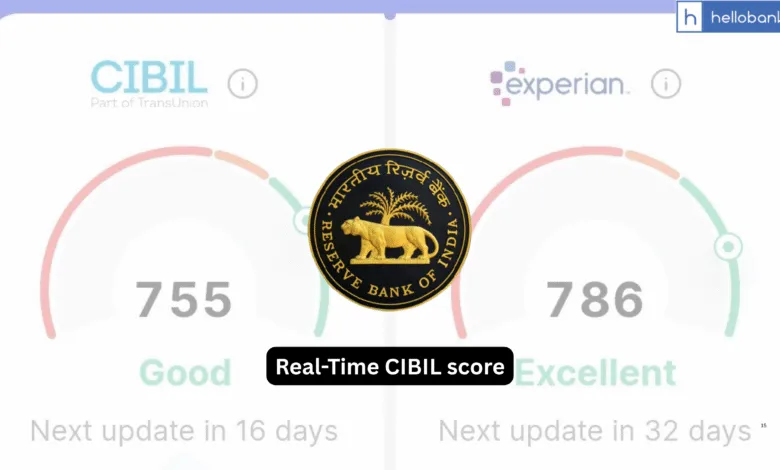

Real-Time CIBIL score: RBI new rule on CIBIL Score! Now instant CIBIL score will be provided for Loans

The Reserve Bank of India (RBI) has made an important announcement that can directly impact anyone applying for a loan. RBI has asked credit bureaus like CIBIL to start updating credit scores in real-time, instead of the current system where updates happen every 15 days.

RBI New rules on CIBIL score: Real-Time CIBIL score updation

A CIBIL score is a three-digit number that shows how good your credit history is. Banks and financial institutions use this score to decide whether to give you a loan or credit card. CIBIL score ranges upto 900 and normally, Banks sanction loans for applicants having CIBIL score of atleast 700.

Until now, these scores were updated every two weeks. That means if you paid off a loan or made a big repayment, it could take up to 15 days for that change to show in your credit report.

Now, with the RBI’s new rule, these updates will happen immediately or almost immediately (real-time). This can be a big help when you’re applying for a home loan, personal loan, or car loan, as banks will have your latest credit information right away.

What RBI Said About This Change

RBI Deputy Governor M. Rajeshwar Rao spoke at a conference organized by CIBIL. He said that faster data sharing by Credit Information Companies (CICs) like TransUnion CIBIL, Experian, and CRIF High Mark will increase transparency, trust, and efficiency in the lending process.

He explained that real-time credit reporting will:

- Improve how accurately banks can assess your creditworthiness.

- Show your latest actions like loan repayments or closures immediately.

- Help borrowers get faster decisions and better loan deals.

Rao admitted that moving to real-time reporting will need investment in technology, better processes, and staff training. But he emphasized that the benefits will be greater than the costs in the long run, both for customers and the banking system.

How will this work?

When you apply for loan in a Bank, the Bank fetches your CIBIL Score by entering details such as Name, Loan Purpose, Loan Amount, PAN, Aadhaar, Address, Mobile Number. If you closed a loan, it will show in your CIBIL report after 15 days. But now, after this new rule, your CIBIL report will be fetched on real-time basis. This means that if you close your loan today and fetch CIBIL report tomorrow, then it will show status of loan as closed. This will be highly beneficial for loan applicants and also for Banks.

Unique Borrower ID

Another major point the RBI raised was the need for a “Unique Borrower Identifier” across all banks and credit agencies. Right now, if your name or details are entered differently by different banks, it can cause confusion or duplicate credit reports. A standard ID will reduce errors and make reports more accurate.