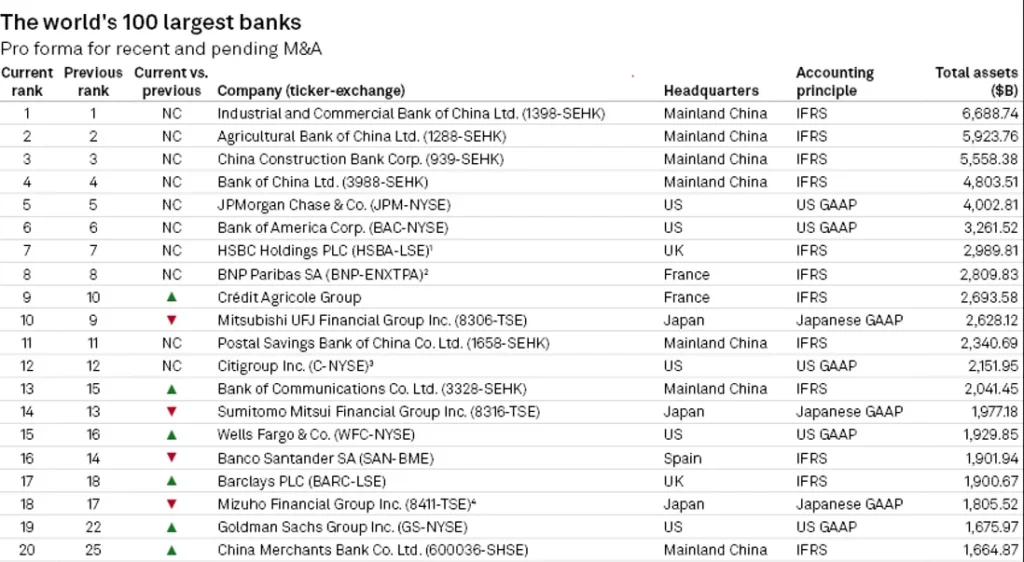

SBI is 43rd Largest Bank in the World, Check Latest Ranking of All Banks

State Bank of India (SBI) and HDFC Bank are the only Indian banks to feature in the latest S&P Global Market Intelligence ranking of the world’s 100 largest banks by assets. This list showcases the financial powerhouses across the globe, with banks from China dominating the rankings.

SBI and HDFC Bank’s Rise in Rankings

State Bank of India has climbed up by four spots to secure the 43rd position. This improvement highlights the bank’s strong performance and growing influence in the global banking sector. On the other hand, HDFC Bank also saw a rise, moving up one place to 73rd in the rankings.

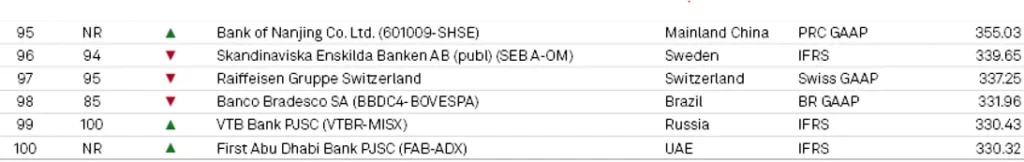

World’s 100 Largest Banks Rankings

Chinese Banks Lead the List

Chinese banks have a significant presence in this ranking. The top four spots are occupied by major Chinese banks, including the Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., China Construction Bank Corp., and Bank of China Ltd. The ranking has remained largely the same from the previous year, with these banks holding their positions.

Overall, a total of 21 Chinese banks made it into the top 100, with seven of them placed within the top 20, showcasing China’s dominant role in the global banking industry.

Changes in European Banks

Some changes have been seen among European banks. For instance, France-based Societe Generale SA dropped three places, moving to the 22nd position. This decline is mainly due to a reduction of USD 27.36 billion in its assets, as some of these assets were held for sale at the end of 2024.

HSBC Holdings PLC, the largest bank in Europe, also experienced a drop in its assets by USD 27.23 billion, largely due to its ongoing restructuring efforts. However, despite this decline, HSBC maintained its position as the seventh-largest bank globally.

New Entrants and the Impact of Mergers & Acquisitions

The ranking also saw new entries, with National Bank of Canada and State Street Corp. joining the top 100 after not being listed in 2024. National Bank of Canada secured the 92nd spot, while State Street took the 93rd spot.

Mergers and acquisitions (M&A) have played a significant role in shaping the size and rankings of banks, especially in Europe. Many European lenders are using acquisitions to grow and streamline their operations. This trend is expected to continue, as banks shed non-performing assets and focus on expanding their reach and capabilities.

The latest S&P Global Market Intelligence ranking reflects the ongoing changes in the global banking landscape. Chinese banks continue to lead, while Indian banks like SBI and HDFC Bank are steadily climbing the ranks. The influence of mergers and acquisitions is evident, especially in Europe, where banks are adapting their business models to stay competitive in a rapidly changing financial environment.