RBI makes changes in DICGC Premium paid by Banks, Understand new rules!

The Reserve Bank of India (RBI), has decided to implement Risk Based Premium (RBP) framework. In this framework, some banks will have to pay less premium for insurance coverage of deposits. Right now, the deposits in banks are insured by DICGC. This means that if a bank fails, then DICGC pays upto Rs.5 lac to the bank customer. For this facility, banks pay a premium to DICGC. Right now, all banks pay the same premium, which is around Rs.0.12 per Rs.100. Now, RBI has made changes to this system. Now, the more financially stable banks would pay less premium.

For example: Banks such as SBI and HDFC will pay less premium, while financially weak banks will have to pay more premium.

Also Read: What are the Timings of GST Department?

The important points of this new system is as follows:

- There shall be two risk assessment models – Tier 1 Model and Tier 2 Model. Tier 1 Model is applicable to Scheduled Commercial Banks other than Regional Rural Banks (RRBs), and based on supervisory ratings, quantitative assessment (CAMELS parameters) and potential loss to Deposit Insurance Fund (DIF) in case of failure of insured banks.

- Tier 2 Model, applicable to RRBs and cooperative banks is based on quantitative assessment (CAMELS parameters) and potential loss to DIF in case of failure of insured banks.

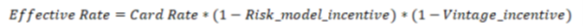

- The maximum Risk_model_incentive shall be 33.33% over the card rate.

- Additionally, the RBP framework also provides benefits of vintage (signifying longer contribution to DICGC’s Deposit Insurance Fund without any major distress or claim payouts from DICGC). Maximum Vintage_incentive of upto 25% shall be provided.

Also Read: Big Update! All MD&CEO posts in Nationalised Banks opened for Private Sector

- The effective rate of premium therefore will be calculated, as under:

- The framework envisages a rating override policy in case of adverse material information/development, subsequent to the initial risk rating.

- The banks will be required to maintain confidentiality of ratings and not to disclose ratings or amount of premium paid to DICGC.

- Local Area Bank (LABs) and Payments Banks (PBs) will continue to pay the premium at card rate (i.e., 12 paise per ₹100 of AD per annum) as there are data point limitations to bring them into a RBP model (they account for less than 1% of the premium collected).

- All UCBs under the Supervisory Action Framework (SAF)/Prompt Corrective Action (PCA) of RBI will continue to pay the card rate of 12 paise and will be considered for RBP from the financial year following the year in which the bank exits SAF/PCA.

- The RBP framework shall be effective from April 1, 2026 and will be reviewed at least once in three years.

Also Read: What FM Sitharaman said about High-Level Committee for Banking Reforms