The Central Board of Directors of the Reserve Bank of India has approved an important change related to deposit insurance for banks. This decision was taken during the 620th board meeting, which was held in Hyderabad. In this meeting, the RBI approved the introduction of a risk-based deposit insurance system for banks. This decision comes after the RBI had proposed this change earlier in October, saying that the old system needed improvement.

Before understanding this change, let us first understand deposit insurance and who manages it in India. In our country, deposit insurance is provided by the Deposit Insurance and Credit Guarantee Corporation, commonly known as DICGC. This institution works under the Deposit Insurance and Credit Guarantee Corporation Act, 1961, and deposit insurance was introduced in India for the first time in 1962. The main purpose of deposit insurance is very simple. It is meant to protect small depositors and keep public trust in the banking system. This means that if any bank fails, depositors do not lose their entire money. At present, each depositor is insured up to ₹5 lakh per bank, which is paid by DICGC.

So, what exactly is DICGC? DICGC is a specialised organisation linked to the RBI and works under the Ministry of Finance, Government of India. It was established on 15 July 1978. DICGC provides insurance on all types of bank deposits, including savings accounts, fixed deposits, current accounts, and recurring deposits. Earlier, the insurance limit was only ₹1 lakh, but it was increased to ₹5 lakh on 4 February 2020, which gave big relief to common depositors.

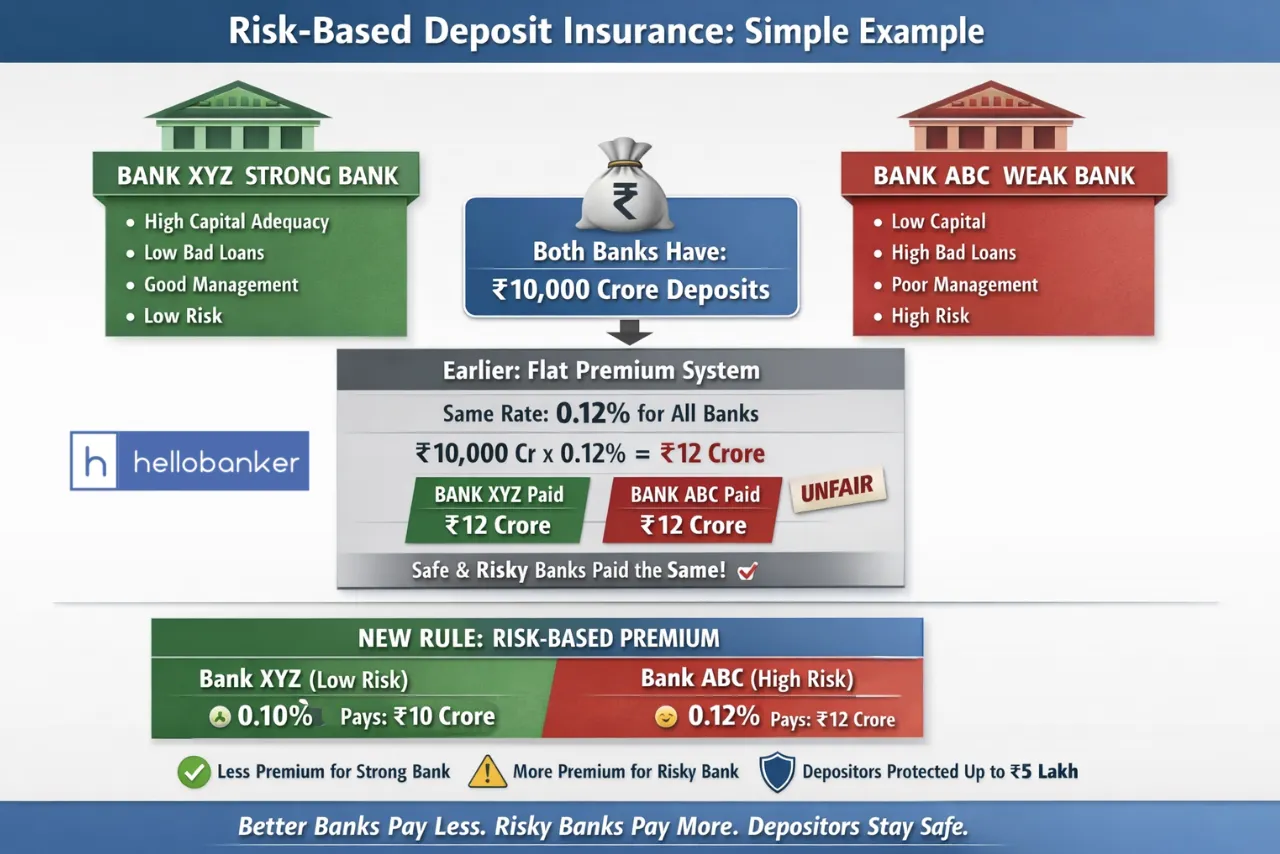

Now the important point is this. Banks insure depositors’ money with DICGC, not depositors directly. Banks pay a premium to DICGC every year for this insurance. At present, this premium system is very simple but also unfair. All banks pay the same flat premium rate, which is 12 paise for every ₹100 of deposits, or 0.12 percent per year. This rate is applied equally to all banks, no matter how strong or weak they are. This means a well-managed bank with strong finances pays the same premium as a risky bank with weak balance sheets and poor management.

Now, the RBI has decided to change this system. Under the new rule, the flat premium system will be replaced with a risk-based premium system. This means banks will no longer pay the same amount. Instead, the premium will depend on how risky a bank is. Banks with strong capital, good asset quality, and better management will be treated as safer banks and will pay lower insurance premiums. On the other hand, banks that have higher risk, weak capital, or poor asset quality will have to pay higher premiums.

Understand with the help of an example:

Suppose there are two banks. One is Bank XYZ, which is financially strong, and the other is Bank ABC, which is financially weak. Both banks have total assessable deposits of ₹10,000 crore.

Under the old system, both Bank XYZ and Bank ABC had to pay the same deposit insurance premium, which was 0.12% (12 paise per ₹100). So, the calculation was simple.

₹10,000 crore × 0.12% = ₹12 crore per year.

This means that both banks paid ₹12 crore each, even though Bank XYZ was strong and Bank ABC was risky.

Now, under the new risk-based system, the premium depends on how risky the bank is. Since Bank XYZ is strong, with good capital adequacy, low bad loans, and strong management, it is classified as a low-risk bank. Therefore, Bank XYZ may be charged a lower premium of 0.10%. In this case, the premium paid by Bank XYZ will be:

₹10,000 crore × 0.10% = ₹10 crore per year.

On the other hand, Bank ABC is weak, with poor asset quality, higher bad loans, and lower capital. Because it is considered a high-risk bank, it may be charged a higher premium of 0.12%. So, Bank ABC will pay:

₹10,000 crore × 0.12% = ₹12 crore per year.

Capital Adequacy Ratio

One important factor used to measure bank strength is the Capital Adequacy Ratio, also known as CAR or CRAR. This ratio shows how financially strong a bank is by comparing its capital with its risk-weighted assets. In simple words, it tells us how well a bank can handle losses and protect depositors’ money. A higher capital adequacy ratio means the bank is more stable and safer.

Overall, this new risk-based deposit insurance system is a positive step. It encourages banks to improve their financial health, follow better governance, and manage risks properly. At the same time, it strengthens the banking system and gives more confidence to depositors that their money is safe.