 39,77,968 | 817.00 | 1.30% | |||

| QUANT MUTUAL FUND – QUANT AGGRESSIVE HYBRID FUND | MF | 11,38,311 | 817.00 | 0.37% | |||

| QUANT MUTUAL FUND – QUANT VALUE FUND | MF | 19,82,864 | 817.00 | 0.65% | |||

| QUANT MUTUAL FUND – QUANT DYNAMIC ASSET ALLOCATION FUND | MF | 13,46,389 | 817.00 | 0.44% | |||

| QUANT MUTUAL FUND – QUANT FOCUSED FUND | MF | 7,46,634 | 817.00 | 0.24% | |||

| QUANT MUTUAL FUND – QUANT PSU FUND | MF | 5,50,796 | 817.00 | 0.18% | |||

| QUANT MUTUAL FUND – QUANT BFSI FUND | MF | 7,09,914 | 817.00 | 0.23% |

The Committee of Directors, at its meeting held today i.e., July 21, 2025 approved the issue and allotment of 30,59,97,552 fully paid-up equity shares to eligible Qualified Institutional Buyers (QIBs) at an Issue Price of ₹817.00 per equity share of face value of ₹1 each (including a premium of ₹816.00 per equity share), aggregating to ₹24,999,99,99,984 (Rupees Twenty-Four Thousand Nine Hundred Ninety-Nine Crore, Ninety-Nine Lakh, Ninety-Nine Thousand, Nine Hundred Eighty-Four only).

Pursuant to the allotment of equity shares in the Issue, the issued Equity Share Capital of the Bank increased from ₹892.54 Crore, comprising of 892,54,05,164 equity shares of face value ₹1 each to ₹923.14 Crore, comprising of 923,14,02,716 equity shares of face value ₹1 each and the Paid-up Equity Share Capital of the Bank increased from ₹892.46 Crore, comprising of 892,46,20,034 equity shares of face value ₹1 each to ₹923.06 Crore, comprising of 923,06,17,586 equity shares of face value ₹1 each.

The Issue opened on July 16, 2025 and closed on July 21, 2025 and the same was intimated to you vide our letter no. CC/S&B/AND/2025-26/257 dated 16.07.2025 and CC/S&B/AND/2025-26/264 dated 21.07.2025 respectively.

Click here to know what is QIP

Also Read: Government Plans to Decrease Stake in PSU Banks, Rs.45,000 Crore will be raised via QIP