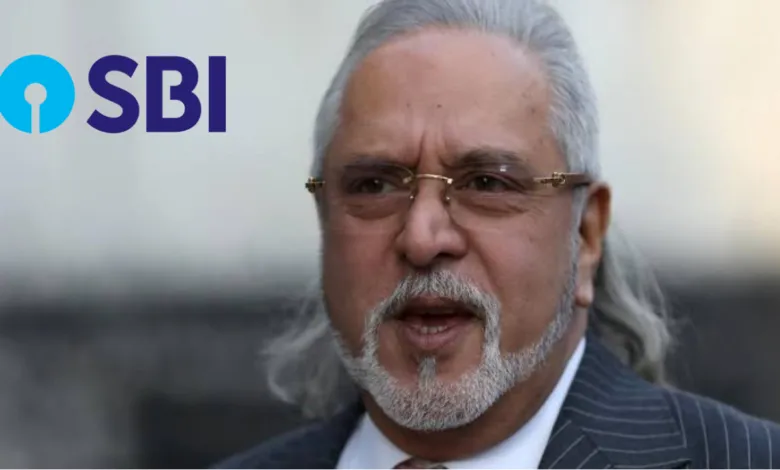

SBI and other Indian Banks Win Bankruptcy Court Case Against Vijay Mallya in London

A group of Indian banks, led by the State Bank of India (SBI), has won an important legal case in London against Vijay Mallya, the former owner of Kingfisher Airlines. The case was about recovering a large debt owed by Mallya after his airline failed.

The London High Court judge, Anthony Mann, announced the decision on Wednesday. He ruled in favor of the Indian banks, which means that the bankruptcy order against Vijay Mallya remains in place. This is a major step for the banks in getting back their money.

What Is the Case About?

Back in 2017, Indian banks took Mallya to court in the UK after a ruling by the Debt Recovery Tribunal (DRT) in India. The DRT had ordered Mallya to pay back over GBP 1.12 billion (around Rs 11,000 crore) because he had given a personal guarantee for loans taken by Kingfisher Airlines.

In 2018, the banks filed a bankruptcy case against Mallya in the UK. Mallya tried to stop it by saying that he had already offered enough assets in India (which were seized by the Enforcement Directorate or ED) and that the banks had security on his assets.

What Happened in the Court?

In 2020, a UK court had said the banks did hold security over Mallya’s assets, which made the bankruptcy request partly incorrect. But the banks challenged that ruling, and in 2021, they were allowed to appeal. They also made changes to their bankruptcy petition, promising that if Mallya is declared bankrupt, they would give up any claim on his assets in India.

Mallya opposed this change, saying it went against Indian laws and public policy. But in April 2021, the UK court said the change was valid and didn’t break any Indian rules.

Now, in the latest ruling, the High Court has:

- Allowed the banks’ appeal that they do not hold security on Mallya’s assets

- Rejected Mallya’s attempt to challenge the bankruptcy order

- Said the bankruptcy order against Mallya stands firm

What the Banks’ Lawyers Said

The law firm TLT LLP, which represents the banks, said this decision is very important. It proves that the banks were right to file the bankruptcy case and that the assets taken by the ED in India don’t cancel the debt under English law.

Nick Curling, legal director at TLT, said, “This is a big win for the banks. We have been working on this case since 2017.”

What Vijay Mallya’s Side Says

Mallya, who was declared bankrupt in July 2021, is now trying another legal route. He has filed an application in the UK court to cancel the bankruptcy order, saying that the assets in India were enough to pay the banks.

His lawyer, Leigh Crestohl, said that Mallya will continue to fight and has also started a separate case in the Karnataka High Court in India. He wants the banks to give a proper account of how much they have recovered and how.

Meanwhile, Mallya is still out on bail in the UK. He is also involved in a private legal matter, which is believed to be related to his asylum request in the UK. This is separate from his extradition case to India, where he is wanted on charges of fraud and money laundering.